Life Insurance After Prostate Cancer (Companies + Rates)

Life insurance after prostate cancer may not even affect your insurance rate, thanks to high survival rates. Get life insurance for as low as $63.35/month.

Free Life Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Zach Fagiano

Licensed Insurance Broker

Zach Fagiano has been in the insurance industry for over 10 years, specializing in property and casualty and risk management consulting. He started out specializing in small businesses and moved up to large commercial real estate risks. During that time, he acquired property & casualty, life & health, and surplus lines brokers licenses. He’s now the Senior Vice President overseeing globa...

Licensed Insurance Broker

UPDATED: Jan 8, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident life insurance decisions. Comparison shopping should be easy. We are not affiliated with any one life insurance provider and cannot guarantee quotes from any single provider. Our life insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about life insurance. Our goal is to be an objective, third-party resource for everything life insurance related. We update our site regularly, and all content is reviewed by life insurance experts.

UPDATED: Jan 8, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident life insurance decisions. Comparison shopping should be easy. We are not affiliated with any one life insurance provider and cannot guarantee quotes from any single provider. Our life insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

While searching for life insurance with a pre-existing condition can be tiring, it is entirely achievable. Don’t be discouraged just because you had or have a serious illness. This review is for those seeking life insurance for prostate cancer survivors.

Even though there isn’t prostate cancer insurance, you should still consider life insurance. Getting life insurance after prostate cancer is possible, provided that you can meet certain requirements. It’s important to keep in mind that you can expect to pay more than you would without that diagnosis, but we’ll help you sort through the process.

We understand: Getting any cancer diagnosis can be scary, and the first thing you may think of is, “Can I treat it?” It is important to know the facts about prostate cancer and the ways of treatment. This guide will walk you through everything you need to know, from buying term life to how to improve your life insurance profile.

Don’t wait — before you dive into this guide about buying life insurance after prostate cancer, enter your ZIP code in our comparison tool to find life insurance quotes in your area.

Prostate Cancer Survivors Life Insurance Rates

Prostate cancer survivors have slightly different rates than those without. Regardless, when you’re younger, your rates are going to be better.

This is a sample life insurance rate for a 50-year-old non-smoking male with prostate cancer.

Average Monthly Life Insurance Rates by Health Class & Policy Amount – 50-Year-Old Non-Smoking Male

| Health Class | $100,000 | $250,000 | $500,000 |

|---|---|---|---|

| Preferred | $26.23 | $48.81 | $89.87 |

| Standard | $36.62 | $75.94 | $141.81 |

| Table 2 | $49.04 | $93.54 | $178.33 |

| Table 4 | $63.35 | $123.00 | $236.05 |

Even at the $500,000 level, the deal still isn’t that bad. As we go up in age, so does the price tag. These sample rates are for non-smoking men in their 60s.

Average Monthly Life Insurance Rates by Health Class & Policy Amount – 60-Year-Old Non-Smoking Male

| Health Class | $100,000 | $250,000 | $500,000 |

|---|---|---|---|

| Preferred | $63.12 | $126.30 | $240.80 |

| Standard | $92.55 | $201.14 | $388.03 |

| Table B | $120.06 | $243.99 | $479.23 |

| Table D | $158.36 | $323.60 | $637.25 |

Then we have those who are at least 70 years old.

Average Monthly Life Insurance Rates by Health Class & Policy Amount – 70-Year-Old Non-Smoking Male

| Health Class | $100,000 | $250,000 | $500,000 |

|---|---|---|---|

| Preferred | $213.62 | $488.61 | $957.09 |

| Standard | $311.58 | $658.46 | $1,292.92 |

| Table B | $375.78 | $846.11 | $1,625.27 |

| Table D | $499.31 | $1,126.43 | $2,165.31 |

The average rates are significantly higher, especially if you just want the standard option.

Keep in mind that these rates are for non-smoking males. Smoking males with prostate cancer can have higher rates due to their risky health habits. The rates can increase moderately or greatly depending upon the company. Overall, it might just be a good idea to get life insurance sooner rather than later for a good rate.

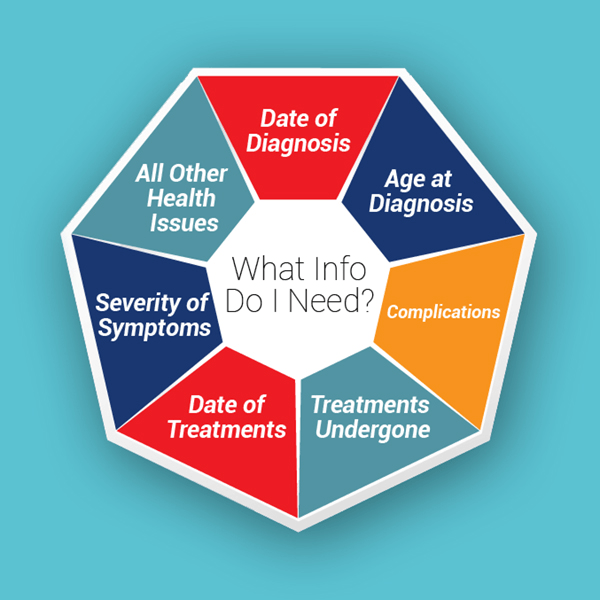

What are the insurance companies looking for when underwriting prostate cancer survivors?

As mentioned in previous articles, each and every insurer on the market has different rules and regulations when it comes to underwriting an individual applying for life insurance.

They all have different risks they are willing to take during the life insurance underwriting of a potential client. That being said, we cover the five most critical things they have in common.

This will give you a general idea of what to expect if you’re shopping for life insurance with a history of prostate cancer.

- Age at diagnosis

- What kind of prostate cancer – Grade and Stage

- PSA (prostate-specific antigen) levels before and after any treatment?

- Gleason Score (a pathology score that predicts progression)

- Treatment type (dates, method)

- Remission or other proof of non-active disease

We’re going to go over in detail what these companies are going to be asking of you to determine your rate. Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

How old were you when first diagnosed?

For most, this may seem like a very innocent question. However, the answer might even get you an instant decline or a postponement. To clarify: if you were first diagnosed before the age of 50, cancers of any kind are more aggressive. This means that it has more potential to metastasize further and can eventually cause your death.

Secondly, having it in your 40s is a huge concern to the insurance underwriter, because a younger person having a disease that mostly happens in an older population shows that your overall health may be in jeopardy.

Even if you beat cancer, you may still be required to wait longer before applying for a traditional policy.

Generally, if you’re over the age of 50, you may need to wait one year. If you’re under the age of 50, you’ll need to wait five years.

What was the cancer’s stage?

Insurers will be looking through your application for evidence of your diagnosis, including the stage and your Gleason Score, to determine the severity of tumors. They will also want to know what your most recent PSA screening results were. If you’ve received treatment and are in remission, that will help improve your chances of getting insurance.

How will each stage affect my ability to qualify for life insurance?

Unfortunately, what stage you are in can determine your rate. So is it better to wait?

- If your diagnostics show stage 1 or 2, you can qualify for preferred rates, provided your overall health is good

- In stage 3, you may still be able to get life insurance, but may need to wait longer after treatment

- If you’re living with stage 4, it will be difficult or impossible to get obtain traditional life insurance, and you may need to opt for a policy from one of the guaranteed issue life insurance companies.

Choosing when to go ahead and purchase life insurance can be a little difficult to determine, so it may be a good idea to get help from a professional.

What was the cancer’s grade (Gleason Score)?

So you might be wondering: “Prostate tumors have a grade?” In short — yes they do. When your tumor cells are examined, they will be graded based on how they look. In a nutshell, the more abnormal your cells look, the higher the grade.

One can even have two scores. The grade can vary between samples, so this can give a couple different scores.

The lowest score is a 1, which means the tumor has a low expectancy of growth. The doctor might also use multiple methods to determine the score. They may take a large number of cells with a high grade of cancer cells so the data might need to be gathered in a modified way to show the aggressiveness of the cancer. So there are plenty of avenues to get to the goal, but what does that even mean?

The doctors will take their sample from the two areas that make up the most cancer. If the tissue looks fairly normal, they will give it a 1. If it’s abnormal, they will score a 5. If the tissue looks so-so (not completely alarming but still cause for concern), they will score anywhere from 2–4.

For example, a Gleason score will be written 3 + 4 = 7 (this is actually a good thing) which means the tumor grade is 3 and less than 4 with a Gleason score of 7.

Gleason score is another crucial aspect the underwriter will be looking at. The Gleason score is a grading system that’s derived from the pathology report. It helps the doctor decide on treatment, and also predict a prognosis.

In short, this grading system categorizes the cancerous cells into five clear patterns from 1 to 5, with 1 considered low-grade tumor cells and 5 high-grade cells (far from being normal cells).

Gleason Score Grading System Used by Life Insurance Underwriters

| Gleason Score Grade | Meaning |

|---|---|

| 1 | Normal |

| 2–4 | Fair |

| 5 | Abnormal |

The pathologist will assign two scores, one for the most predominant pattern, and one for the second most predominant pattern in your biopsy report. Adding these two parameters will give you the Gleason score/grade, from 2–10.

Gleason scores of 2–4 are less aggressive, while 7–10 are more aggressive.

A Gleason score under 6 can get you preferred rates.

What treatment did you have?

The treatment that was recommended to you will give the underwriter a glimpse of the severity of your prostate cancer. There are many treatments out there, such as hormone therapy, radiation, radical prostatectomy, and observation only, to name a few.

From the insurance company’s viewpoint, any time a prostatectomy was successfully performed and the cancer did not spread outside the prostate, it’s good news. You can apply for life insurance after your prostatectomy and traditional life insurance would be your best bet. Looking at sample life insurance rates can help be prepared.

What are your current and pre-treatment PSA levels?

Prostate-specific antigen, also called PSA, is a protein-produced cell of the prostate gland. PSA is found in both healthy cells and cancer cells and can be evaluated using a blood test.

The PSA levels help the doctor decide upon the type of treatment recommended, or whether or not a biopsy is warranted if PSA levels are too high.

Most doctors consider PSA levels of 4.0 ng/mL or lower to be normal. PSA levels and life insurance go hand in hand.

An insurance underwriter expects to see a current PSA of less than 0.1. If your score is anything higher, it’s usually considered to be a recurrence of prostate cancer.

What is an acceptable PSA level?

From the insurance company’s point of view here is what they consider insurable or not if you’ve never had prostate cancer:

- Ages 40–49 – less than 2.5 ng/mL

- Ages 50–59 – less than 3.5 ng/mL

- Ages 60–69 – less than 4.5 ng/mL

- Ages 70+ – less than 6.5 ng/mL

Hard get a visual on the acceptable PSA levels?

Prostate-Specific Antigen (PSA) Levels Used by Life Insurance Underwriters

| PSA Level | Meaning |

|---|---|

| 0 to 2.5 ng/mL | Safe |

| 2.6 to 4 ng/mL | Moderate |

| 4.0 to 10.0 ng/mL | Suspicious |

| 10.0 ng/mL and above | Dangerous |

Safe is nothing to be alarmed about, but moderate may be a good early detection, so you might want to check with your doctor. Suspicious is about a 25 percent chance of prostate cancer. Dangerous is extremely concerning and you should contact your doctor.

This may give you an idea of what to expect from your potential insurance company. Again, this may vary from company to company.

Other Questions the Underwriter Will Ask

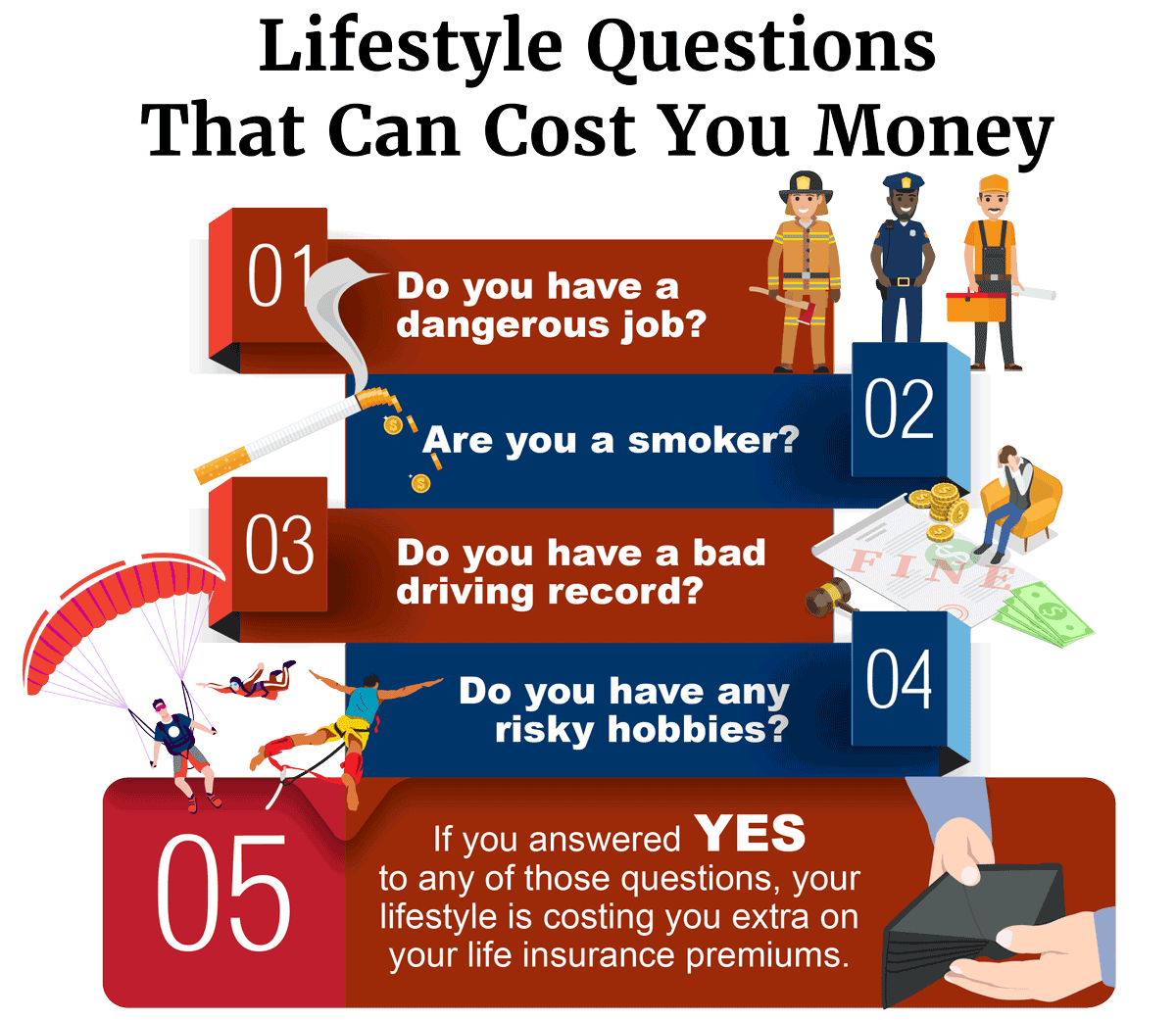

Keep in mind that the type of policy you purchase will determine the type of questions you’ll be asked to answer. For instance, a simplified issue policy that doesn’t require an exam will have a few health questions that require a yes/no answer. On the contrary, a term policy that requires an exam will have certain questions so make sure you review what a term life insurance policy offers and its details.

They will ask your age, gender, state of residence, height and weight. They will also ask you about your occupation, hobbies, health history, smoking habits, and criminal history. There will be some additional questions, but those may depend on your own personal situation.

Be prepared to answer all these questions even if some of these may not be required depending on your choice of company.

How to Get a Better Life Insurance Rate After Prostate Cancer

Getting a better rate can completely depend on how you approach your treatment, how you live your life and how you continue to live your life after treatment.

Even if your cancer is aggressive, your rate can still vary. Overall, insurance companies appear to give better rates to men over 60 who have had successful treatment.

How to Improve Your Life Insurance Profile After Prostate Cancer

If you’re in remission, showing that your cancer treatment has helped you, you have a better chance of being insured. Documenting all of your treatment and positive results can help you find a better rate, although it may be sub-standard.

If you’ve survived prostate cancer beyond five years, your life insurance profile is improved.

With modern treatment, the typical survival rate is much higher than in previous generations and will be taken into consideration. This is something high-risk insurers are familiar with and will take into consideration.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

What is prostate cancer?

According to Mayo Clinic, this type of cancer occurs in the prostate, a small walnut-shaped gland in men that produces the seminal fluid that nourishes and transports sperm. It’s one of the most common cancers in men, with more than 3 million cases in the United States every year, according to the Centers for Disease Control and Prevention (CDC).

Generally, the cancer metastasis is slow, is initially confined to the prostate gland, and may cause no serious harm. Other forms of prostate cancer are more aggressive and can grow very rapidly (metastasis, or spreading to other parts of the body). If detected early when it’s still confined to the prostate gland, there is a higher chance of successful treatment.

Prostate Cancer Diagnosis

To get a proper diagnosis, the doctor may use several different avenues to confirm that the cancer is in fact present.

Digital rectal exam

This is the most common test performed. If you have your annual checkup (and you’re a male), then this is very familiar and is the first step to show the signs of a healthy or unhealthy prostate.

Biopsy

This type of diagnosis requires a small probe to be inserted into the rectum to collect a piece of sample tissue to run the proper tests. This will also allow the doctor to see what stage the cancer is in.

Imaging

There are different types of imaging tests that the doctor can run to help get more information.

- CT scan – This monitors the blood flow around the prostate and the anatomy of the tissues to determine the tumor growth.

- Bone scan – Prostate cancer could possibly get into the bone, so the oncologist might ask for a bone scan to see the progression of the cancer (or just to see if it has even progressed to the bone).

- Magnetic resonance imaging (MRI) – May be used just to look at the prostate health overall.

- ProstaScint scan – This type of scan is used to determine if the cancer has spread to the lymph nodes, bones or any additional tissues.

- PET/CT Scan – This can actually help show cancer cells before they form into a tumor. This helps to get ahead of it, therefore making the treatment process easier.

- Ultrasound – This helps to monitor the tumor and the surrounding tissues.

The doctor will recommend one of these, but it will ultimately depend on what stage you’re in and where your cancer is located.

Bloodwork – PSA (Prostate-Specific Antigen test)

PSA is a protein in the prostate cells that helps keep semen liquified. If there is a high PSA count determined, this could mean there are signs of prostate cancer.

Case Studies: Life Insurance After Prostate Cancer (Companies + Rates)

Case Study 1: Richard – Age 55

Richard is a non-smoking male who was diagnosed with early-stage prostate cancer five years ago. He underwent successful treatment and is now in remission. Richard is concerned about securing life insurance to protect his family financially. After shopping around and comparing quotes from different companies, he finds a policy offering a coverage amount of $500,000 with a monthly premium of $110.50.

Case Study 2: David – Age 65

David is a non-smoking male who had prostate cancer and underwent radiation treatment. While his cancer is in remission, he knows that life insurance rates may be higher due to his medical history and age. After thorough research, he finds a life insurance policy with a coverage amount of $500,000 at a monthly rate of $220.80.

Case Study 3: Robert – Age 72

Robert is a non-smoking male who had prostate cancer surgery five years ago. He is in good health now and wants to secure life insurance to provide financial stability for his loved ones. However, due to his age and medical history, he faces challenges in finding affordable coverage. After extensive comparison, Robert secures a life insurance policy with a coverage amount of $250,000 at a monthly rate of $410.20.

Life Insurance After Prostate Cancer: The Bottom Line

If you’re looking for life insurance and you’ve had prostate cancer, consider working with an insurance broker. Tackling this project by yourself won’t save you any money and will only add frustration and headache to you in the process. Don’t make this the hardest part of the whole situation!

An insurance broker is qualified to search for and offer you the best rates available.

With prostate cancer, whatever stage you’re in, or have recovered from, your best bet is to compare rates and work with an agent who can help you.

Half of consumers want a primary financial advisor: 37 percent have one, while 14 percent are looking for one. Over 40 percent of baby boomers have a primary financial advisor, but only one in three Gen Xers and millennials have one.

Another avenue is to get insurance through work. This can help you narrow down insurance companies and also lower the cost. Being insured through work can help cancel out those big concerns so you can focus on other things — like your treatment if you’re at that stage.

There are plenty of treatment options, but which one you and your health care physician choose are completely up to you. Some may be extremely invasive while others are a little more laid back.

Having prostate cancer is scary but is common. People still are insured and can recover from their illness.

Now that you know it’s possible to get life insurance after prostate cancer, are you ready to compare life insurance rates? Enter your ZIP code below. Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

References:

- https://www.mayoclinic.org/diseases-conditions/prostate-cancer/symptoms-causes/syc-20353087

- https://www.cdc.gov/cancer/prostate/statistics/index.htm

Frequently Asked Questions

Are there resources available to men diagnosed with prostate cancer?

Yes! There are numerous resources available for men and families dealing with the devastating diagnosis of prostate cancer.

How do I choose a physician or specialist for diagnosis and treatment?

Finding more than one physician or putting together a multidisciplinary team may be your best option in choosing a specialist for treatment. This will allow different physicians with multiple specialties to treat you, which can allow them to come up with a great plan for your treatment.

What is “active surveillance,” and will this help me with life insurance rates?

Active surveillance is watching the cancer to see if it’ll progress. This is mainly for low-risk patients. It’s hard to determine if it will or won’t improve your rates. You’ll need to speak to a professional to get a firm answer since rates will vary.

How long do men with prostate cancer live?

Men with prostate cancer actually live a long life five years after diagnosis. According to the American Society of Clinical Oncology, the survival rate for men with prostate cancer living longer than 10 years is 98 percent.

How bad is stage 2 prostate cancer?

Stage 2 prostate cancer can cause erectile dysfunction or issues using the bathroom. It can also spread to nearby tissues in the body. Even though these can be alarming, the later stages of prostate cancer can be more life-threatening.

What is the most successful treatment for prostate cancer?

According to cancer.gov, radiation has proven to be the most effective treatment against cancer. It’s also the best treatment for older men or men with health issues.

Who is most at risk of getting prostate cancer?

All men are at risk of getting prostate cancer. It’s hard to determine if you will or won’t get it. With that being said, the most common risk factor is age, so the older you are, the higher your chances are of getting it.

What is the most accurate test for detecting prostate cancer?

While each test can be unique to the situation, a prostate health index (PHI) will look at the blood, which can give a better way to detect signs of prostate cancer. It is approved for men who have a PSA score between 4 and 10.

What about life insurance after a prostatectomy?

A prostatectomy is a procedure for surgical removal of the prostate gland (in situ). Often times if this surgery is successful, you can apply for life insurance not shortly after your recovery.

What about health insurance after prostate cancer?

Finding health insurance after having prostate cancer if you didn’t already have it might be tricky. Policies for pre-existing conditions could make finding a policy impossible or at the least finding an affordable policy. High survival rates may help your cause compared to other types of cancer.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Zach Fagiano

Licensed Insurance Broker

Zach Fagiano has been in the insurance industry for over 10 years, specializing in property and casualty and risk management consulting. He started out specializing in small businesses and moved up to large commercial real estate risks. During that time, he acquired property & casualty, life & health, and surplus lines brokers licenses. He’s now the Senior Vice President overseeing globa...

Licensed Insurance Broker

Editorial Guidelines: We are a free online resource for anyone interested in learning more about life insurance. Our goal is to be an objective, third-party resource for everything life insurance related. We update our site regularly, and all content is reviewed by life insurance experts.