The Life Insurance Underwriting Process

Free Life Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Kristen Gryglik

Licensed Insurance Agent

Kristen is a licensed insurance agent working in the greater Boston area. She has over 20 years of experience counseling individuals and businesses on which insurance policies best fit their needs and budgets. She knows everyone has their own unique needs and circumstances, and she is passionate about counseling others on which policy is right for them. Licensed in Massachusetts, New Hampshire,...

Licensed Insurance Agent

UPDATED: Jan 8, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident life insurance decisions. Comparison shopping should be easy. We are not affiliated with any one life insurance provider and cannot guarantee quotes from any single provider. Our life insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about life insurance. Our goal is to be an objective, third-party resource for everything life insurance related. We update our site regularly, and all content is reviewed by life insurance experts.

UPDATED: Jan 8, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident life insurance decisions. Comparison shopping should be easy. We are not affiliated with any one life insurance provider and cannot guarantee quotes from any single provider. Our life insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

Life insurance underwriting is where your policy’s destiny is determined. While most buyers believe they are done after submitting the application, this is the farthest thing from the truth. Life insurance underwriting is where your premiums, approval or denials are established.

Many consumers merely sign up based on price alone. They fail to ask the most crucial question: Could I actually be eligible for the rate I see online? Having a broker who understands life insurance underwriting for each company could save you a bundle and perhaps prevent your application from being declined.

Let’s find out what should you remember with regard to life insurance underwriting including underwriting myth, facts, and how to get the best life insurance rates.

Related: 5 surprising ways to save money on life insurance.

What Is Life Insurance Underwriting

In essence, life insurance underwriting is the method through which insurers evaluate the risk a potential buyer poses in order to decide whether or not to approve, deny, or rate up a life insurance policy. As a rule of thumb, the healthier a person is, the less risk he/she poses, and the lower rates he/she will get.

The insurance underwriter’s task is to safeguard the life insurance book of business by following the underwriting criteria or guidelines, which are outlined by each carrier. All insurance companies go by different underwriting criteria.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Type of Life Insurance Underwriting

There are two types of life insurance underwriting: Simplified Issue and Full Medical.

Simplified Issue Underwriting

There are no-exam or medical records required (depending on the insurer) for this type of policy. These are usually the final expense type, which has a lower death amount, but they sometimes have up to 1 million in face amount for no-exam policies. “Simplified” also means quicker turnaround after you submit your application. Make no mistakes; a simplified issue policy will cost you more than a full exam policy.

Full Medical Underwriting

These require a full paramedic exam with blood and urine specimens and, in some cases, EKG. If you have any health issues such as diabetes or overweight, the underwriter will ask for medical records or an attending physician statement (APS).

This process also means that the insurance company is fully aware of the health risk you pose, so, in return, you are getting the best rate for your health class. If you are super healthy, this is the best way to get the lowest possible rate. Full medical underwriting could take 2–6 weeks for a decision.

Life Insurance Underwriting Process

Depending on the type of life insurance you apply for (simplified vs. full exam), the company, your age, and the amount will determine the process the underwriter uses to evaluate your policy. For instance, if you applied with Sagicor for a no-exam policy, they will require a signed application and then will look at three different elements to evaluate it: the pharmaceutical database, motor vehicle records, and medical information bureau.

This is usually done automatically after the application has been submitted without a human underwriter (they call this the Accelwriting Underwriting Process), and you could have a policy within a few minutes to a few days.

If for another example, you applied for a fully underwritten policy with Prudential, they will need the completed application; lab results from the exam; and, in some cases an APS as well as a phone interview. If you applied for a large face amount, they will also do financial underwriting, which will look closely at your assets, income, and liabilities.

Life Insurance Underwriting Questions

As mentioned before, every carrier has its own underwriting guidelines and risk assessment when evaluating a potential client. The less underwriting the companies does, the more risk they take, and the higher rates you pay.

However, all companies have similar questions and information they are interested in when you apply. Here is another post about what information life insurance test reveal.

Life insurance underwriting questions are a way for the underwriter to try to estimate how long you are going to live and determine the final rate of the insurance policy.

They will likely ask about…

- Current age

- Gender

- Height and weight

- Insurable interest (family protection, estate planning, etc.)

- Income and liabilities

- Occupation

- High-risk hobbies, if any

- Current and past health history

- Family history

- Foreign travel

- Smoking habits

- Alcohol habits

- Driving history

- Criminal history

- Prescription usage

You may be surprised at how much information insurance companies need in order to classify your risk. After all, keep in mind they are on the hook for many millions or more should you die, so they are trying to make sure they are still in business when you need them. In short, insurers hedge their odds by having you answer all the requested info.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Life Insurance Underwriting Classes

The underwriter will classify you based on your health risk in a category called a rating class. Also, the insurance company has the final rating classes, not the broker. It’s important to note that not all carriers follow the same classes for the same illness. For instance, you may get a standard rating class with one company for elevated cholesterol and preferred with another.

Here are the available underwriting classes:

- Preferred Plus

- Preferred

- Standard Plus

- Standard

- Table Rating (Substandard table 1–12)

If the broker did his/her job correctly, you shouldn’t be surprised when the final rate comes back. If he/she quoted you a super preferred (best health) and you received table 4 (which is about 200% higher), you might be angry. Worst, if you applied alone and thought that, just because the quote engine showed you a rate, that’s how the company works—you could be in trouble.

Here is another great article about getting conflicting rates as a result of not understanding life insurance underwriting questions.

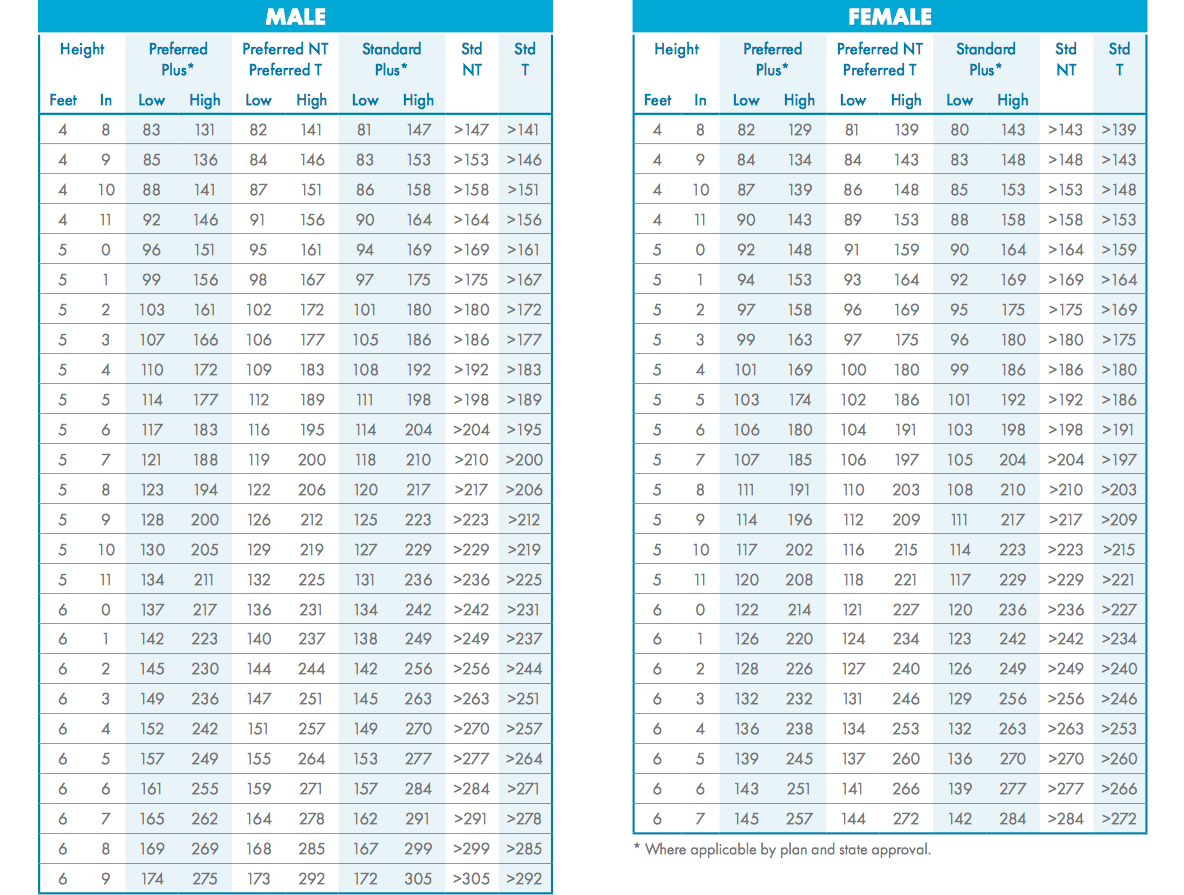

Life Insurance Weight Chart

A weight chart consists of the max allowable weights for given heights. Each company has its independent “build chart” parameters based on the underwriting criteria they follow. It’s one of the first questions a broker may ask regarding your health. This alone could put you in a standard or substandard classes even if you are in a great health and take no medication.

Carriers are very serious when it comes to height and weight because overweight individuals are statistically more prone to diseases in the future, which can result in premature death.

Life Insurance Underwriting Credit Opportunities

In order to be competitive with regard to impaired risk prospects, a few companies such as AIG, Banner, and Prudential came up with a very creative idea called underwriting credit opportunities. Crediting decisions are evidence-based decisions the underwriter can use to offset “debits like” such as weight, high blood pressure, etc. For example, the underwriter may use treadmill credit to offset high blood pressure or high cholesterol. This could improve someone’s class from substandard to preferred and, therefore, save the client money. Think of this as a gesture by the carrier saying that they are looking at everything and rewarding you for the good things you have going for you.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Financial Underwriting for Life Insurance

In some cases—usually when the amount of life insurance benefit is high—the insurer goes the extra mile to evaluate the financial background of a prospect. Financial underwriting is important to eliminate over-insurance. When one’s life insurance exceeds his or her economic value, this is a concern for the carrier. If someone makes $20k per year and buys a $20 million life insurance policy, this raises a red flag with the underwriter. Even if the prospect is very healthy, they will not issue him a policy for that amount.

There are many ways in which they calculate the amount of insurance, affordability, and assets. For now, let’s make it as simple as possible:

Up to age 40: You can buy 35 times your yearly income.

41–50: You can buy 25 times your yearly income.

51–60: You can buy 20 times your yearly income.

61–70: You can buy 10 times your yearly income.

71–80: You can buy 5 times your yearly income.

Case Studies: The Life Insurance Underwriting Process

Case Study 1: Utilizing Simplified Issue Insurance

John recently decided to purchase life insurance to secure his family’s financial future. Due to his age and health concerns, he opted for a simplified issue insurance policy. This type of insurance does not require a medical exam and has a quicker turnaround time for approval. John submitted his application, which included answering a set of health-related questions.

The underwriting process for the simplified issue policy involved the underwriter reviewing John’s application and conducting an assessment based on the provided information. Since John did not have any major health issues and met the criteria for the simplified issue policy, he was approved within a few days.

Case Study 2: Utilizing Full Medical Underwriting

Sarah, being in excellent health and wanting to obtain the lowest possible rate, decided to apply for a fully underwritten life insurance policy. She completed the application, underwent a paramedic exam, and provided blood and urine specimens. Additionally, Sarah consented to the insurer accessing her medical records for a comprehensive evaluation.

During the underwriting process, the underwriter carefully reviewed Sarah’s application, medical records, and exam results. Given her excellent health, Sarah received a preferred plus rating class, which provided her with the most competitive rates available.

Case Study 3: Utilizing Underwriting Credit Opportunities

Mark applied for life insurance and disclosed his history of hypertension. While this health condition could have potentially affected his rates, the underwriter considered the underwriting credit opportunities provided by the insurance company. In this case, the underwriter used treadmill credit to offset the impact of Mark’s hypertension.

By factoring in his healthy lifestyle, regular exercise routine, and well-controlled hypertension, the underwriter assigned Mark a preferred rating class. This enabled Mark to secure more favorable rates despite his medical history.

Last Thought

While life insurance underwriting remains a mystery for most, this guide should give you enough information to realize why it’s crucial to understand it before you buy a policy. You can go ahead and run a quote yourself using the quoter on the righthand side of the page.

If you choose to apply by yourself, you may want to be familiar with all life insurance underwriting, which is constantly changing and evolving. The good news is that working with a broker costs you nothing; we get paid by the carrier. And because we represent more than 50 insurers, we will match you with the best one for you.

Frequently Asked Questions

Can I update my policy if my health improves after underwriting?

Policy updates or conversions due to improved health are generally not possible once the policy is issued. However, some companies may offer specific provisions or riders for such cases.

Can I reapply for life insurance if my application is declined?

Yes, you can still apply with other insurance companies if your application is declined by one. Each company has its own underwriting criteria.

Can I skip the underwriting process with guaranteed issue policies?

Guaranteed issue policies usually do not require medical underwriting or health-related questions, but they may have limitations and higher premiums.

How long does the underwriting process typically take?

The duration of the underwriting process varies but can range from a few days for simplified issue policies to several weeks for fully underwritten policies.

Are there any factors that underwriters don’t consider?

Underwriters typically do not consider factors such as race, ethnicity, or sexual orientation when evaluating an application.

Can I appeal an underwriting decision?

Yes, you can often appeal an underwriting decision by providing additional relevant information or documentation to support your case.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Kristen Gryglik

Licensed Insurance Agent

Kristen is a licensed insurance agent working in the greater Boston area. She has over 20 years of experience counseling individuals and businesses on which insurance policies best fit their needs and budgets. She knows everyone has their own unique needs and circumstances, and she is passionate about counseling others on which policy is right for them. Licensed in Massachusetts, New Hampshire,...

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about life insurance. Our goal is to be an objective, third-party resource for everything life insurance related. We update our site regularly, and all content is reviewed by life insurance experts.