Aflac Life Insurance Review (Companies + Rates)

Free Life Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Schimri Yoyo

Licensed Agent & Financial Advisor

Schimri Yoyo is a financial advisor with active life and health insurance licenses in seven states and over 20 years of experience. During his career, he has held roles at Foresters Financial, Strayer University, Minnesota Life, Securian Financial Services, Delaware Valley Advisors, Bridgemark Wealth Management, and Fidelity. Schimri is an educator eager to assist individuals and families in ...

Licensed Agent & Financial Advisor

UPDATED: Jan 8, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident life insurance decisions. Comparison shopping should be easy. We are not affiliated with any one life insurance provider and cannot guarantee quotes from any single provider. Our life insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about life insurance. Our goal is to be an objective, third-party resource for everything life insurance related. We update our site regularly, and all content is reviewed by life insurance experts.

UPDATED: Jan 8, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident life insurance decisions. Comparison shopping should be easy. We are not affiliated with any one life insurance provider and cannot guarantee quotes from any single provider. Our life insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

| Key Info | Company Specifics |

|---|---|

| Year Founded | 1955 |

| Current Executive | CEO - Daniel P. Amos |

| Number of Employees | 11,390 |

| Total Sales | $21,758,000 |

| Total Assets | $7,471,000 |

| HQ Address | 1932 Wynnton Road, Columbus, GA 31999 |

| Phone Number | 1-800-992-3522 |

| Company Website | www.aflac.com |

| Premiums Written | 2,679,835 |

| Financial Standing | $2,920,000,000 |

| Best For | Supplemental Insurance |

No one likes thinking about their inevitable death, but having life insurance will be extremely helpful for your loved ones. Your peace of mind can benefit from knowing you have the perfect life insurance policy.

Life insurance provides your loved ones with a financial safety net. However, there are aspects of life insurance that can be beneficial while you are still alive.

Below I evaluate Aflac’s life insurance policies and additional benefit options. This article is about one specific company, and further research should occur before purchasing a policy.

Start comparing life insurance rates now by using our FREE tool above!

Aflac’s Ratings

| A.M. Best | A- (Excellent) |

| BBB | A+ (Highest) |

| Moody's | A3 |

| S&P | A- |

| NAIC Complaint Index-Group Life | 102.53 |

| NAIC Complaint Index-Individual Life | 0.76 |

| Consumer Affairs | 3.5 out of 5 stars / 1,253 ratings |

A.M. Best

Best’s credit ratings are forward-looking, independent, and objective opinions regarding insurer’s, issuer’s, or financial obligation’s relative creditworthiness. In short, it allows the consumer a professional risk assessment of any rated company.

Best’s Financial Strength Ratings focus on how well the company can hold up its end of the bargain. Aflac obtained a Best’s Financial Strength Rating of A-; this means that Aflac has an excellent disposition to handle its financial obligations.

Better Business Bureau (BBB)

The BBB ratings do not focus on money but on the interactions between business and consumers. It is important to note that customer reviews are not applicable; BBB gathers data from public sources and the enterprises themselves.

There are seven rating elements the BBB evaluated before giving Aflac an A+. The A+ means Aflac has been operating a long time with minimal complaints and a few unresolved complaints.

Moody’s

Moody’s uses 10 factors to provide the framework for their ratings. They utilize historical and forward-looking data to rate the financial strength of companies by focusing on business, economic, and operating factors.

Aflac obtained an A3, which is equivalent to having a strong-to-superior ability to repay short-term obligations.

Standard & Poor (S&P)

At S&P, credit ratings provide forward-looking credit risk, which assists in developing smooth-functioning capital markets by providing information and insight to market participants. Aflac received an A-, meaning they have a strong capacity to pay any financial obligations but may be somewhat susceptible to changing economic conditions.

NAIC Complaint Index

The purpose of a National Association of Insurance Commissioners (NAIC) Complaint Index is to compare the performances of different companies. 1.00 is the national average, so anything above means more complaints than average anything below means fewer. To determine a company’s index, you must divide the number of complaints by the number of premiums written.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Company History

American Family Life Insurance Company was founded in 1955 in Columbus, Georgia, by the Amos brothers, John, Paul, and Bill. They believed Americans need financial protection when unexpected medical bills arise. In 1958, a cancer policy was introduced to help those families weighed down by such a financial burden.

The company changed names in 1964, switching to American Family Life Assurance Company. The small change can seem insignificant, but it shifted the companies direction. You see, insurance protects you from accidents and unforeseen events. Assurance covers you when the inevitable occurs.

American Family Life exploded during the 1970s, moving from being a regional seller of insurance to a national one, and eventually a seller on the international stage. The momentum of their growth carried throughout the 1980s, where their total assets exceeded $1 billion.

They also adopted the acronym “AFLAC” and began broadening their product. Aflac U.S. introduced an accident policy, while Aflac Japan introduced the world’s first dementia policy.

During the 1990s, the company decided to vamp up their advertising company with its new name. They also began to spread their interest in philanthropy and technology. The Aflac Cancer Center came to life in 1995 and the SmartApp® in 1996. Three years later, the SmartApp® won the Computerworld Smithsonian Award for Excellence in Technology.

At the same time, we welcomed the new century; we also welcomed one of the most iconic commercial stars: the Aflac Duck. The new icon has bolstered the company for the last couple of decades.

This boost enabled the company to focus on benefiting the community with particular attention to cancer patients. In 2018, they designed a robot, My Special Aflac Duck, to help children cope with cancer.

Aflac’s Market Share

Over the years, Aflac has become one of the best-known supplemental insurance companies in the world. Aflac continues to operate via its headquarters in its hometown of Columbus, Georgia, as well as in Japan.

Though it’s widely known as Aflac, its original name of American Family Life Assurance Company is still prevalent across the nation. They also have some subsidiaries that don’t share the Aflac name: Communicorp Inc. and Continental American Insurance Company.

Currently, Aflac has 1.12 percent of the market share but has seen tremendous growth since the inception of the company. Over the last five years, however, the company has dipped up and down like most companies tend to do. From a long-term standpoint, Aflac continues to make steady growth over time.

Aflac’s Position for the Future

Aflac has had decades of growth and expansion. There doesn’t seem to be an end in sight for this company.

Since 2015, Aflac’s assets have increased each year by a total of over $12,000. The price of Aflac’s stock has seen immense growth. Just last year, the stock value jumped from $67 to $135.

Though Aflac only has 1.12 percent of the market share, it seems safe to say they won’t be going anywhere anytime soon.

Aflac’s Online Presence

Nowadays, when we look for answers, we instinctively reach for our phones or laptops. Sometimes, though, you end up discovering more questions, as well as solutions that can change your opinions.

Aflac dominates its Google search; social media, branches of its website, local agents, and even company-specific questions pop up. Anything you are looking for regarding Aflac, you can find online.

If you’ve chosen to get supplemental insurance through Aflac, you’ll have to find an agent. A great agent can help with any paperwork as well as explain your policy or other policy options, all of which you can do online.

Aflac’s Commercials

Aflac’s commercials are some of the most iconic due to the main star: the Aflac Duck. If you have never come across them on the television, they have their own YouTube channel you can visit and check.

They have a few different themes for their commercials, too. There has often been misconstrued information about what Aflac offers, thus giving birth to the “Aflac Isn’t” line of ads.

The main goal of all their commercials is to make people understand Aflac is an assurance company, rather than an insurance company. They are there when all your insurance doesn’t stack up.

Aflac in the Community

Over the years, Aflac has been very dedicated to giving back to the community. Devoted so that they found a variety of ways to do it. From donations to volunteer hours, Aflac aims to give more each year.

In 2018 alone, Aflac:

- Logged 15,356 hours of volunteer work, a 29 percent increase from 2017.

- Gave out almost 2,000 My Special Aflac DucksⓇ at more than 100 hospitals.

- Raised over $133 million for childhood cancer

- Received ISO (International Organization on Standardization) 14001:2015 certification in environmental management.

Giving back to the community is not the only place Aflac has learned to be more self-aware. The way Aflac treats its employees is essential.

Aflac’s Employees

From an employee standpoint, Aflac knocks it out of the park as employers.

- 92 percent say it is a great place to work

- 95 percent say they felt welcomed upon joining

- 94 percent feel good about the contributions to the community

- 93 percent are proud to tell others where they work

Not only do their employees rave about them, but they have also been given awards and recognition for a variety of things. In these most recent years, Aflac has made it onto 13 reputable lists.

- America’s 50 Most Community-Minded Companies

- Top 10 Newsweek US 500 Green Rankings

- World’s Most Ethical Companies List

- World’s Most Admired Companies List

- 100 Best Companies to Work for List

- Dow Jones Sustainability Index

- 100 Best-Performing CEOs in the World

- 50 Best Companies for Diversity

- 50 Best Companies for Latinas to Work For in the U.S.

- Great Place to Work for Millennials

- Security 500 List

- Computer World’s Best Places to Work in IT

- Best CEOs for Diversity

When we break down the ages of the employees and how long they tend to stay, we can get a bigger picture of the Aflac employees.

The parameters of each generation, in this case, are that millennials were born in 1981 or later, Gen Xers are born between 1965 – 1980, and baby boomers were born 1945-1964.

To build off this information, we can see how long employees have been working at Aflac. The separate groups are less than two years, two to five years, six to 10 years, 11-15 years, 16-20 years, and over 20 years.

Shopping for Life Insurance

Anything can be bought online, and most people find it more convenient. Life insurance is no different. About half of adult consumers visited a life insurance company website and/or sought life insurance information online.

Though three out of five adults have a life insurance policy, it can be mighty confusing. Beyond learning about life insurance, it’s best to know how much you personally should have.

Aflac has a Life Insurance Calculator that will help you estimate the necessary amount specific to your life. It’s only eight questions, meaning it’s straightforward but possibly may not account for everything.

The smart approach for shopping for life insurance is acquiring the most information and the most quotes possible. Every estimate is meant only to inform your decision, not make it for you.

Coverage Offered

The financial future of your loved ones may be in jeopardy without you there. Not only is life insurance designed to provide a safety net for a family in mourning, but it’s also supposed to put you at ease while you’re still here.

A good employer knows that having employees with lower stress levels tend to be more productive. Aflac offers life insurance through employers.

Under most circumstances, Aflac doesn’t find it necessary to ask the medical questions other providers do. That means you could qualify for up to $50,000 without any need to mention that you went to the doctor three times last year for hammertoe.

Also, Aflac knows that life is unpredictable. They make it easy to take your plan with you if you leave your job. Aflac also makes it available for parents to purchase juvenile life insurance.

After the worst happens, the right type of coverage is a must.

It is essential to mention that life insurance through Aflac is offered as a supplemental insurance plan, which is in addition to the plan one would already have through their employer. For employers, the cost falls directly to the employee who obtains a life insurance policy,

Though employers don’t split the cost, the rates offered are often fairly low, especially in comparison to companies that offer individual life insurance. Group insurance plans always seem to have a bulk discount.

Types of Coverage Offered

A common type of life insurance across the industry is whole life insurance. The basic criteria for whole life are that it remains in force for the duration of one’s life and pays a benefit upon that person’s death. Each company will have its unique policies for whole life insurance.

Whole

Aflac’s Group Whole Life Insurance can cover not just employees but their spouses and children as well. Some of the highlights of this type of insurance are:

- Very few medical questions upon application

- Premiums won’t increase

- Portable coverage

- Premiums paid conveniently via payroll deduction

- Builds cash value

Riders

There are also four types of riders or additional coverage options offered by Aflac:

- Waiver of Premium Benefit Rider: If the insured becomes disabled due to bodily injury or disease, the premium will be waived, and the coverage will continue for the duration of the disability.

- Accidental Death Benefit Rider: Additional benefit granted if the insured dies due to accident-related injuries.

- Accelerated Benefit Rider: Upon diagnosis of a terminal illness, Aflac will payout up to half of your Whole Life Benefit.

- Optional Children’s Term Insurance Rider: Benefit received upon proof of death of the insured child if before the child’s 25th birthday.

Whole life insurance policies provide financial protection for life’s situations beyond the typical passing on of the insured.

Factors That Affect Your Rate

Insurance companies and their policies are far from one-size-fits-all. Many different characteristics can affect your rates. The insurance companies’ goals are to maximize profits and the number of premiums while minimizing and assessing the risks.

Though Aflac prides itself on being able to offer coverage where other companies fall short, they still take these factors into consideration.

Demographics

Age is the number-one factor when it comes to setting a price for life insurance premiums. The younger you are, the less likely the insurance companies will have to pay out soon.

Gender is another factor that lies outside of our control when it comes to affecting life insurance rates. Women, in general, live longer than men, and, as you could guess from the logic above, longer life expectancy equals lower rates.

Current Health & Family Medical History

Before most insurance companies agree to insure you, a medical exam — where blood pressure, cholesterol, and the heart are looked at and assessed, as well as overall health evaluation — must be performed.

Insurers may also request your full health records before insuring you. This is to check for serious conditions such as high cholesterol, diabetes, or high blood pressure, which would increase your rates.

Some of these medical conditions can be managed or minimized. However, there is a medical history that cannot be overshadowed or diminished. Complicated family medical history (i.e., stroke, cancer) and pre-existing medical conditions of your own often harm life insurance rates.

While these are important to pay attention to when shopping for life insurance, Aflac does not require extensive medical history with their group life insurance.

High-Risk Occupations

What you do for a living may be the reason you or your employer is interested in a life insurance policy through Aflac. Insurance companies will charge you more, the more danger your life is in, while on the clock.

Construction and transportation are two industries with a high number of fatal work injuries, and your dream of becoming a pilot will be costly, as well.

High-Risk Habits

Insurers can seem very interested in what you do in your everyday life. Habits like smoking cause insurers to increase their rates. If you devalue your life by making unhealthy choices, the insurance companies will increase the premiums of your life insurance.

The higher the risk of you dying, the more you will pay to cover your life.

Smoking is a major behavior evaluated, but it is not the only one. How you drive and how you have fun are just as important. Do you have one or many instances on your driving record relating to speeding, reckless driving, or driving while under the influence of drugs or alcohol?

Whatever insurance company you go with, they will take a look into your life and charge you accordingly. So, to all the adrenaline junkies out there, know a higher premium is a possibility because of your choice to engage in high-risk activities, like skydiving or racing cars.

How much weight each factor holds varies from company to company. This is why getting quotes is so important when it comes to maximizing your policy and your dollar.

Veteran or Active Military Status

During active military service, there is a low-cost option called the Servicemembers’ Group Life Insurance, where you are automatically enrolled under the maximum coverage if you qualify. You may deny or change the coverage, but it is available to all military members.

What happens when you are no longer active duty? Veterans who had an SGLI policy are eligible to switch to Veterans’ Group Life Insurance. A plus side to this that no proof of good health is necessary. There is, however, a maximum of $400,000-worth of coverage.

Aflac’s Programs

To make things simpler for their customers, Aflac has developed a resource tool called MyAflac. This allows you to manage your policy from claims to your agent’s contact information. It is also how you enroll in Aflac AlwaysⓇ.

Aflac AlwaysⓇ is a program that allows customers to protect their coverage in case of losing a job, an employer stops paying, or you retire. By setting up a personal payment option through this program, you will always be covered.

Aflac also provides four additional resources that can be super helpful.

- Products At-A-Glance

- Glossary of Benefits Terminology

- Benefits Estimator

- How-To Videos

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Canceling Your Policy

We all know life doesn’t always go to plan. Sometimes canceling your policy is the right move for you. There are two general ways this can go.

Since Aflac offers life insurance through employers, open enrollment is the most important piece of the puzzle. Open enrollment comes about once a year, allowing you an easy way to cancel your policy.

Sometimes waiting is not an option. If you are no longer paying via payroll deduction or you are no longer eligible for benefits through your employer, you may cancel outside of open enrollment.

How to Cancel

During Open Enrollment: You must submit a signed written request that includes your policy number. This should be mailed to Aflac Policyholder Services, 1932 Wynnton Rd Columbus, GA.

Outside Open Enrollment: You must submit your written request to your local Aflac office, which will then be forwarded for processing.

Click here for an example of a Request for Cancellation of Policy/Certificate form.

How to Make a Claim

Having to make a claim on a life insurance policy can be emotionally straining. Sympathetic and knowledgeable agents should be there to help you every step of the way.

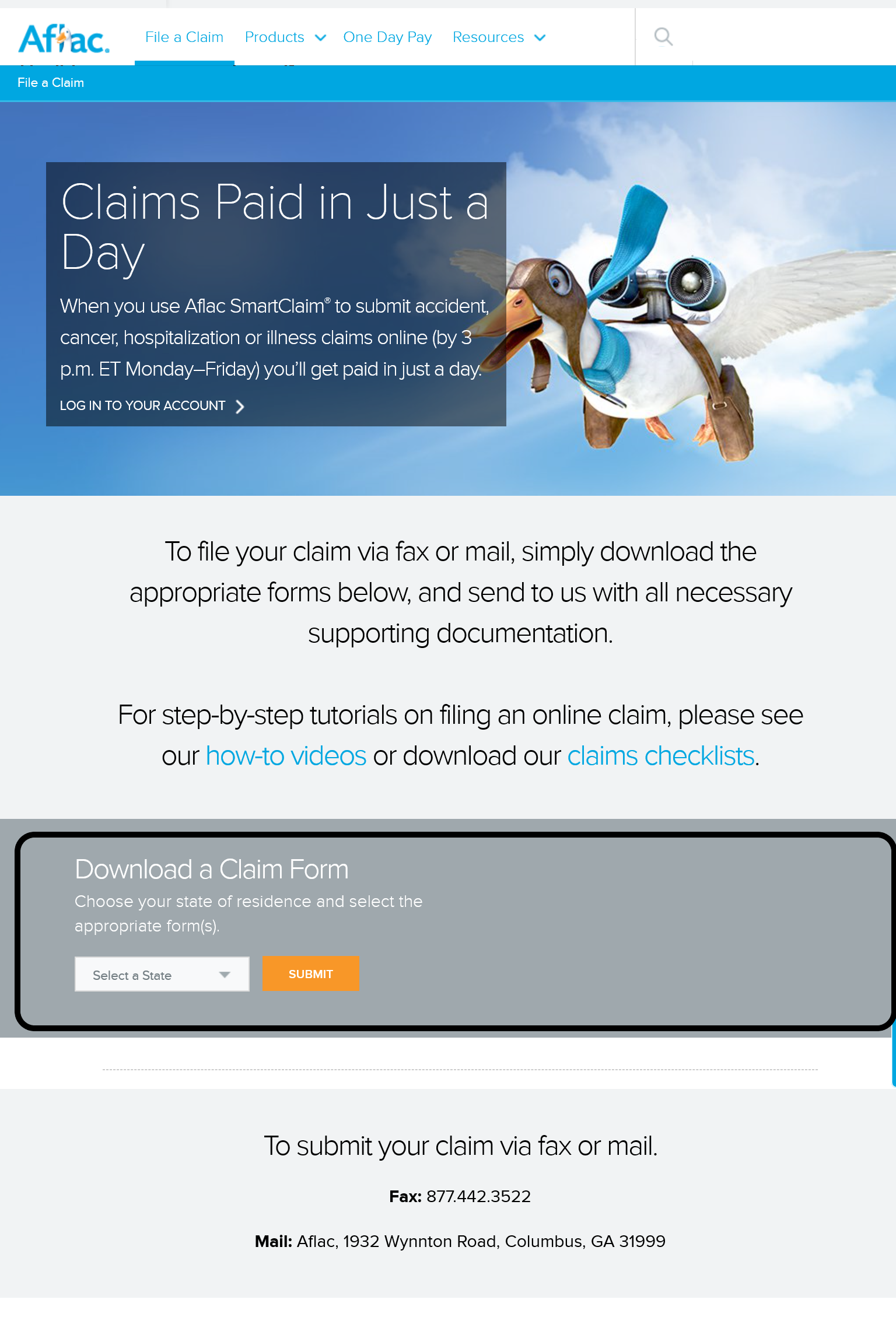

Aflac tries to make this process as easy and simple as possible for everyone. They provide step-by-step how-to videos as well as downloadable claims checklists for a variety of possible claims.

For each type of claim, there is a form to be filled out and mailed or faxed to Aflac’s Claims Department.

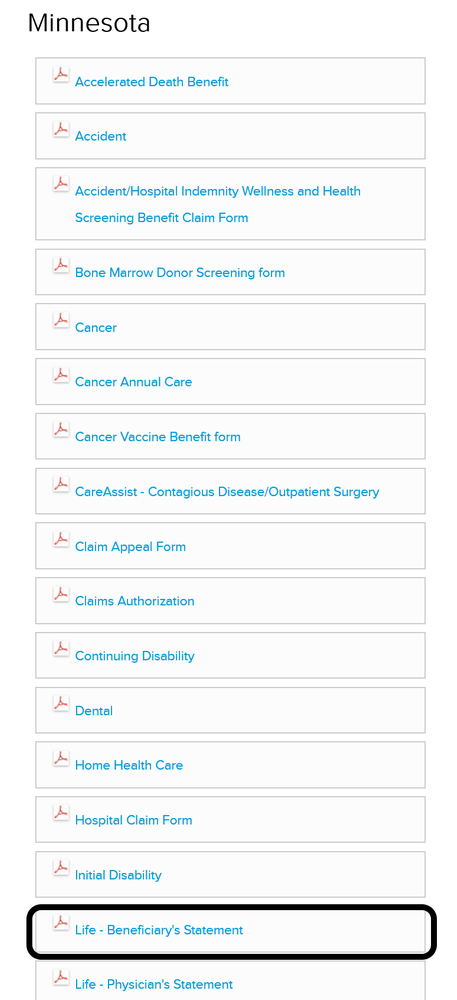

It only takes a few clicks to find the right form for you by state and claim type.

#1 – Visit Aflac’s Home Page

#2 – Click on “Individuals & Families” in the Top Left-Hand Corner of the Page

#3 – Click on “File A Claim” in the Top Left-Hand Corner of the Page

#4 – Scroll Down to the Gray “Download a Claim Form” Box Where You Will Select Your State

#5 – Select the Form “Life – Beneficiaries Statement”

- (The image below is based on the selection of Minnesota. Other states may vary.)

Additionally, there are a few documents that you must submit along with this form.

- Proof of Death – Physician’s Statement (see above)

- Death Certificate

- Authorization to Obtain Information

If there are conflicts with the original beneficiary, additional items may be requested.

How to Get a Quote Online

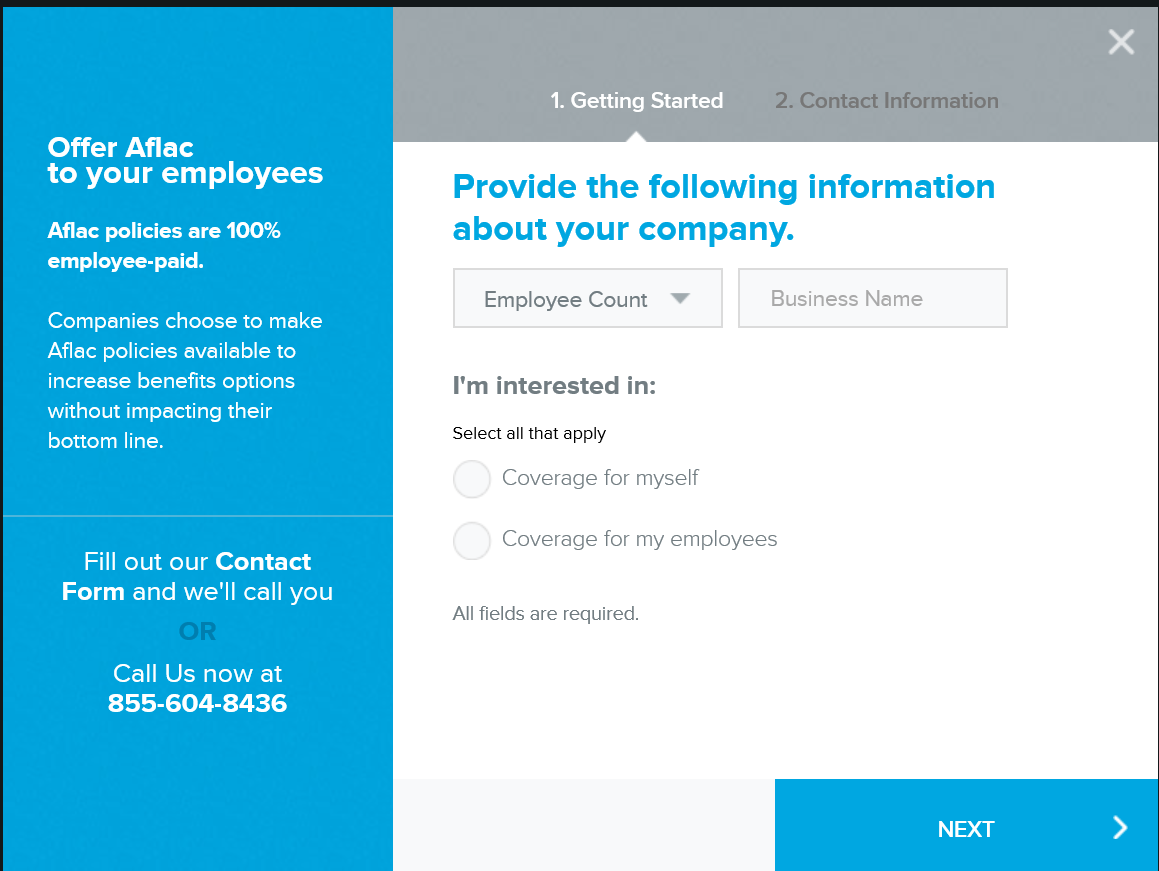

Requesting a quote from Aflac isn’t complicated. Keep in mind, life insurance is only offered through employers, even though the policies are 100 percent paid for by employees.

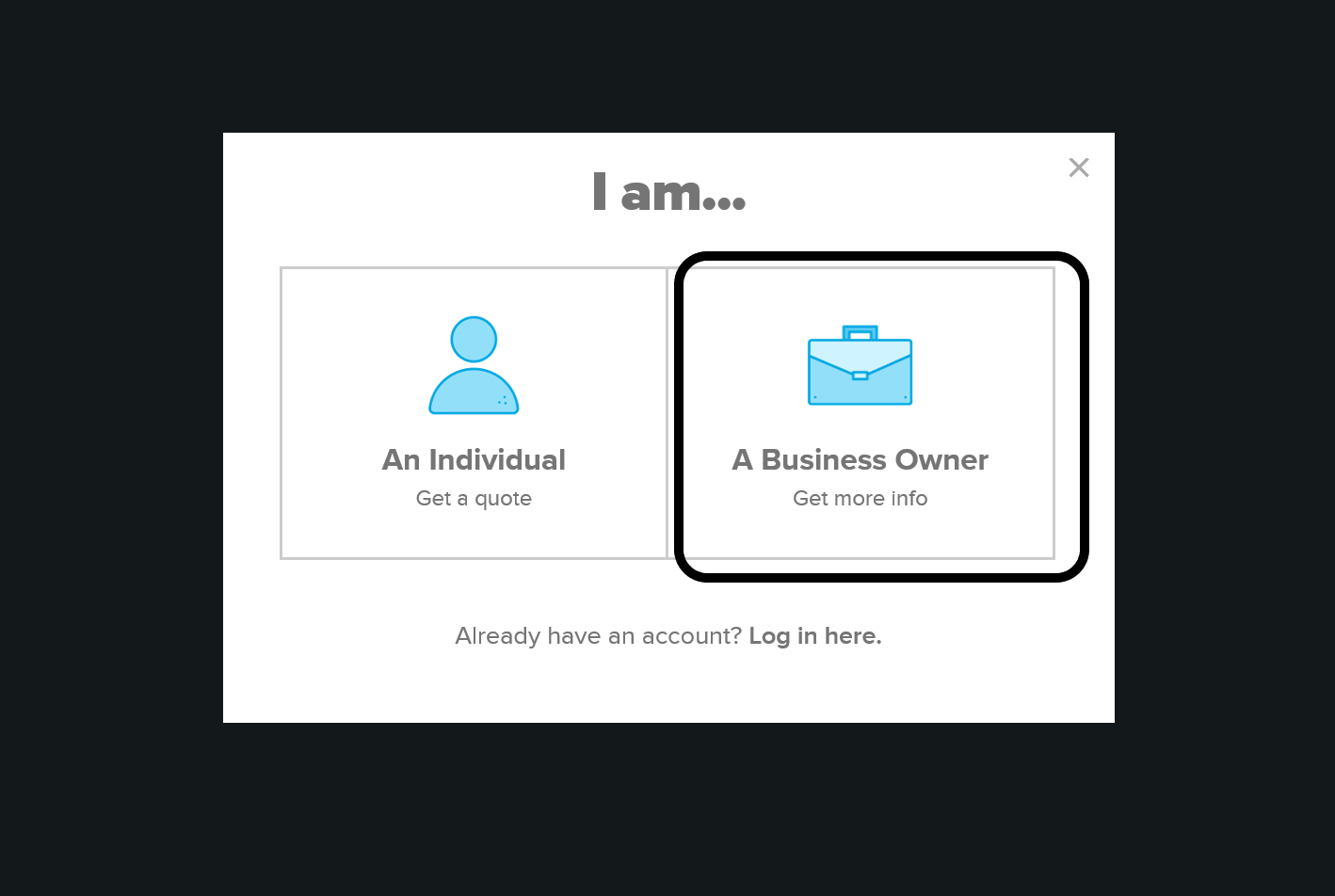

#1 – At the Top of Aflac’s Home Page, in the Right-Hand Corner, Click “Get a Quote”

#2 – When Given Two Options to Click On, for Life Insurance, You Must Be Quoted as a “Business Owner”

- However, if you are interested in individual insurance, excluding life, click on “Individual.”

#3 – You Will Have the Option of Filling Out the Form and Receiving a Callback or Calling the Number Provided to Obtain Your Quote Over the Phone

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Design of Website/App

Aflac’s website is set up in a straightforward fashion. Not only does it have a ton of information and resource tools regarding shopping for a policy, but it also makes viewing and changing your policy easy and straightforward.

Their homepage is dedicated to helping people understand what coverage Aflac offers. If you already have an account, you can log in and have access to view and change any of your information.

There is also an app Aflac provides called MyAflac. The app is designed primarily to file claims and manage your account, including direct deposit information.

On Google Play, MyAflac has three out of five stars. The design of the app does not seem to be a problem, where people have the most complaints is in the functioning of the software.

Pros & Cons

Nothing in life is perfect, especially insurance companies. Aflac prides itself on providing coverage where other insurances fall short. However, there are places Aflac falls short itself.

Pros

- Aflac is a provider of supplemental insurance. When an insurance company leaves you high and dry when you have extra expenses, Aflac is there to protect you financially.

- You can make a claim three different ways: online, over the phone, or through their app.

- You will receive benefit payments faster than most other companies.

- If you leave your job, Aflac makes it easy to keep your coverage.

Cons

- Aflac does not allow you to purchase individual life insurance unless through an employer.

- You can only cancel your policy during open enrollment or upon leaving your job.

- Even though you must go through an employer, life insurance policies are 100 percent paid by employees.

The Bottom Line

Aflac only offers life insurance through employers, which can be frustrating if you have Aflac for other types of insurance coverage. However, once you acquire a policy via your employer, there are options to keep it regardless.

With additional rider options, Aflac makes it easy to have peace of mind no matter what terrible unexpected events life has in store.

It is best for everyone to be prepared for life’s unpredictable moments. Start comparing quotes by using our FREE tool below!

Frequently Asked Questions

What is Aflac Life Insurance?

Aflac Life Insurance is a type of life insurance coverage provided by Aflac, a well-known insurance company. It offers financial protection and peace of mind to policyholders and their loved ones in the event of the policyholder’s death.

How does Aflac Life Insurance work?

Aflac Life Insurance operates by paying out a death benefit to the designated beneficiaries upon the death of the insured person. Policyholders pay regular premiums to maintain the coverage, and the beneficiaries receive the benefit amount tax-free, which can be used for various purposes such as funeral expenses, debts, or income replacement.

What types of life insurance policies does Aflac offer?

Aflac offers several types of life insurance policies, including term life insurance, whole life insurance, and universal life insurance. Each policy type has its own features and benefits, allowing individuals to choose the coverage that suits their needs and preferences.

What is term life insurance?

Term life insurance is a type of life insurance that provides coverage for a specific period, typically 10, 20, or 30 years. If the insured person dies within the policy term, the beneficiaries receive the death benefit. Term life insurance is generally more affordable compared to permanent life insurance policies.

What is whole life insurance?

Whole life insurance is a type of permanent life insurance that provides coverage for the entire lifetime of the insured person, as long as premiums are paid. In addition to the death benefit, whole life insurance also accumulates cash value over time, which can be borrowed against or withdrawn by the policyholder.

What is universal life insurance?

Universal life insurance is another type of permanent life insurance that offers flexibility in terms of premium payments and death benefit amounts. It combines a death benefit with a cash value component that can grow based on interest rates and market performance. Policyholders have the option to adjust their premiums and death benefits within certain limits.

How can I obtain a quote for Aflac Life Insurance rates?

To obtain a quote for Aflac Life Insurance rates, you can visit Aflac’s official website or contact their customer service directly. They will gather relevant information about your age, health, desired coverage amount, and policy type to provide you with an accurate quote tailored to your circumstances.

What factors can influence Aflac Life Insurance rates?

Several factors can influence Aflac Life Insurance rates, including the policyholder’s age, health condition, gender, occupation, lifestyle habits (such as smoking), and the type and amount of coverage desired. Generally, younger and healthier individuals may receive lower rates compared to older or less healthy individuals.

Does Aflac offer any additional benefits or riders with their life insurance policies?

Yes, Aflac offers various additional benefits and riders that can enhance the coverage of their life insurance policies. These may include options for accelerated death benefits, which allow policyholders to access a portion of their death benefit in the event of a terminal illness, as well as options for adding riders like accidental death or child rider coverage.

Can I customize my Aflac Life Insurance policy?

Yes, Aflac allows policyholders to customize their life insurance policies to a certain extent. You can select the type of policy, coverage amount, and duration that aligns with your specific needs. Additionally, you can explore additional riders or benefits that suit your preferences, although these may involve additional costs.

How reliable is Aflac as an insurance company?

Aflac is a well-established insurance company that has been in operation for several decades.

How do I cancel my Aflac life insurance policy?

During open enrollment, you may submit a written request to the PolicyHolder department at Aflac Headquarters.

If you are trying to cancel outside of the open enrollment period, you must not be set up through payroll deduction or no longer with the employer your plan was through. A written request must be sent to your local Aflac agent.

How much protection does Aflac’s life insurance provide?

Depending on one’s income and overall health, the amount of coverage may vary. Aflac has policies that offer up to $500,000 of protection.

How long does it take Aflac to pay you?

Aflac offers a one-day pay option for most insurance claims. Life insurance claims may take a little longer due to the extra paperwork that is required. However, Aflac is still faster than most companies.

Does my Whole Life Insurance coverage through Aflac accumulate cash value?

Yes, but it takes typically three to six years for the value to build. Varies plan to plan.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Schimri Yoyo

Licensed Agent & Financial Advisor

Schimri Yoyo is a financial advisor with active life and health insurance licenses in seven states and over 20 years of experience. During his career, he has held roles at Foresters Financial, Strayer University, Minnesota Life, Securian Financial Services, Delaware Valley Advisors, Bridgemark Wealth Management, and Fidelity. Schimri is an educator eager to assist individuals and families in ...

Licensed Agent & Financial Advisor

Editorial Guidelines: We are a free online resource for anyone interested in learning more about life insurance. Our goal is to be an objective, third-party resource for everything life insurance related. We update our site regularly, and all content is reviewed by life insurance experts.