Dos and Don’ts of Life Insurance (Top 20)

Knowing the dos and don'ts of life insurance before you buy a policy is crucial to getting the most affordable life insurance rate. Learn everything you need to know about life insurance and whether term or whole life is right for you, then get life insurance coverage for as low as $10.85/mo.

Free Life Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Jeffrey Manola

Licensed Life Insurance Agent

Jeffrey Manola is an experienced life insurance agent who founded TopQuoteLifeInsurance.com and NoMedicalExamQuotes.com. His mission when creating these sites was to provide online consumers searching for life insurance with the most affordable term life insurance, permanent life insurance, no medical exam life insurance, and burial insurance. Not only does he strive to provide consumers with t...

Licensed Life Insurance Agent

UPDATED: Jan 8, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident life insurance decisions. Comparison shopping should be easy. We are not affiliated with any one life insurance provider and cannot guarantee quotes from any single provider. Our life insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about life insurance. Our goal is to be an objective, third-party resource for everything life insurance related. We update our site regularly, and all content is reviewed by life insurance experts.

UPDATED: Jan 8, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident life insurance decisions. Comparison shopping should be easy. We are not affiliated with any one life insurance provider and cannot guarantee quotes from any single provider. Our life insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

Here’s what you need to know…

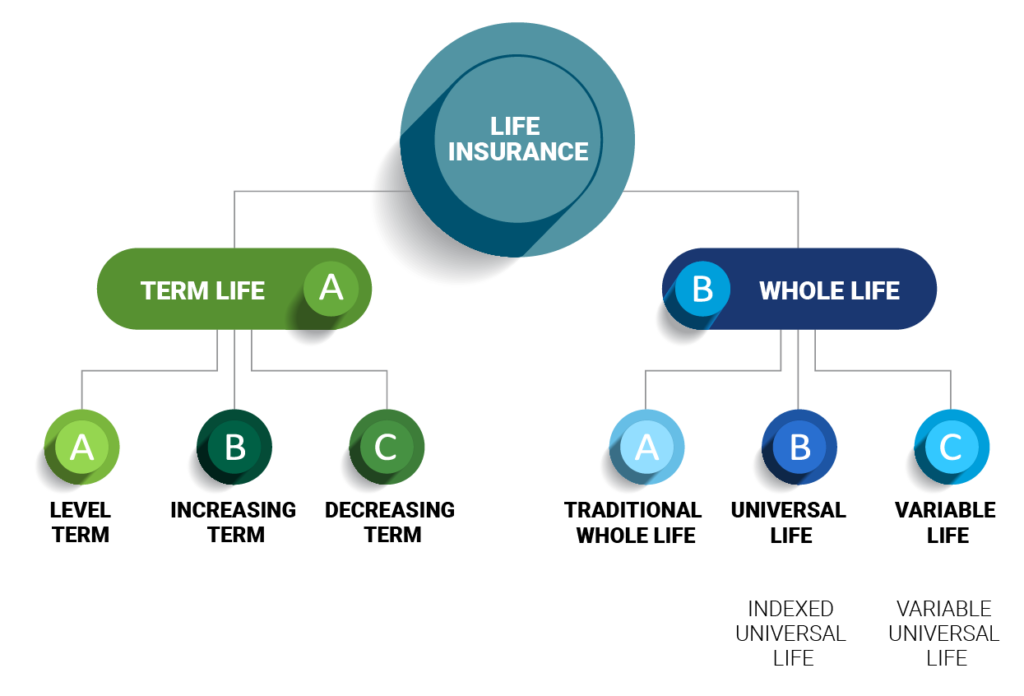

- Life insurance falls into two main categories: term or whole

- Life insurance policies can be customized with riders that increase benefits, add coverage, or protect premiums

- The best life insurance policy is the one that gives you the coverage you need at the lowest price

There are a lot of life insurance tips out there, from understanding your life insurance policy to child life insurance buyer’s guides. Some are good, some are bad, and some are designed only to sell you a product you probably don’t need.

We’ve sorted through the good and bad advice to bring you a list of the top 20 dos and don’ts of life insurance. In it, you’ll learn the truth about life insurance, what to look for in life insurance, and how to buy life insurance.

If you’re already familiar with the life insurance dos and don’ts, you can use the free tool above to instantly compare quotes from multiple life insurers at once. Get started now.

Shopping for Life Insurance Quotes

Before we get started, let’s talk numbers. So, how much does life insurance really cost? As it turns out, far less than you think. But don’t take our word for it, check out the table below with some sample monthly rates for yourself.

Average Monthly Term Life Insurance Rates for a 30-Year-Old, Non-Smoker Male

| Coverage Amount | 10-Year Term Length Average Monthly Rates | 20-Year Term Length Average Monthly Rates | 30-Year Term Length Average Monthly Rates |

|---|---|---|---|

| $100,000 | $10.85 | $12.53 | $16.36 |

| $250,000 | $13.45 | $17.45 | $24.41 |

| $500,000 | $18.56 | $26.22 | $37.93 |

As you can see, term life insurance rates average about $10.85 for a healthy, non-smoking 30-year-old male applying for $100,000 in coverage. That’s not bad. Use our free quote tool on this page to find out exactly how much you would pay.

What is life insurance?

Why life insurance? The truth is the role of a life insurance policy is to serve as a contract between you and the insurer. In exchange for regular payments, the insurer promises to pay cash to your designated beneficiaries upon your death.

Now that life insurance is explained, let’s dive a little into deeper.

#1 – Do Buy Term & Invest the Rest

Life insurance falls into two main categories: term or whole. Term protects you for a set period, while whole protects you for life. So, which life insurance is best? That will depend on your goals — both long-term and short-term.

Although a term policy is always cheaper, most whole policies have a cash value that grows like a savings account or 401k. Because of that, they are often marketed as an investment. However, that investment component adds to the cost, comes with risk, and might be more than the typical person needs out of a policy.

Most financial planners suggest that a term policy is a better choice for a majority of families. You’ve probably heard the same advice from your favorite personal financial advisors in the media. What life insurance does Dave Ramsey recommend? Always term.

For most, life insurance and investments should be viewed as two separate needs. If you really want cash growth, you should buy term life insurance over whole and invest the difference yourself.

So, why is permanent life insurance bad? It isn’t. It just gets a bad reputation because it’s more expensive, but again, that depends on perspective.

#2 – Do Consider Riders

Life insurance policies can be customized with riders that increase death benefits, add additional coverage for spouses and children, or protect your premiums.

Some common riders are as follows.

Common Term Life Insurance Riders

| Rider | Description |

|---|---|

| Accidental death benefit | Pays a benefit in addition to the death benefit of the policy if the insured dies as a result of qualifying accidental injuries |

| Terminal illness | Gives early access to a percentage of the death benefit if diagnosed by a physician as having 12 months or fewer to live |

| Child | Pays a death benefit to the insured parent upon the death of an eligible child |

| Spouse | Pays a death benefit to the insured person upon the death of an eligible spouse |

| Waiver of premium | Waives the policy premiums if the insured becomes completely disabled |

| Disability income | Pays a monthly income of 1 – 2% of the face value if the insured becomes disabled |

| Guaranteed insurability | Guarantees you the right to buy additional insurance, without proof of good health, at specified dates in the future |

| Return of premium | The insurer will return your premiums at the end of the term, minus the additional cost of the rider |

Always explore your rider options.

Compare Quotes From Top Companies and Save Secured with SHA-256 Encryption

Who needs life insurance?

Is life insurance necessary? That varies from person to person, but the answer is usually yes. Some people don’t need life insurance, but they’re the minority. Most adults need some kind of coverage, even those who think they don’t.

#3 – Do Consider Who Will Need the Proceeds from a Life Insurance Policy

Think about anyone in your life who would suffer financially or get stuck with a bill after you’re gone.

You should obviously consider a policy if you have a spouse or children who depend on your income, but you should still think about coverage even if you don’t.

According to the National Funeral Directors Association, the average funeral costs around $7,500. Something as simple as a low-value final expense policy can help you pay for your own funeral and burial without impacting any extended family or friends.

#4 – Do Consider Multiple Beneficiaries

What happens if you outlive your beneficiary and never update your policy? What happens if your beneficiary is your spouse and you both die together? Having multiple beneficiaries can help.

Having multiple beneficiaries, including another adult, is also smart if your beneficiary may still be a minor when you die.

#5 – Do Buy Life Insurance for Non-Working Spouse

Any spouse – regardless of salary – tends to contribute in some way to the finances of the household: cooking, offsetting childcare costs, etc. That contribution would need to be replaced in the event of their death. That spouse could also leave behind debts that the primary income provider is obligated to pay.

When to Get Life Insurance

There’s no time like the present when it comes to life insurance. If you’re wondering the best time to buy, the answer is always now.

#6 – Don’t Wait Until You Need It to Buy It

If you don’t currently have a spouse, children, or house, don’t wait until you do to buy coverage.

Premiums increases with age. The longer you wait, the more expensive it will be. It’s better to lock in a low price for a long term while you’re young than to buy after your rates go up.

#7 – Don’t Cancel Your Coverage Without Having a Replacement Policy

If you cancel a policy before you have a new one in place, you risk dying while unprotected — and protection is one of the main functions of life insurance. You also run the risk of higher prices after a gap in coverage. Life insurance rates only increase with time. They never go down.

#8 – Don’t Apply for A Guaranteed Issue Policy First

A guaranteed issue policy promises coverage regardless of age or medical history. With no medical exam, the insurer automatically assumes the highest risk and charges high rates.

Guaranteed issue is a good option for someone with medical conditions that prevent them from getting coverage. However, it is needlessly expensive for those who don’t. You should never apply for a guaranteed issue unless it’s your only option.

How much life insurance coverage do I need?

Buying the right amount of life insurance is just as important as buying the right type.

#9 – Don’t Buy More Coverage Than You Need

Too little life insurance puts your family at risk, but too much is a waste of money. The key is to calculate your total need, then buy only that amount.

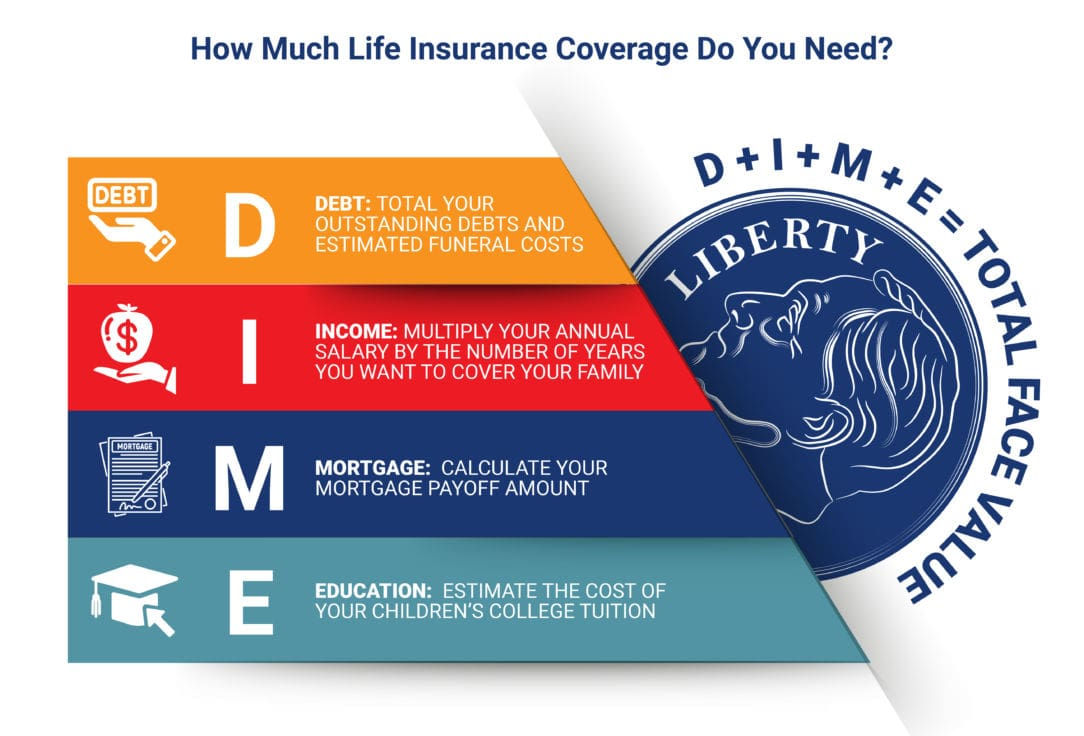

Some financial advisors recommend buying 10 times your annual income. Another popular method is the DIME method:

- D: Debt

- I: Income

- M: Mortgage

- E: Education

Adding up your total obligations in those four categories will give you the minimum face value you need. Here’s a quick example.

- Debt: $10,000 car loan + $5,000 credit card + $7,500 funeral costs = $17,500

- Income: $375,000

- Mortgage: $75,000

- Education: $30,000

- Total need: $502,500

To meet all of those obligations, you would need a life insurance policy with a face value of around $500,000.

Compare Quotes From Top Companies and Save Secured with SHA-256 Encryption

#10 – Do Consider Your Long-Term Financial Goals

The death benefit from a life insurance policy is generally meant to cover two types of obligations: immediate and future. Immediate obligations are the things that need to be paid soon after your death:

- Funeral costs

- Medical bills

- Mortgage balances

- Personal loans

- Credit card debt

Future obligations are all of the expenses (either planned or unexpected) that you want to pay for after your death:

- Income replacement

- Spouse’s retirement

- Emergency savings fund

- Children’s college tuition

Remember to think ahead when buying a policy.

#11 – Do Buy the Life Insurance Policy That Fits You

The best life insurance policy is the one that gives you the coverage you need at the lowest price. That will be different for everyone.

Depending on where you’re at in life and your long-term financial goals, that could mean a million-dollar term policy, $500,000 whole policy, or a $10,000 final expense policy.

You can use the information in the following guides to determine the best policy for you.

- Smart Term Life Buying Guide

- All-Inclusive Whole Life Tips

- Final Expense Life Insurance Sample Rates

Don’t get upsold on a policy with features or coverage that you don’t need.

Where to Buy Life Insurance

The internet has made it easier than ever to buy life insurance. You can quickly compare costs and policy features to make sure you’re buying from the right company.

#12 – Don’t Get Quotes from an Insurance Company Directly

No insurer is going to tell you that their policy costs more than identical coverage from a competitor. The burden is on you to find the best price.

Use online quote tools like the ones on this page to instantly compare quotes from multiple insurers at once. After you have a better idea of who has the best prices, then you can go directly to the insurer’s exact prices.

#13 – Don’t Go to Your Local Property and Casualty Insurance Agent

Casualty insurance isn’t life insurance. It protects other lives, not yours. Plus, few property insurers also sell life insurance.

If your local P&C agent advertises add-on life insurance, it will likely be subsidized by another company and might not offer the full coverage you need. You’re better off going straight to a life insurer or a dedicated life insurance agency.

#14 – Do Shop Around & Compare Prices

The Insurance Information Institute reports that there are nearly 1,000 life insurers in the country. Don’t settle for the first policy you find. Shop around and compare prices to make sure you’re getting the best coverage for the lowest cost.

How to Get the Best Rate

Your life insurance rates are determined by a lot of factors out of your control (age, gender, family medical history), but there are things you can do to get the lowest rate.

#15 – Do Keep A Clean Driving Record

Figures from the National Highway Traffic Safety Administration indicated that Car accidents account for around 35,000 deaths per year in the United States. Life insurers access public driving records to determine your risk of traffic death. A clean record means lower rates.

#16 – Don’t Lie During the Medical Exam

Underwriters have access to public prescription and Medical Information Bureau (MIB) records, so it’s important to be honest on your application. If your records contradict your application, the insurer could deny your coverage.

When you die, if the insurer discovers that you intentionally provided false information to obtain a lower rate or higher face value, most states will allow them to deny the claim.

#17 – Do Quit Smoking

The most common risk factor that insurers look for is smoking. Smokers always pay higher rates than non-smokers.

If you do smoke, not only is it important to quit, you should quit as soon as possible. Most insurers require you to be tobacco-free for at least a year before you can claim a non-smoking rate.

The insurer will verify your abstinence with a blood or urine test.

How to Maintain Your Policy

Buying life insurance was the first step. There are also steps you can take during the life of the policy to make sure you get the most out of it and that it’s there for your family when they need it.

#18 – Don’t Let Your Policy Lapse

Late payments can result in penalties and could lead to the cancellation of your policy. If you have a policy canceled for non-payment, you can expect additional fees to get it reinstated, or higher rates at the next insurer.

If you die while your policy has lapsed, you essentially have no life insurance, despite all the premiums you already paid.

#19 –Do Reassess Your Needs Regularly

During the course of your policy, you might acquire new debts. This would necessitate more coverage or pay off some obligations, which would mean you need less. It’s important to always make sure your coverage matches your financial needs.

Most policies allow you to increase your death benefit (with a new medical exam). Most also allow you to decrease your face value to a set minimum at least once without forfeiting your coverage.

#20 – Do Consider an Irrevocable Life Trust

If you are passing on a significant amount of cash in your estate, you can funnel all of those assets into the cash account of a whole life insurance policy to protect your heirs from the tax burden.

You can establish an irrevocable life insurance trust that owns the policy for you, thereby removing it from your estate. You can also use the trust to protect the cash value on your policy from creditors.

Compare Quotes From Top Companies and Save Secured with SHA-256 Encryption

Dos & Don’ts of Life Insurance: The Bottom Line

You have a lot of options when purchasing life insurance. It’s important to buy the right policy that fits your exact financial need.

Our hope is that this collection of life insurance facts and tips helps you make the best decision. Still have questions? Be sure to check out the other guides on this site that go in-depth on all the topics discussed here.

Now that you’re familiar with the top 20 dos and don’t of life insurance, use the free tool below to instantly compare rates from multiple insurers at once. Get started now!

References:

- http://www.nfda.org/news/statistics

- https://www.iii.org/fact-statistic/facts-statistics-industry-overview

- https://www.nhtsa.gov/traffic-deaths-2018

Frequently Asked Questions

What factors might make purchasing life insurance a poor choice for a person?

You might not need a policy if you are single, debt-free, or self-insured with your own savings. A policy could still prove beneficial, but it isn’t as necessary.

What should I look for when getting life insurance?

The most important things to consider are face value, term length, and cost. Find a policy in which all three meet your specific need.

What can you do with life insurance?

Your beneficiaries can spend the death benefit on anything they like. The funds are typically used for debt payment and income replacement, but you can also use them for estate planning (paying taxes, establishing trusts, etc.)

Why is life insurance important?

Life insurance provides financial protection for your loved ones in the event of your death. It can help cover expenses such as funeral costs, outstanding debts, mortgage payments, and income replacement.

Can I have multiple life insurance policies?

Yes, it is possible to have multiple life insurance policies from different insurers. However, it’s essential to ensure that the combined coverage amounts align with your financial needs and that you can afford the premiums.

What happens if I stop paying the premiums?

If you stop paying the premiums for your life insurance policy, it may lapse or be terminated. In some cases, there may be a grace period during which you can still reinstate the policy by paying the outstanding premiums. However, it’s important to understand the specific terms and conditions of your policy, as different policies and insurers may have varying guidelines.

What happens if I outlive my life insurance policy?

If you outlive your life insurance policy, and it is a term life insurance policy, the coverage will expire at the end of the policy term, and no death benefit will be paid out. However, if you have a permanent life insurance policy that accumulates cash value, you may have the option to continue the policy, convert it to a different type of policy, or access the accumulated cash value. It’s recommended to review your policy documents or consult with your insurance company to understand the options available to you.

Can I change my life insurance coverage amount?

In some cases, you may have the option to increase or decrease your life insurance coverage amount. However, any changes to the coverage amount will likely require a review of your application, underwriting, and potentially revised premium payments. It’s recommended to contact your insurance company or agent to discuss your desired changes and understand the process and implications involved.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Jeffrey Manola

Licensed Life Insurance Agent

Jeffrey Manola is an experienced life insurance agent who founded TopQuoteLifeInsurance.com and NoMedicalExamQuotes.com. His mission when creating these sites was to provide online consumers searching for life insurance with the most affordable term life insurance, permanent life insurance, no medical exam life insurance, and burial insurance. Not only does he strive to provide consumers with t...

Licensed Life Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about life insurance. Our goal is to be an objective, third-party resource for everything life insurance related. We update our site regularly, and all content is reviewed by life insurance experts.