Protective Life Insurance Review 2026 (Companies + Rates)

Protective Life Insurance Company reviews find the company with an A+ rating from A.M. Best. Protective Life insurance rates can be as low as $11 per month for a 20-year, $250,000 term life insurance policy. Protective Life offers only term life insurance quotes online, so if you want to discuss other options, contact the company by phone.

Read moreFree Life Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Brandon Frady

Licensed Insurance Agent

Brandon Frady has been a licensed insurance agent and insurance office manager since 2018. He has experience in ventures from retail to finance, working positions from cashier to management, but it wasn’t until Brandon started working in the insurance industry that he truly felt at home in his career. In his day-to-day interactions, he aims to live out his business philosophy in how he treats hi...

Licensed Insurance Agent

UPDATED: Feb 6, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident life insurance decisions. Comparison shopping should be easy. We are not affiliated with any one life insurance provider and cannot guarantee quotes from any single provider. Our life insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about life insurance. Our goal is to be an objective, third-party resource for everything life insurance related. We update our site regularly, and all content is reviewed by life insurance experts.

UPDATED: Feb 6, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident life insurance decisions. Comparison shopping should be easy. We are not affiliated with any one life insurance provider and cannot guarantee quotes from any single provider. Our life insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

Protective Life Insurance Company Overview

| Key Info | Company Specifics |

|---|---|

| Year Founded | 1907 |

| Current Executive | CEO - Richard J. Bielen |

| Number of Employees | 2,957 |

| Total Sales / Total Assets | $6,015,623,000 / $121,088,629,000 |

| HQ Address | 2801 Hwy 280 South Birmingham, AL 35223 |

| Phone Number | 1-205 -268-8611 |

| Company Website | www.protective.com |

| Premiums Written – Individual Life | $482,000,000 |

| Financial Standing | $348,505,000 |

| Best For | Term Life Insurance |

What are the best term life insurance companies? Protective Life Insurance may be among them.

This company has been providing cheap term life insurance for consumers for over 100 years. Our Protective Life Insurance review (aka Protective Life) offers you a free insurance review that will help you decide whether this is the best life insurance company for your needs.

Ready to buy life insurance? Before jumping into our Protective Life Insurance Company review, compare rates among competing companies using our FREE quote tool above.

Shopping for Protective Life Insurance Quotes

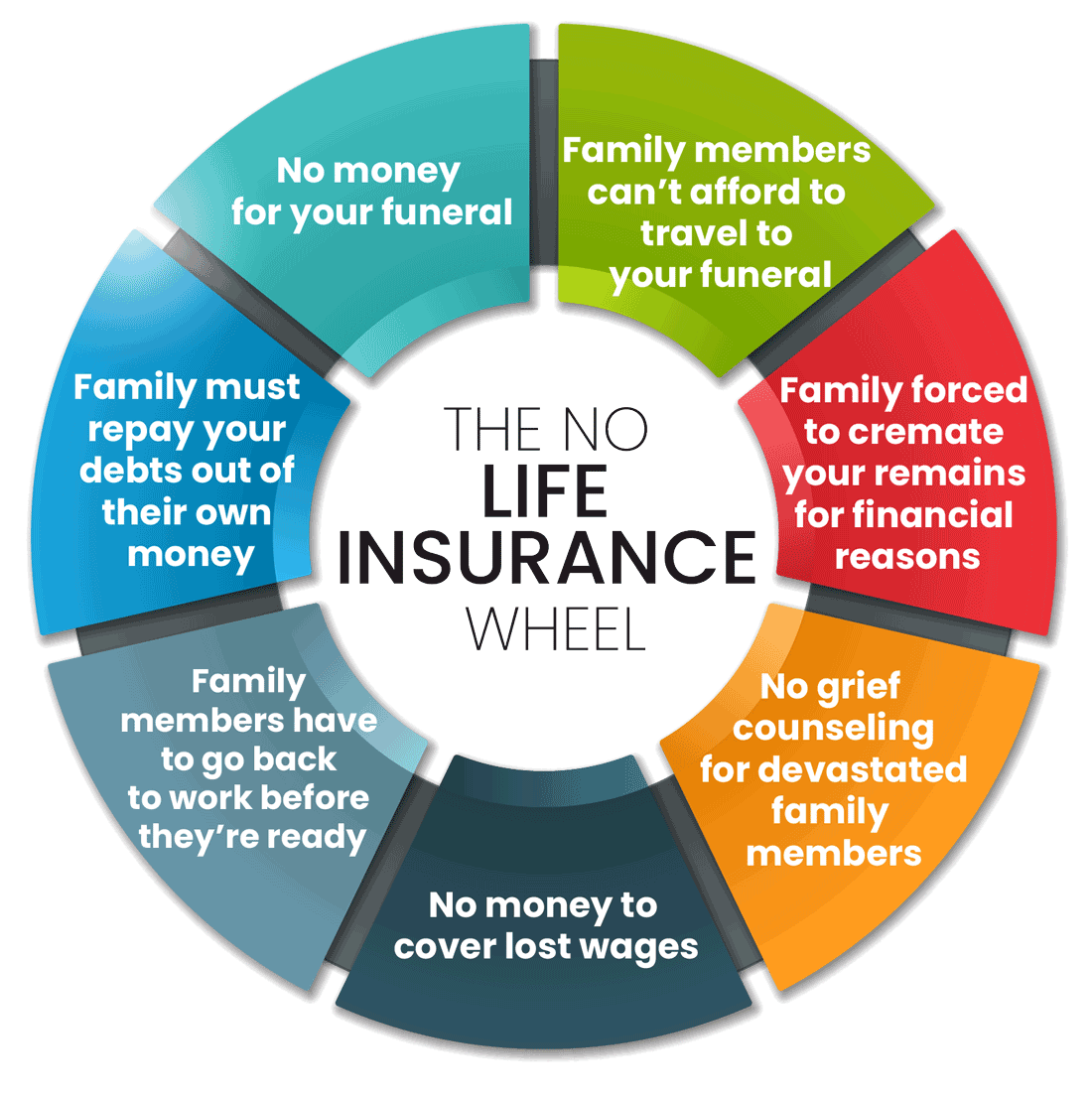

It’s important to shop around for the cheapest life insurance quotes sooner rather than later, as one-third of people would face serious financial problems if a loved one died.

The only way to find out for sure how much your life insurance will cost is to get a quick life insurance quote — after all, you would be in good company, as 1 in 3 purchased or attempted to purchase life insurance online. However, you can get an idea by looking at sample rates tables.

Protective Life Insurance Average Monthly Rates – 20-Year/$250,000 Policy

| Policyholder Age | Male Non-Smoker | Female Non-Smoker | Male Smoker | Female Smoker |

|---|---|---|---|---|

| 25 | $12.74 | $11.38 | $56.53 | $42.50 |

| 30 | $13.00 | $11.59 | $59.29 | $47.18 |

| 35 | $13.69 | $12.47 | $71.19 | $57.38 |

| 40 | $18.02 | $15.58 | $100.52 | $83.09 |

| 45 | $27.43 | $22.17 | $166.39 | $119.00 |

| 50 | $40.92 | $30.52 | $247.78 | $179.57 |

| 55 | $62.50 | $48.90 | $358.70 | $280.72 |

| 60 | $108.89 | $76.94 | $510.85 | $449.23 |

| 65 | $205.01 | $134.17 | N/A | N/A |

This table offers some sample rates for the average Protective policyholder who purchases a 20-year term life insurance policy with $250,000 worth of coverage. As you can see, smokers tend to pay far more for life insurance than non-smokers and rates tend to go up as you age.

Average Protective Life Insurance Rates by Age

Typical Protective life insurance rates by age range from about $12/mo to over $400/mo, depending on other factors such as your general health and whether you smoke.

This makes Protective one of the best life insurance companies out there in terms of price, especially compared to the top NAIC-ranked companies by market share.

Average Monthly Rates by Non-Smoker Age for Protective Life and Top Life Insurance Companies

| Companies | 25-Years-Old Non-Smoker | 35-Years-Old Non-Smoker | 45-Years-Old Non-Smoker | 55-Years-Old Non-Smoker | 65-Years-Old Non-Smoker |

|---|---|---|---|---|---|

| Massachusetts Mutual | $11.63 | $12.00 | $18.29 | $34.33 | $75.50 |

| Protective | $12.06 | $12.30 | $24.80 | $55.70 | $169.59 |

| State Farm | $12.79 | $14.21 | $19.88 | $30.71 | $68.29 |

| New York Life Insurance | $12.92 | $13.50 | $21.13 | $46.25 | $97.50 |

| Aegon/TransAmerica | $14.17 | $13.83 | $20.17 | $40.83 | $104.42 |

| John Hancock | $14.62 | $15.34 | $22.23 | $39.20 | $96.55 |

| Lincoln National | $17.42 | $17.88 | $23.42 | $43.75 | $103.33 |

| Prudential | $18.00 | $18.50 | $28.83 | $45.00 | $98.04 |

This average Protective life insurance age chart looks at the average cost of Protective life insurance versus the top companies for non-smokers. Keep in mind that your average cost may be higher or lower depending on other factors such as your general health, the type of job you have, or your military status.

In any case, Protective’s average life insurance rates are far lower for almost every age group than these top-ranked companies. Although Protective Life Insurance’s ranking is lower than these other companies, you may be able to save hundreds of dollars a month using this company if it otherwise meets your needs.

Protective’s Life Insurance Policies

Protective life insurance offers only term life insurance quotes online. However, its website encourages readers to contact the company by phone to discuss other options, such as whole life insurance policies. Protective Life offers life insurance policies for adults only.

Term Life Insurance

Term life insurance is a time-limited type of life insurance. Policies are only good for a period of 10 to 30 years, and your premium amount is based on how much coverage you purchase as well as other factors such as your health, whether or not you smoke, and your age and gender.

The major advantage of term life insurance is that it is cheaper — you might be able to get it from Protective for only a few dollars per month. However, keep in mind when buying term life that term life insurance does expire, so the policy won’t do your family any good if you die after the ending date.

In some cases, you may be able to renew a term life policy or convert it to a whole life insurance policy.

Term life is a popular type of life insurance for parents, as it allows them to provide for their children if one of them should die unexpectedly without being expensive when they have other child-related bills to pay.

Whole Life Insurance

Unlike term life insurance, whole life is a type of permanent life insurance. This type of insurance grows in cash value over time, and you can withdraw or borrow against the policy’s cash value as needed.

Guaranteed issue whole life insurance for seniors provides coverage without requiring a medical exam. Usually, you have to be over the age of 50 to qualify. This is a good option if you have health conditions or other circumstances that would make the cost of regular life insurance prohibitive. Find out how much whole life insurance costs.

Protective Custom Choice Universal Life

Universal life insurance allows you the flexibility to choose your premium amount and to invest your payments as you see fit.

The Custom Choice Universal Life plan is similar to term life insurance because you choose an initial term of 10 to 30 years. After that initial term is over, the death benefit will start to decrease every year, but your premium will stay the same.

Protective Custom Choice Universal Life Insurance Death Benefit & Average Annual Rate by Policy Year

| Policy Year | Death Benefit | Protective Life Insurance Average Annual Rate |

|---|---|---|

| 1–15 | $500,000 | $245.30 |

| 16 | $209,348 | $245.30 |

| 20 | $135,975 | $245.30 |

| 30 | $50,645 | $245.30 |

| 40 | $21,336 | $245.30 |

| 50 | $10,000 | $341.43 |

Once the life insurance death benefit level reaches $10,000, your premium will begin to increase. Your premiums may also increase once the initial term expires.

Survivorship Life

Protective Life offers a joint life insurance policy for married people. Its survivorship life policy allows both parties to be insured via one policy. The policy doesn’t kick in until the second spouse to die has passed away.

The major advantage of this type of life insurance is that it is cheaper than having two separate policies. Keep in mind, though, that you will not get any benefits to help pay for your spouse’s funeral cost if they die first.

Other Life Insurance Products

Protective Life does not offer any other life insurance products such as disability insurance.

Life Insurance Riders

Protective Life offers several standard life insurance riders — or supplementary types of insurance you can elect to include.

All Protective Life insurance policies come with an accelerated death benefit at no additional cost. This rider allows you to get your death benefits while still alive if you have certain critical or terminal illnesses such as heart attacks, strokes, or cancer. You can use this money to pay for medical expenses or cost of living while dealing with this illness.

Although Protective Life doesn’t offer life insurance for children, you can purchase a children’s rider which covers your children via your policy.

Finally, Protective’s accidental death rider allows your family to get higher benefits if you die as the result of an automobile or other accident. Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

How to Get a Quote Online With Protective Life

The best way to get life insurance quotes is to use our quote tool. However, Protective Life offers term life insurance quotes online. Your first step is to visit Protective Life’s insurance home page. The quote button is right at the top of the page.

Once you click that green “term life quote” button, the quote form comes up. You’ll need to know how much coverage you need and how long a term you want as well as your height, weight, home address, and general health status.

If you don’t know your coverage amount, don’t panic – Protective Life has an insurance calculator on its website that you can use to figure this out.

Fill out the form and click on “See My Quote” to get your term life insurance quote.

This form only works for term life insurance. The best way to get other life insurance quotes from Protective is to call them at 1-844-733-5433.

Canceling Your Life Insurance Policy

Can you cancel your life insurance policy? In most cases, you should be able to.

Some people try to cancel their Protective Life Insurance policy by failing to pay their premiums. While it’s true that Protective will cancel your policy if you do this, it’s not a good idea, as this can negatively affect your credit. Instead, contact the company to cancel your life insurance.

How to Cancel

Protective doesn’t allow you to cancel your life insurance online. Instead, call the company at 1-800-866-9933 and tell the customer service representative, “I want to cancel my Protective Life insurance.”.

The representative will take care of getting you any necessary forms in the mail. Fill these forms out and send them back. In most cases, you won’t get a refund, although you may get the cash value of a permanent life insurance policy returned to you.

You should check your next few bank statements to make sure Protective Life is no longer charging you for life insurance premiums after you have canceled the insurance. If you continue to get charged, call Protective Life to resolve the situation.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

How to Make a Claim With Protective Life

When a loved one dies, making a claim may be the last thing on your mind. It’s important to do this as soon as possible because the sooner you make your claim, the sooner you’ll get the benefits you need to pay funeral expenses or cover the loss of income your loved one brought in.

How long do you have to make a life insurance claim? That depends on state law, but you probably want to do it within a few weeks of the death to protect your finances. If you’re wondering how long it takes to make a life insurance claim, the answer is: not long. Protective makes it easy by offering you the ability to request your claim packet online and get forms by email.

Your first step is to contact Protective to notify them about the death.

You can call Protective or do this notification online. When you do this, you can request forms be emailed, faxed, or mailed to you. Once you get the forms, you need to fill them out. Provide information such as your loved one’s full legal name, address, county of residence, and cause of death. You’ll also need to submit copies of the death certificate.

If you don’t have a copy of the death certificate, visit your state’s Department of Vital Records to obtain it. The Center for Disease Control and Prevention has contact information for each state’s Department of Vital Records on its website.

After you send the forms back, you should receive your benefits within 30 days, though you’ll often get them faster. If Protective has any questions, that can delay the processing of your claim. Make sure to answer the phone if they call so that you can resolve any issues promptly.

Protective Life’s Customer Experience

Before purchasing life insurance, it’s important to know what kind of customer experience you can expect. Protective Life doesn’t have the best customer experience reviews from J.D. Power, which rates the company at 754/1,000 for customer service and gives it three out of five circles. This means that Protective Life’s customer service is considered average.

The NAIC Complaint Index, however, lists Protective Life’s complaints as far below average.

Protective Life Insurance Complaint Index (NAIC)

| Year | Protective Life Insurance Complaint Index |

|---|---|

| 2019 | 0.37 |

| 2018 | 0.19 |

| 2017 | 0.47 |

Protective Life certainly doesn’t have the worst customer service reviews, and in fact has two-thirds fewer complaints than the average insurance company, according to the NAIC Company Complaint Index.

Protective Life’s Programs

Protective Life has a learning center on its website that offers articles about different types of life insurance, what type to get, and so forth. These articles are helpful, but keep in mind that Protective Life may not offer all the types of life insurance discussed in them. Always call Protective Life if you have questions about the specific products they sell.

Protective Life has an insurance calculator on its website that will allow you to estimate how much coverage you need prior to asking for a term life insurance quote.

Design of Website/App

Protective Life does not offer an app specifically for life insurance. There is a Protective app that allows you to download ID cards and make payments on any type of Protective insurance.

Protective Life’s website is easy to navigate. You can quickly access information about life insurance by clicking the menu item at the top, and there is a learning center and claims center available on the site. You can also log in to your Protective account to make payments online.

About Protective Life Insurance

Protective Life Insurance Company was established in 1907 by former Alabama Governor William Dorsey Jelks.

Who bought Protective Life Insurance Company when it was first founded? Protective Life of Birmingham served customers in Alabama, paying out its first death claim in 1909.

Protective Life insurance Company history includes over 100 years of experience with life insurance. Its goal is to strive to deliver a comprehensive solution that is not only easy to get and understand but is affordable as well.

Protective sells life insurance products in all 50 states. The corporation has over 2,700 employees, annual revenues of $4.48 billion, and assets of $75 billion.

Protective Life Insurance Ratings

What is the rating for Protective Life Insurance Company? It depends on who you ask. Overall, Protective’s life insurance ratings for 2019 are positive, although companies may differ as to exactly how stable the company is.

A.M Best, which offers credit ratings for businesses, gives Protective a rating of A+. A.M. Best’s life insurance company ratings range from A+ to D, with A+ being the best possible credit rating. This rating means Protective’s financial strength rating is as high as it can be and that the company is likely to pay all its obligations.

A high rating is important because it means that your family will likely receive their Protective life insurance payout as expected after they file a claim.

Protective’s ranking from The Better Business Bureau is decidedly more mixed. The BBB offers the company a rating of A-, although it is not a BBB-accredited company. However, customer reviews are not taken into account in this rating, and the average review, based on 31 customer reviews, is only 1.5 out of 5 stars.

Many negative reviews revolve around difficulties using the company’s website, such as their Protective life insurance login leading them to discover that a payment was not processed. These complaints are related to the Protective Life Birmingham office, as that is where the company is headquartered. Protective Life has responded on the BBB site to the majority of complaints.

Moody’s, another service that provides financial stability ratings for companies. Moody’s gives Protective a rating of A1, which means it is a low credit risk and is likely to pay all of its short-term obligations on time.

Standard & Poor’s (S&P) offers Protective a rating of AA-, which means the company’s risk is below average and that, generally, you can expect it to be financially stable, though it may have some minor problems.

Protective Life’s Market Share

What is the most reliable life insurance company? Protective Life certainly seems to be in the running, based on its NAIC rankings. While Protective Life has not placed in the NAIC top 10 in recent years, it has done well, placing between 17 and 19 for 2016–2018 and cornering about 1.5 percent of the market each year.

Protective Life’s headquarters are in Birmingham, Alabama. It has several subsidiaries.

- Protective Life and Annuity Insurance Company (New York)

- West Coast Life Insurance Company

- MONY Life Insurance Company

- Protective Property and Casualty Insurance Company

- United States Warranty Corporation

Although typical Protective Life competitors such as Chase Life insurance may be rated higher in terms of market share, the company’s premiums have been fairly stable from year to year.

Protective Life Insurance Direct Premiums Written (NAIC)

| Year | Protective Life Insurance Direct Premiums Written |

|---|---|

| 2016 | $2,468,179,517 |

| 2017 | $2,444,518,881 |

| 2018 | $2,403,640,825 |

Protective wrote about 40 million dollars less worth of premiums in 2018 than 2016, but since the company averages approximately $2.4 billion worth of premiums each year, this is not a serious loss.

In any case, Protective reported a financial gain of $3.48 million for 2019. This gain, along with its strong ratings from sites such as AM Best and Moody’s, suggests that Protective Life is a financially stable company that will continue to be able to pay out claims as required for the foreseeable future.

Top 10 Life Insurance Companies & Protective Life by Market Share (NAIC)

| Rank | Companies | Market Share |

|---|---|---|

| 1 | Northwestern Mutual | 6.42% |

| 2 | Metropolitan | 6.00% |

| 3 | New York Life | 5.68% |

| 4 | Prudential | 5.57% |

| 5 | Lincoln | 5.36% |

| 6 | Massachusetts Mutual | 4.19% |

| 7 | Aegon US | 2.94% |

| 8 | John Hancock | 2.83% |

| 9 | State Farm | 2.83% |

| 10 | Minnesota Mutual | 2.70% |

| 14 | Protective Life | 1.57% |

Protective Life’s market share compared to the competition is slightly low, but it is still doing well considering that it is in the top 20 ranked companies year after year. Its small but consistent market share is a strong indicator of financial stability. Thus, it is poised to remain stable or even to grow in the future.

Pacific Life is one of Protective Life’s top competitors, and many people are interested in comparing Protective Life versus Pacific Life.

Protective Life Insurance vs Pacific Life Insurance Market Share

| Years | Protective Life | Pacific Life |

|---|---|---|

| 2018 | 1.57% | 2.29% |

| 2017 | 1.49% | 2.08% |

| 2016 | 1.59% | 1.94% |

Like other typical Protective Life competitors, Pacific Life is ranked slightly higher than Protective Life, but that should not concern you. Protective Life’s financials appear to be relatively stable from year to year even if it does not command a formidable share of the market.

Protective Life’s Online Presence

One of the best indicators that a life insurance company is equipped for the modern world is the way that the life insurance company is using social media. Protective Life has a Facebook page, Twitter account, Youtube channel, LinkedIn page, and Instagram account. While these accounts are not advertised heavily on its website, it is clear that social media campaigns are part of Protective’s insurance company strategy.

Protective’s social media pages are professional and set up well. Its Facebook page offers a message box where you can write comments or concerns and get a response within a few hours, and all of its social media pages provide useful content such as links to blogs about topics of interest to consumers.

It is clear that Protective Life is running a robust insurance company social media campaign. Its website is also designed to be user friendly, contains lots of information for consumers, and offers a “virtual assistant” chatbox that you can type questions into if you want to get more information while browsing the site.

Protective Life’s Commercials

LIfe insurance TV ads are still a popular way to reach consumers, and Protective Life uses them effectively. Protective Life’s insurance TV commercials focus on how the company makes life better for families.

For example, this commercial shows a busy African American family buying a house, getting a kid ready for school, and the kid playing the clarinet, among other things. The idea behind the commercial is that Protective helps take some of the financial burdens off of parents so that they have one less thing to worry about.

Protective Life in the Community

If all else is equal, many consumers prefer to work with businesses that give back to the community.

Protective Life takes this responsibility seriously and has created a foundation to help ensure that its one of the strongest companies that give back to the community, especially in Birmingham.

As the above video explains, the Protective Foundation works with various non-profits to help communities. Although it currently does not support educational institutions, it has previously provided funds and volunteers to assist schools with getting equipment and supplies as well as assisting with food education in inner-city schools.

Non-profit organizations must have 501(c)(3) status before applying for assistance from the foundation. Interested parties can submit funding proposals via the Protective Foundation’s website.

Protective Life’s Employees

Protective Life employs 2,957 people, 57 percent of whom say they would recommend the company to a friend, according to Glassdoor.com.

Employees enjoy Protective Life Insurance benefits such as cheap health insurance, paid time off, and a 401(k) with employee matching. Protective Life Insurance Company reviews on Glassdoor state that Protective is one of the best life insurance companies to work for in Birmingham and that the benefits are decent.

However, there is little room for advancement and some employees complain about how hard they are expected to work.

Protective values diversity and has put together a video celebrating the diversity of its employees.

The company has received several awards in the past few years, including inclusion on Forbes’ list of the best midsize American companies, being listed as one of the top places to work by the Birmingham Business Journal, and is recognized as one of the top Ohio places to work by the Cincinnati Enquirer.

Pros & Cons of Protective Life Insurance

There are pros and cons of life insurance coverage with any company. Check out these pros and cons of Protective Life Insurance.

Pros of Protective Life Insurance

The biggest advantage of using Protective Life insurance is that it is far cheaper than most of the competition. Its high NAIC rating suggests that it is financially stable, too, so you can trust this company to be there when you need it.

Protective Life’s website is easy to use and you can chat online or call the company if you have questions. You can also manage your policy online.

Cons of Protective Life Insurance

Protective Life Insurance mostly deals with term life insurance. While other policies are available, you can’t get quotes or information about them online and have to call the company. Most term life policies are renewable, but your rates will go up when you renew.

Finally, there are no policies specifically for children at this company, although you can purchase a rider to cover your children. Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Protective Life Insurance: The Bottom Line

Protective Life is a top-rated company with over 100 years in selling life insurance products. Its rates are among the cheapest you can find anywhere and it offers average to above-average service for the price.

However, it is mostly geared toward individuals who are looking for term life insurance, and it doesn’t offer final expense insurance.

Now that you’ve read our Protective Life Insurance Company review, find out which company is right for you. Compare quotes using our FREE tool below.

Frequently Asked Questions

Is Protective Life insurance a mutual company?

No. Its Japanese sister company, Dai-Ichi Life, used to be the oldest life insurance mutual company in Japan but demutualized in 2010.

How does Protective Life differ from protected insurance?

If you’re looking for Protected insurance reviews, you’ll want to look at car insurance sites, as this company is not a life insurance company. If car insurance is your thing, you may want to also check out Protective auto insurance reviews so you can compare the two companies.

Does Protective Life offer other types of life insurance besides term life insurance?

It does, but you have to call the company to discuss these options. You can get term life insurance quotes on its website.

What is Promise Term life insurance?

Promise Term life insurance is a term life insurance plan that Pacific Life, one of Protective Life’s top competitors, offers to consumers.

Is Protective Life a good company?

Good is a subjective term. If you read the review above, you’ll see that Protective Life gets relatively high ratings, is financially stable, and offers a variety of products.

How can I apply for Protective Life Insurance?

To apply for Protective Life Insurance, you can visit their website or contact their customer service. They will guide you through the application process, which typically involves providing personal information, medical history, and choosing the desired coverage amount and policy type.

Can I customize my Protective Life Insurance policy?

Yes, Protective Life Insurance offers flexibility in customizing policies to meet individual needs. Depending on the policy type, you may have options to adjust the coverage amount, premium payments, and even add optional riders for additional protection or benefits.

How reliable is Protective Life Insurance?

Protective Life Insurance is a reputable insurance company with a long-standing presence in the industry. They have been in operation for over a century and have received high ratings from independent rating agencies, indicating their financial strength and ability to fulfill their obligations to policyholders.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Brandon Frady

Licensed Insurance Agent

Brandon Frady has been a licensed insurance agent and insurance office manager since 2018. He has experience in ventures from retail to finance, working positions from cashier to management, but it wasn’t until Brandon started working in the insurance industry that he truly felt at home in his career. In his day-to-day interactions, he aims to live out his business philosophy in how he treats hi...

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about life insurance. Our goal is to be an objective, third-party resource for everything life insurance related. We update our site regularly, and all content is reviewed by life insurance experts.