No Exam Life Insurance: Buyer’s Guide (Companies + Rates)

With no exam life insurance, there's no need to worry about your pre-existing medical conditions or needles during underwriting. Get up to $500,000 in coverage for as little as $13.12/month without taking an exam.

Free Life Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Zach Fagiano

Licensed Insurance Broker

Zach Fagiano has been in the insurance industry for over 10 years, specializing in property and casualty and risk management consulting. He started out specializing in small businesses and moved up to large commercial real estate risks. During that time, he acquired property & casualty, life & health, and surplus lines brokers licenses. He’s now the Senior Vice President overseeing globa...

Licensed Insurance Broker

UPDATED: Jan 8, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident life insurance decisions. Comparison shopping should be easy. We are not affiliated with any one life insurance provider and cannot guarantee quotes from any single provider. Our life insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about life insurance. Our goal is to be an objective, third-party resource for everything life insurance related. We update our site regularly, and all content is reviewed by life insurance experts.

UPDATED: Jan 8, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident life insurance decisions. Comparison shopping should be easy. We are not affiliated with any one life insurance provider and cannot guarantee quotes from any single provider. Our life insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

If you want life insurance coverage but don’t want to take a medical exam, you can still get up to $500,000 in coverage with a no exam life insurance policy. No exam life insurance policies often have higher costs and lower face values than a policy that requires an exam.

We designed this guide to give you all the information you need to decide if you’re one of those who would benefit from a no exam policy, including sample life insurance rates, coverage limits, and policy types.

If you already know that a no exam life insurance policy is for you, use our FREE tool above to start comparing no exam life insurance quotes.

Shopping for No Exam Life Insurance Quotes

Final expense insurance is simple. If you’re looking for a quote, you can get one in several ways: online, directly with the insurer, or through an independent agent.

Can I get life insurance with no medical exam and no waiting period?

A lot of insurers offer term life insurance policies that don’t require any medical exam. However, just because there is no exam doesn’t mean that the policies also have guaranteed approval. So, how does no medical life insurance work?

Most insurers will still require you to fill out a medical questionnaire about your personal medical history and that of your family. Approval will naturally be quicker since there is no medical exam, but most policies will still have a short waiting period as your application is reviewed.

Even you can get life insurance without an exam, life insurers still have access to your Medical Information Bureau records and your prescriptions history.

They’ll use both resources to verify your responses. It’s important to be honest, even on a no exam life insurance policy. If the insurer finds that you misrepresented your health, your application could be denied.

How much life insurance can I get without a medical exam?

A no exam policy represents a greater risk to the insurer. Because they don’t have the health information that comes from a medical exam, they assume you have higher mortality risk.

One of the main ways insurers minimize their risk is to limit the amount of life insurance coverage you can get without a medical exam.

How much life insurance you can get without a physical is usually limited to face values of $500,000 and below. You won’t be able to get a million-dollar life insurance policy without a medical exam.

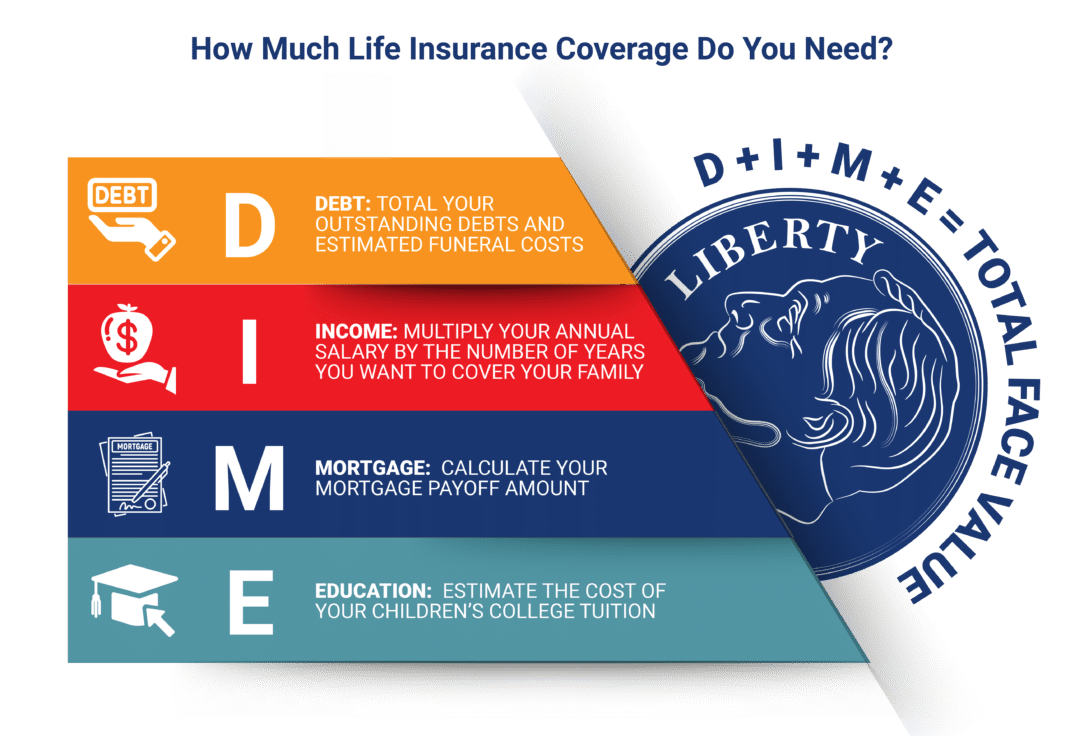

How much life insurance should you purchase? You can use the DIME method to calculate the appropriate coverage amount.

Once you know how much life insurance you’ll need, you can start shopping for a no exam policy.

How much does no exam life insurance cost?

A no exam life insurance policy is a big selling point for some, but it might cost more in the long run. A no exam policy represents a greater risk to the insurer. They pass that risk along to you in the form of increased premiums.

A young person might not see much difference in rates between an exam and no exam life insurance policy, but older people can expect to pay more. The following tables show average sample term life insurance rates by age for exam versus no exam life insurance policies.

All rates are for non-smokers.

Average Monthly Term Life Insurance Rates for Non-Smokers With Exam

| Policyholder Age & Gender | 10-Year/ $100,000 Policy | 20-Year/ $100,000 Policy | 10-Year/ $250,000 Policy | 20-Year/ $250,000 Policy | 10-Year/ $500,000 Policy | 20-Year/ $500,000 Policy | 10-Year/ $1,000,000 Policy | 20-Year/ $1,000,000 Policy |

|---|---|---|---|---|---|---|---|---|

| 20-Year-Old Female | $6.92 | $7.66 | $8.79 | $10.00 | $12.18 | $13.92 | $17.50 | $21.75 |

| 20-Year-Old Male | $7.17 | $9.14 | $9.62 | $13.17 | $14.07 | $20.74 | $21.29 | $34.79 |

| 30-Year-Old Female | $6.92 | $8.41 | $8.79 | $12.12 | $12.42 | $18.19 | $18.84 | $29.43 |

| 30-Year-Old Male | $7.17 | $9.31 | $9.62 | $13.42 | $14.07 | $20.69 | $21.29 | $35.53 |

| 40-Year-Old Female | $7.94 | $10.43 | $10.87 | $15.44 | $16.55 | $25.26 | $26.20 | $43.94 |

| 40-Year-Old Male | $8.37 | $11.27 | $11.71 | $18.18 | $18.20 | $29.36 | $29.06 | $52.78 |

| 50-Year-Old Female | $12.86 | $18.83 | $20.48 | $31.67 | $35.56 | $55.78 | $62.27 | $103.55 |

| 50-Year-Old Male | $14.16 | $22.88 | $23.81 | $42.79 | $41.76 | $78.75 | $75.71 | $146.03 |

| 60-Year-Old Female | $23.44 | $37.43 | $42.18 | $77.92 | $76.05 | $140.83 | $139.92 | $269.92 |

| 60-Year-Old Male | $28.63 | $54.68 | $60.13 | $111.56 | $112.83 | $211.13 | $214.36 | $406.93 |

| 70-Year-Old Female | $55.47 | $128.19 | $108.34 | $265.90 | $200.43 | $531.87 | $369.79 | $1016.72 |

| 70-Year-Old Male | $79.36 | $172.38 | $179.62 | $406.56 | $319.34 | $812.58 | $609.92 | $1553.16 |

| 80-Year-Old Female | $195.21 | N/A | $478.84 | N/A | $951.56 | N/A | $1848.87 | N/A |

| 80-Year-Old Male | $243.60 | N/A | $599.81 | N/A | $1193.50 | N/A | $2275.00 | N/A |

Compare those rates with the rates with no exam. Insurance companies don’t offer $1 million 10-year or 20-year term policies with no exam.

Average Monthly Term Life Insurance Rates for Non-Smokers Without Exam

| Policyholder Age & Gender | 10-Year/ $100,000 Policy | 20-Year/ $100,000 Policy | 10-Year/ $250,000 Policy | 20-Year/ $250,000 Policy | 10-Year/ $500,000 Policy | 20-Year/ $500,000 Policy |

|---|---|---|---|---|---|---|

| 20-Year-Old Female | $8.04 | $8.96 | $10.34 | $13.09 | $13.12 | $18.70 |

| 20-Year-Old Male | $9.41 | $9.92 | $13.92 | $14.57 | $18.27 | $20.88 |

| 30-Year-Old Female | $8.10 | $9.14 | $10.34 | $13.31 | $13.05 | $19.14 |

| 30-Year-Old Male | $9.41 | $9.92 | $13.92 | $14.79 | $18.27 | $21.32 |

| 40-Year-Old Female | $9.93 | $12.12 | $13.96 | $18.99 | $17.70 | $29.67 |

| 40-Year-Old Male | $10.75 | $12.67 | $16.25 | $21.67 | $23.75 | $36.92 |

| 50-Year-Old Female | $15.87 | $20.16 | $22.87 | $36.46 | $38.08 | $65.87 |

| 50-Year-Old Male | $17.87 | $24.63 | $27.67 | $51.68 | $45.70 | $96.06 |

| 60-Year-Old Female | $27.47 | $42.26 | $48.22 | $90.37 | $83.13 | $173.03 |

| 60-Year-Old Male | $36.14 | $64.34 | $68.32 | $147.70 | $127.32 | $286.85 |

| 70-Year-Old Female | $166.39 | N/A | $406.65 | N/A | N/A | N/A |

| 70-Year-Old Male | $221.36 | N/A | $544.08 | N/A | N/A | N/A |

| 80-Year-Old Female | N/A | N/A | N/A | N/A | N/A | N/A |

| 80-Year-Old Male | $655.72 | N/A | N/A | N/A | N/A | N/A |

As you can see, no exam rates are higher at every age. Depending on your health, taking the exam could show the insurer that you’re a lower risk and earn you a lower rate.

How to Get a No Exam Life Insurance Quote

Instant anonymous life insurance quotes are an easy way to compare prices between companies and policies. There are two main ways to get a no exam life insurance quote: Online or through an agent.

Many insurers have quote tools on their website. You choose your desired coverage, enter your information, and the tool will return an estimated cost. There are also independent quote tools (like the ones on this page), that give instant quotes from multiple insurers at once, allowing you to compare prices quickly.

Whole life insurance has a lot of additional factors that influence its premiums. As such, many companies don’t give out quotes for them online.

On the other hand, term quotes are readily available.

Some insurers also sell direct term policies. After getting your quote, you can immediately apply for the policy online without an agent.

What to Expect When You Apply for No Exam Life Insurance

No exam life insurance isn’t the same as guaranteed acceptance life insurance.

Does all life insurance require a blood test? No, but nearly all still have medical guidelines, age limits, and other factors that affect your approval and rates.

Here are some things to expect when you apply.

Health Classes:

Life insurance underwriters use your personal information to assign you to a different health class (or risk class). Each has an established price range.

Some insurers use different terms, but most use some variation of the following classes.

- Preferred Plus – This is the lowest risk category with the best rates. People in this class are typically young and healthy with no pre-existing conditions or worrisome family history.

- Preferred – This is a lower risk category with better rates than most. People in this class are very healthy but are a little bit older or have potential warning signs like elevated cholesterol or a family history of some disease.

- Standard Plus – This is a low-risk category with below-average premiums. People in this class are healthy but are advancing in age or have health markers such as blood pressure or BMI outside of the desired range.

- Standard – This is an average risk category with average premiums. People in this class have an average life expectancy, but also have minor health conditions or family history that keeps them out of a preferred class.

- Substandard – This is a high-risk category with above-average premiums. People in this class are at an advanced age or have significant health issues that could decrease their life expectancy. If their application is approved, they are typically charged the standard rate plus an additional percentage that grows based on the severity of their condition.

With a no exam policy, you are automatically entered into the standard class, even if your actual health would place you in a preferred category.

Age Limits:

Many insurers will not approve applicants over a specific age for a no exam policy (usually between 45-60 years of age, depending on the amount of coverage).

Pre-Existing Medical Conditions:

Just because the policy doesn’t require a medical exam, doesn’t mean you can hide medical conditions on your application. It’s important to be honest.

The insurer will still check public medical records when making their underwriting decisions. If it’s found that you withheld something on your application that you end up dying from, it could jeopardize your death benefit.

Watch the following video for information on how life insurance companies verify your medical history.

Underwriting Processing Time:

Even though there is no physical exam required, no exam life insurance policies are still fully-underwritten policies. They aren’t always instant approval. Depending on the insurer, it could still take weeks for your policy to go into effect. Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

What is no exam life insurance?

A no exam life insurance policy is a term life insurance policy that is approved without a physical medical exam or bloodwork.

The life insurance underwriting process comes with a lot of requirements. Based on your age, gender, and health history, the insurer could require any of the following before approving coverage:

- Simple paramedical exam

- Full paramedical exam

- Blood and urine test

- EKG

- Attending physician statement

- Medical Information Bureau report

- Prescription history report

Watch the following video for a brief overview of the life insurance medical exam process.

https://youtu.be/4wOqIX_zQsY

A no exam policy forgoes all the physical tests on that list. Some rely strictly on the life insurance Medical Information Bureau records and prescription history reports. Others don’t require either, they simply take you at your word on your medical questionnaire.

What No Exam Life Insurance Covers

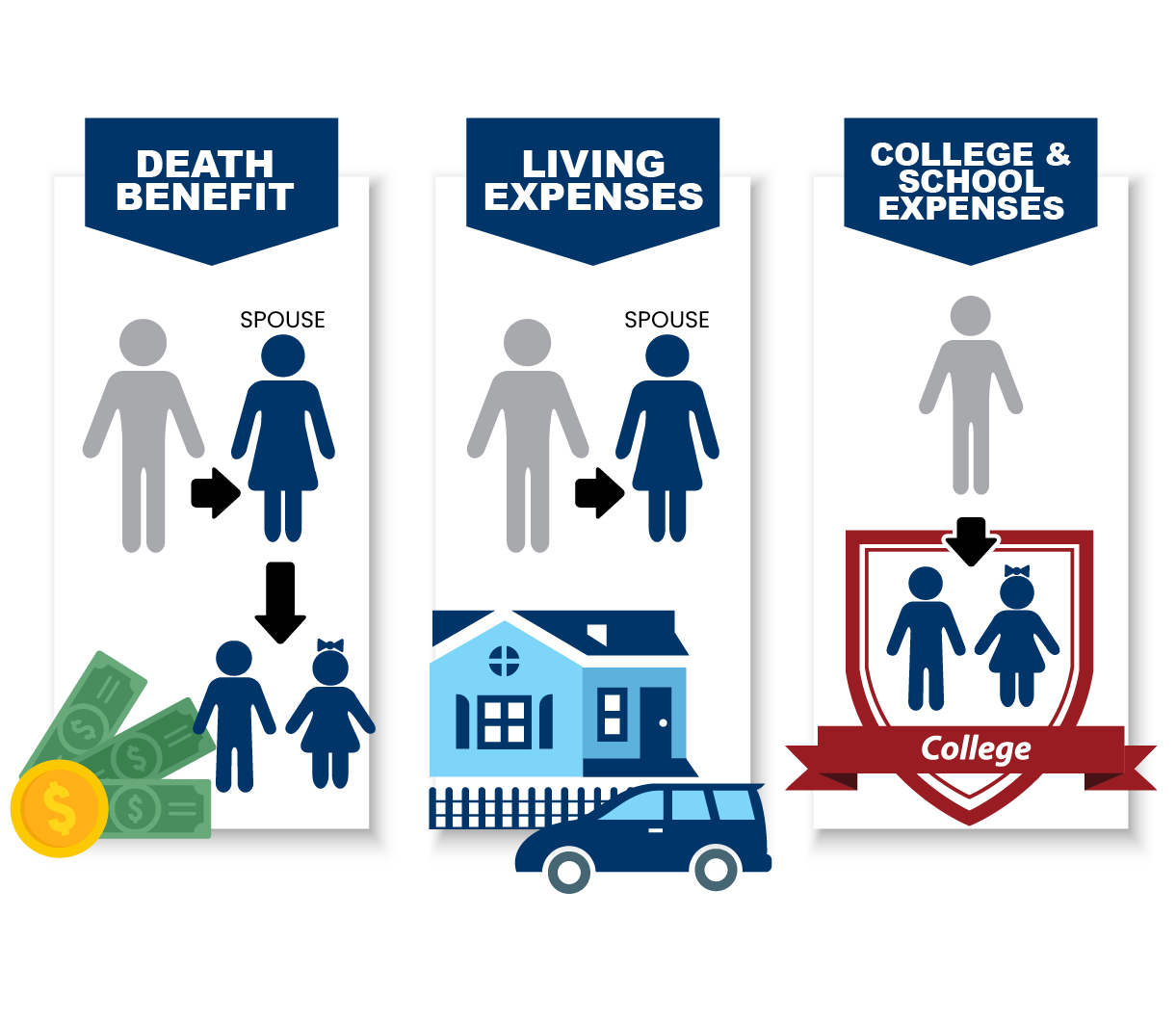

The payout from a life insurance policy is generally meant to cover two types of obligations: immediate and future.

Immediate obligations are the things that need to be paid soon after your death. These include:

- Funeral costs

- Medical bills

- Mortgage balances

- Personal loans

- Credit card debt

Future obligations are all the expenses that you want to pay for after your death, either planned or unplanned. They include:

- Income replacement

- Spouse’s retirement

- Emergency savings fund

- Children’s college tuition

Whether a no exam policy can cover all these obligations depends on your personal need.

Because they assume higher risk, many no exam life insurance policies come with limited face values, which may not be enough if you have a lot of financial obligations in these categories.

Who Should Buy No Exam Life Insurance

It’s estimated that 50 percent of Americans have pre-existing medical conditions that could impact their ability to obtain insurance. Up to 20 percent of the population also suffer from iatrophobia or “white-coat syndrome,” a fear of doctors and medical procedures. For both groups, a life insurance medical exam represents a large hurdle. It can keep them from getting approved or even stop them from applying in the first place. A no exam policy solves both problems.

As mentioned earlier, no exam life insurance policies automatically assume a higher risk. If you’re in good health, you could save a lot of money by taking the medical exam and earning yourself a better risk classification.

That said, there are plenty of people for whom a no exam life insurance policy is a good choice, regardless of the somewhat higher costs.

People with pre-existing medical conditions:

As discussed, it’s estimated that half of all Americans have pre-existing medical conditions that could impact their ability to obtain insurance.

If you have a medical history that you think would either make you uninsurable (or one that would earn you a prohibitively high monthly rate), a no exam policy could be a way to get coverage.

You may not be able to get as high of a coverage amount as you’d like, but there will be some amount that you qualify for, however small.

People without large coverage needs:

The main reason for purchasing life insurance is to protect your family from financial hardship after your passing.

If you don’t have a lot of financial obligations that need to be covered such as mortgages, tuition bills, or car loans, then a lower face value no exam life insurance policy could be a good fit.

If you’re young enough that there won’t be a significant rate difference between an exam and a no exam life insurance policy, then you could skip the hassle of an exam and get a significant (but not exorbitant) amount of life insurance coverage to leave your family a comfortable benefit.

People with a fear of doctors or needles:

For some people, there is a major psychological barrier preventing them from taking a medical exam. It’s estimated that up to one-fifth of the U.S. population suffers from iatrophobia or a fear of doctors. Sometimes called “white-coat syndrome,” the symptoms of iatrophobia range from mild anxiety to full-blown panic attacks.

Watch the following video for a brief look at one of the physiological symptoms of white-coat syndrome.

A no exam life insurance policy is the best way for people afflicted with this phobia to obtain the coverage they need. No waiting rooms, no doctors, and no needles.

No Exam Life Insurance for Seniors

Because no exam life insurance policies are a higher risk for the insurer, you may be too old for life insurance policies with some companies. As a result, seniors have fewer options for no exam policies.

Traditional term life insurance for seniors is readily available, but they’ll likely require a medical exam.

Some companies offer guaranteed acceptance life insurance policies with no exam to seniors ages 55–88, but the face values are very low. For most, coverage is limited to $10,000 and below. These policies are more akin to burial life insurance for seniors than traditional life insurance. Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Types of No Exam Life Insurance

No exam life insurance has two basic types: simplified issue and guaranteed issue. Each has its own benefits and drawbacks.

Simplified Issue Life Insurance

Simplified issue life insurance is a basic term policy with no physical exam required. However, there is still a medical questionnaire that determines approval and rates.

Simplified issue policies have more traditional face values, but most limit coverage to $500,000.

The main drawback is that these policies are more expensive than a traditional term life policy because of the increased risk for the insurer.

Guaranteed Issue Life Insurance

If you want a life insurance policy where your health doesn’t come into play at all, you’ll need guaranteed acceptance life insurance with no health questions.

Guaranteed issue life insurance policies don’t require a medical exam or questionnaire. If you apply, you’ll be approved.

Guaranteed issue policies have very limited face values compared to traditional term policies. Most have a maximum of $25,000, an amount that decreases with age.

Aside from the low face values, the main drawback, again, is the price. These policies are much more expensive than traditional term policies relative to the amount of coverage you get.

These policies are mostly recommended for people with pre-existing medical conditions that disqualify them from getting any other term life insurance. They are typically used just to pay funeral expenses, since the average funeral costs over $7,000.

Whole Life Insurance With No Medical Exam

Unfortunately, there aren’t traditional whole life insurance policies that are sold to everyone without an exam. It all depends on the applicant, and even then, the chances of being approved without a medical exam are low.

Young, healthy applicants seeking lower face value policies may be approved for a whole policy with no exam based on the answers to their health questionnaire and a review of their medical records, but it doesn’t happen often.

The only real form of guaranteed, no exam permanent life insurance policies are final expense life insurance policies with very low face values.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Best No Exam Life Insurance Companies

When looking for the best life insurance companies, you should start with the top insurers in the country. While not all of them will be the best fit for you, you stand a good chance of finding a policy to fit your needs among the companies on that list.

To help in your search, we’ve put together the following table that shows the current top 10 overall providers of life insurance by policies written and market share.

Top 20 Life Insurance Companies by Market Share

| Rank | Companies | Direct Premiums Written | Market Share |

|---|---|---|---|

| 1 | MetLife | $10,877,337,000 | 6.7% |

| 2 | Northwestern Mutual | $10,550,806,000 | 6.5% |

| 3 | New York Life | $9,385,843,000 | 5.8% |

| 4 | Prudential | $9,170,883,000 | 5.6% |

| 5 | Lincoln National | $8,825,314,000 | 5.4% |

| 6 | MassMutual | $6,874,972,000 | 4.2% |

| 7 | Transamerica | $4,867,311,000 | 3.0% |

| 8 | John Hancock | $4,657,312,000 | 2.9% |

| 9 | State Farm | $4,636,147,000 | 2.9% |

| 10 | Securian | $4,426,864,000 | 2.7% |

These companies are responsible for nearly 65 percent of the 290 million life insurance policies written in the United States.

Pros & Cons of No Exam Life Insurance

As with any product, final expense insurance comes with benefits and drawbacks. Here are some of the biggest you should consider before making a purchase a policy.

Pros & Cons of No Exam Life Insurance

| Pros | Cons |

|---|---|

| Convenient | Limited benefits |

| Guaranteed acceptance for some policies | Age limits |

| No medical exam for those with a fear of doctors or needles | More expensive compared to traditional term policies |

| Easy application | Places healthy individuals in lower health classes |

It’s important to weigh each of these pros and cons carefully before making a purchase decision.

Case Studies: Utilizing No Exam Life Insurance for Different Scenarios

Case Study 1: Pre-existing Medical Conditions

John, a 55-year-old individual, has a history of diabetes and high blood pressure. He wants to secure life insurance coverage to protect his family financially.

However, he is concerned that his pre-existing conditions might affect his eligibility or result in higher premiums. John decides to explore the option of no exam life insurance. By choosing a no exam policy, John can bypass the medical examination process and still obtain coverage.

He fills out a medical questionnaire and provides necessary information about his health history. The insurer reviews his application and offers him a no exam life insurance policy with coverage up to $300,000. John accepts the offer, knowing that his pre-existing conditions are considered during underwriting, and he can provide financial security for his loved ones.

Case Study 2: Fear of Medical Procedures

Sarah, a 40-year-old individual, has always had a fear of medical procedures and doctors. She understands the importance of having life insurance but avoids applying due to her anxiety. When Sarah learns about no exam life insurance, she sees it as a viable option to overcome her fear and secure coverage.

She chooses a no exam policy that doesn’t require any physical tests or medical exams. Instead, she completes a medical questionnaire and provides relevant information about her health. The insurer reviews her application, takes her responses into consideration, and offers her a no exam life insurance policy with coverage up to $250,000.

Sarah is relieved that she can obtain coverage without undergoing medical procedures, allowing her to protect her family’s financial future.

Case Study 3: Convenience and Quick Coverage

Michael, a 30-year-old individual, leads a busy lifestyle and doesn’t have time to schedule and attend a medical exam for life insurance. However, he recognizes the importance of having coverage to safeguard his family. He decides to explore the option of no exam life insurance for its convenience and quick approval process.

Michael applies for a no exam policy online and completes a medical questionnaire. The insurer evaluates his application, reviews his medical records and prescription history, and offers him a no exam life insurance policy with coverage up to $500,000.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

No Exam Life Insurance: The Bottom Line

No exam life insurance policies are a way to ensure that everyone can get the life insurance coverage they need. If you need life insurance with pre-existing conditions, a fear of doctors, or simply don’t have the desire to take a medical exam, you can likely get approval.

That convenience comes at a price. No exam life insurance policies are more expensive and have limited face values. For that reason, they are recommended for those people who have no other choice. If you’re young, healthy, and have no aversions to simple medical procedures, you should apply for a traditional policy.

The exam might be inconvenient, but you’ll save money. Plus, depending on your age, health, and coverage, you might not have to take an exam anyway.

This guide was designed to give you all the information you need to decide if no exam life insurance is the best choice for you. Do you still have questions? If so, be sure to explore the many other guides on this site for all the insurance answers you need.

If you’re looking for information on a specific no exam life insurance policy, read our review of the companies selling some of the most popular policies:

- Gerber no exam life insurance

- Metlife life insurance no medical exam (now Brighthouse Financial)

- AARP term life insurance no medical exam

- Mutual of Omaha term life insurance no medical exam

If you’re ready to shop for no exam life insurance quotes now, use the FREE tool below to compare rates from multiple insurers at once.

References:

- https://www.cms.gov/CCIIO/Resources/Forms-Reports-and-Other-Resources/preexisting

- https://www.ncbi.nlm.nih.gov/pubmed/31230872

- https://naic.org/cis_consumer_information.htm

- https://www.nfda.org/news/media-center/nfda-news-releases/id/4797/2019-nfda-general-price-list-study-shows-funeral-costs-not-rising-as-fast-as-rate-of-inflation

Frequently Asked Questions

Can seniors get no exam life insurance?

Yes, there are options for no exam life insurance for seniors. However, age limits and coverage amounts may vary among insurers.

Who should buy no exam life insurance?

No exam life insurance can be suitable for individuals who prefer to avoid medical exams or have pre-existing medical conditions that may affect their eligibility for traditional policies. It can also be a convenient option for those who need quick coverage.

Can I buy a no exam life insurance policy if I have pre-existing medical conditions?

No exam life insurance policies are designed to be accessible for individuals with pre-existing medical conditions. While traditional policies may require medical exams and assessments, no exam policies typically rely on medical questionnaires and other information sources to evaluate your application.

Can I convert my no exam life insurance policy to a permanent policy later on?

Conversion options may vary between insurance companies and policy types. Some no exam life insurance policies offer conversion privileges, allowing you to convert your term policy to a permanent policy at a later date without the need for a medical exam. It’s important to review the policy details to understand the conversion options available to you.

Can I cancel my no exam life insurance policy if I change my mind?

Yes, you generally have the option to cancel your no exam life insurance policy if you change your mind. However, the cancellation process and any applicable fees or refunds may vary between insurance companies. It’s advisable to review the policy terms and contact your insurance provider directly to understand the cancellation procedure.

Can I name multiple beneficiaries on my no exam life insurance policy?

Yes, most no exam life insurance policies allow you to name multiple beneficiaries. You can designate individuals, organizations, or trusts as beneficiaries and specify the percentage of the death benefit they will receive. It’s important to review the policy terms and consult with an attorney or estate planner if you have specific instructions regarding beneficiary designations.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Zach Fagiano

Licensed Insurance Broker

Zach Fagiano has been in the insurance industry for over 10 years, specializing in property and casualty and risk management consulting. He started out specializing in small businesses and moved up to large commercial real estate risks. During that time, he acquired property & casualty, life & health, and surplus lines brokers licenses. He’s now the Senior Vice President overseeing globa...

Licensed Insurance Broker

Editorial Guidelines: We are a free online resource for anyone interested in learning more about life insurance. Our goal is to be an objective, third-party resource for everything life insurance related. We update our site regularly, and all content is reviewed by life insurance experts.