Key Person Insurance: Buyer’s Guide (Companies + 2026 Rates)

Key person insurance covers business costs related to the death of your most valuable employees so that you can stay in business after a key person's death. Rates start as low as $100/month.

Free Life Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Michael Leotta

Insurance Operations Specialist

Michael earned a degree in Business Management with an insurance focus, which led to a successful 25-year career in insurance claims operations and support. He possesses a high-level of business acumen across multiple areas of the insurance industry. Over the course of his career, he served in multiple roles supporting claims operations including: Claims Specialist, Claims Trainer, Claim Automatio...

Insurance Operations Specialist

UPDATED: Jan 8, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident life insurance decisions. Comparison shopping should be easy. We are not affiliated with any one life insurance provider and cannot guarantee quotes from any single provider. Our life insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about life insurance. Our goal is to be an objective, third-party resource for everything life insurance related. We update our site regularly, and all content is reviewed by life insurance experts.

UPDATED: Jan 8, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident life insurance decisions. Comparison shopping should be easy. We are not affiliated with any one life insurance provider and cannot guarantee quotes from any single provider. Our life insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

Key person insurance is a type of corporate-owned life insurance that covers the most important employees in a business. In most cases, this type of life insurance covers CEOs or managers. Rates start as low as $100/month. But is it right for you?

One of the most frequently asked questions about life insurance is how key person insurance is different from group life insurance. Key person insurance doesn’t cover all employees and the benefits go to the business when the key employee dies, while group life insurance is a type of personal life insurance employers can offer to all their workers at reduced rates.

As any what is the purpose of key person life insurance quizlet will tell you, key person insurance can protect your business in the event that a key employee dies.

Ready to find out which key person insurance company is best for you? Get a FREE key man insurance quote using our tool.

Top Key Person Life Insurance Companies

The top three companies for key person life insurance are Northwestern Mutual, MetLife, and Prudential.

Top Three Key Person Life Insurance Companies by Market Share

| Companies | Market Share | NAIC Ranking |

|---|---|---|

| Northwestern Mutual | 6.42% | 1 |

| MetLife | 6.00% | 2 |

| Prudential | 5.57% | 4 |

Northwestern Mutual Insurance is the best-performing life insurance company in the United States. It has dominated the market for over 10 years and offers group life insurance that you can purchase and provide for employees as well as key person life insurance that you can purchase for your key employees.

Northwestern Mutual’s market strength also means the company is extremely financially stable. You won’t have to worry about whether or not it can afford to pay benefits when you need them.

Similarly, MetLife is a well-known company that holds about 6 percent of the market. You’ll find a wide range of business life insurance products here, including key person life insurance, and are likely to be able to purchase policies that meet your business’ unique needs.

Prudential may be only the fourth-highest ranked life insurance company, but it is strong. Prudential has a market share of 5.57 percent and offers a number of personal and business life insurance products. You should be able to purchase key person life insurance and other corporate-owned life insurance products here.

Sample Life Insurance Rates

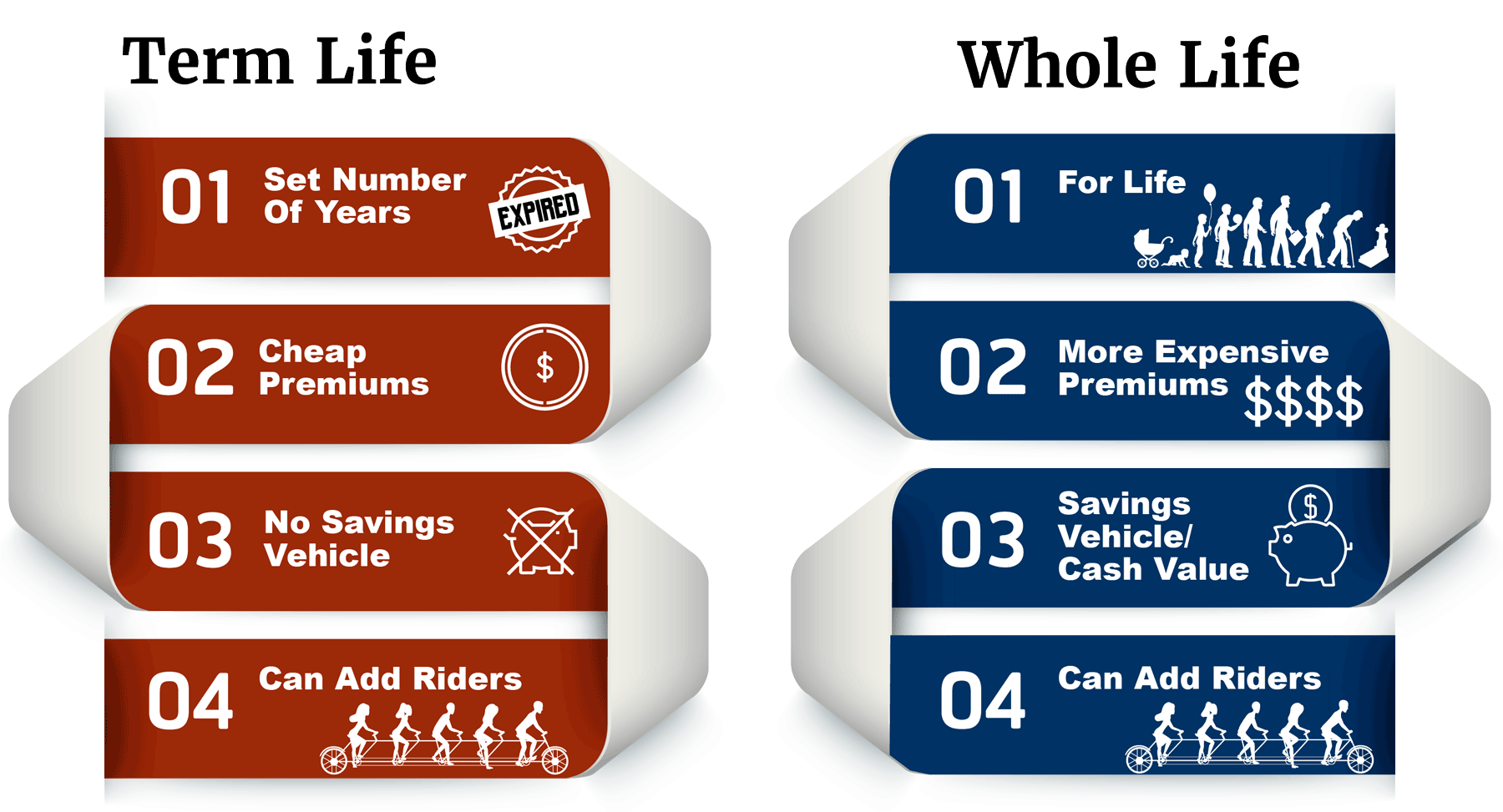

When trying to get the best rate on key person life insurance, there are several factors to consider. First, decide what type of life insurance you want to purchase for your key employees. Term life insurance policies are often cheaper than whole life insurance policies, though you’ll have to decide how long a term you want.

The table below shows the average rates for a term life insurance policy:

Top 10 Life Insurance Companies Average Term Life Monthly Rates by Age

| Gender & Tobacco Use | Age 25 | Age 35 | Age 45 | Age 55 | Age 65 |

|---|---|---|---|---|---|

| Female Non-Smoker | $164.50 | $170.47 | $247.50 | $417.01 | $898.76 |

| Male Non-Smoker | $183.61 | $190.40 | $274.59 | $543.23 | $1,308.00 |

| Female Smoker | $248.90 | $289.34 | $494.59 | $999.43 | $2,267.36 |

| Male Smoker | $328.31 | $366.70 | $648.16 | $1,386.70 | $3,333.99 |

Keep in mind that the greater the amount of coverage you purchase, the higher your rates will be.

According to Investopedia, companies should compare quotes on several coverage amounts: $100,000, $250,000, $500,000, $750,000 and $1 million, and even $10 million dollar life insurance policies,

Finally, if you’re considering purchasing key person insurance, it’s better to buy sooner rather than later. The older your key employees are, the higher their rates are going to be, so you’ll want to buy as soon as possible.

How much key person insurance do you need?

How much key man insurance do I need? How is key person insurance calculated? Most employers use a combination of methods to decide how much coverage they need and then the life insurance company offers a rate based on that number.

The valuation method involves calculating the person’s annual salary and multiplying it by how many years you expect them to remain with the company prior to retirement. The contributions to earnings approach requires you to calculate your average net income over five years and multiply it by a percentage representing the rate of return.

You would then subtract this amount from the key employee’s salary. This is often done in connection with the salary approach, which takes into account how much it would cost to train a new person to replace the key employee.

Often, the best way to calculate coverage amounts is to do all three of these calculations and average the results.

Key Person Life Insurance Coverage Calculation Methods

| Calculation Methods | Calculation Formula | Life Insurance Coverage Amount Equation Example |

|---|---|---|

| Valuation approach | Annual salary X years to retirement | $65,000 X 10 = $650,000 |

| Contribution to earnings approach | Annual salary - Average net income X rate of return (percent) X Number of years to train replacement | $65,000 - $400,000 X .08 X 3 = $99,000 |

| Salary approach | Key person's salary - Replacement's salary X number of years it would take to train replacement | $65,000 - $40,000 X 3 = $75,000 |

| Combined approach | Average results from all three calculations | ($75,000 + $99,000 + $650,000)/3 = $275,000 |

The above table shows these calculation methods for a key employee who makes $65,000 per year and is expected to retire in 10 years. In this hypothetical, the company makes approximately $400,000 per year. Each of these calculations nets a different coverage amount, which is why averaging the coverage amounts is helpful in determining how much coverage to ask for.

Once you’ve decided upon a company, you’ll fill out a key man life insurance questionnaire that helps make your needs clearer. Filling this out as completely and honestly as possible will help your insurance agent come up with a rate that meets your needs.

What is key person life insurance?

Key person life insurance is a type of corporate-owned life insurance that companies can take out on important people in the company, known as key people.

Various types of corporate-owned life insurance, or COLI, have been around for well over 100 years, though key person life insurance only began to be popular in the 1960s. The two other main types of corporate-owned life insurance are split-dollar insurance and key man insurance buy-sell agreements.

What does key person mean? According to Investopedia, if a team member’s absence would “sink the company,” then that person is considered a key person. What is the purpose of key person insurance? It’s insurance that would allow corporations to get financial benefits should such a team member die.

In principle, this is analogous to personal life insurance, but for businesses.

When an insured person dies, their personal life insurance beneficiaries are usually their family members, so they are not devastated by the loss of income and/or funeral expenses.

Similarly, with key person life insurance, when the key person dies, the business is entitled to benefits so that it is not devastated by the loss of income or expenses related to hiring a new person to fill the deceased’s role.

Key man insurance clauses dictate exactly how this works for each business, but in general, key person insurance protects business interests in the event of a team member’s death.

As the below video explains, there are serious financial consequences if a key person dies.

https://www.youtube.com/watch?v=Ia4QNAxBBQY

Some of these financial consequences are as follows:

- Loss of income from the person’s absence from the company

- Vulnerability to competitors taking business while the company is in upheaval

- Loss of credit due to lower financial stability

- Business debts and expenses that need to be paid

- The need to hire someone new to take the key person’s place

Purchasing key person insurance can help offset these problems. The company will receive life insurance death benefits when the key person dies. These benefits can help the business remain financially solvent while getting its affairs in order following the death of the key person.

Key person insurance has increased in popularity and will continue to do so in the coming years over other types of COLI. One reason being is that key person benefits are sometimes tax-free as well as helpful to restructuring a business after a key person dies, and many research companies provide a key man insurance PDF that demonstrates the viability of these types of policies.

How Key Life Insurance Works

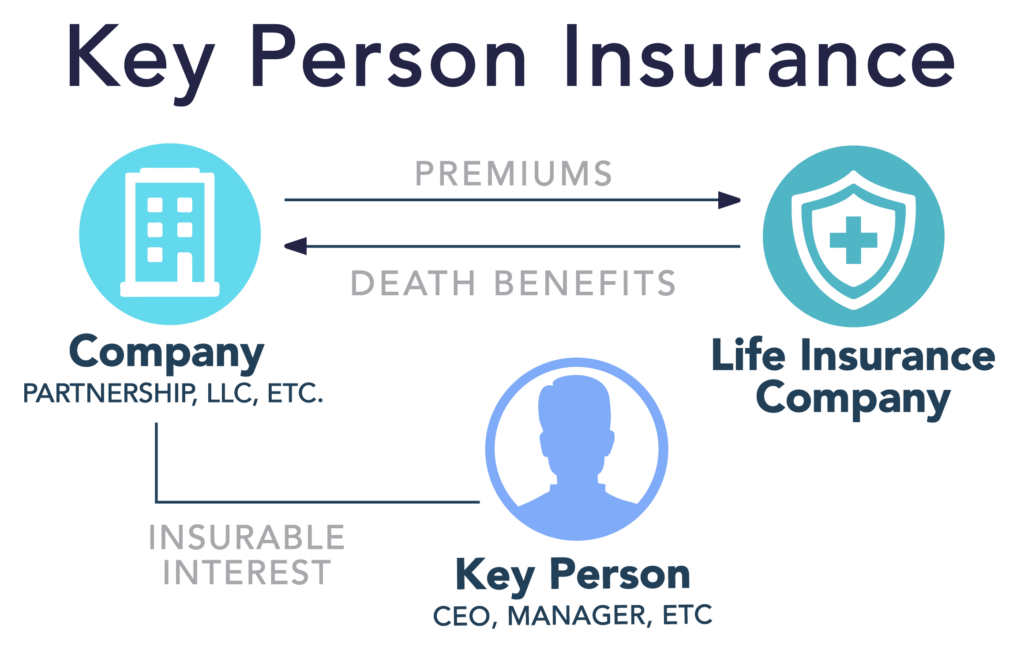

How does key person insurance work? Unlike employer-based group life insurance, key person life insurance is owned by the business.

The business purchases the policy on key employees such as CEOs, informing the employee in writing of the purchase as noted above. Every month, the business pays premiums on the key person insurance policy, although in some cases the key employee may pay part of the key person insurance cost.

The basic idea is that if a key person should die unexpectedly, the business can file a claim and get benefits. Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Types of Key Person Life Insurance

Key person life insurance doesn’t refer to just one type of policy. Your business can purchase term, whole, or other types of key person life insurance. Read on to learn the differences.

Term Life Insurance

Term life insurance is often the cheapest type of life insurance policy. As the name implies, this kind of life insurance covers key people for a specific period of time.

Term life insurance can cover policyholders for 10, 20, or even 30 years. There are also different coverage amounts you can purchase.

When considering term life insurance, it’s important to realize that the insurance does not cover your key employees if it’s an expired term life insurance policy. For example, if you purchase a 10-year policy and your key employee dies 12 years later, your business will not be entitled to any benefits.

In some cases, however, term life insurance policies can be converted to whole life insurance policies at the end of the term. If you choose to go with a term life insurance policy for your key employees, this is something to keep in mind.

Term life insurance policies tend to be popular with business owners because they are cheaper than many other types of life insurance policies.

Whole Life Insurance

Whole life insurance policies have advantages over term life insurance policies.

Mainly, whole life insurance policies cover your key employees permanently. You don’t have to worry about what happens if your employee stays with your company for longer than anticipated because they will be covered for as long as you maintain the policy.

In addition, whole life insurance policies build cash value over time. This allows your business to borrow against the cash value of the policy if needed.

Universal Life Insurance

Universal life insurance is a more flexible type of life insurance that allows you to choose how much to pay into it every month and what investments to make with your insurance payments. It is not very common for businesses to purchase universal life insurance for key employees.

If you do choose to purchase this type of insurance, however, you can build cash value far more quickly than you can with a whole life insurance policy.

Special Key Person Insurance Provisions

Just as personal life insurance has life insurance riders you can purchase along with your basic insurance, key person insurance as special provisions you can purchase along with your basic policies for your key employees.

First-to-Die Provision

The first-to-die provision allows you to get benefits if only one of several key employees dies. For example, if you have key employee insurance on three employees and one dies, you can get death benefits for your company even though the other employees are still alive.

This provision is a good idea if you have a policy on several employees so that you can make sure to get the benefits your business needs if any of your key employees dies.

Buy-Out Provision

The buy-out provision is similar to a buy-sell agreement, but it applies to shareholders rather than partners. This is an important distinction because key employees often own stock in the companies they work for. The company may not be able to afford to repurchase shares on its own, so this type of insurance is helpful.

Repurchasing shares can provide liquidity for the key employee’s heirs and allow you to regain any controlling interest the deceased employee had in the company.

Depending on how your business is structured, you may want to partner this provision with a buy-sell agreement so that you can buy out the deceased partner completely as well as repurchase their shares in the company.

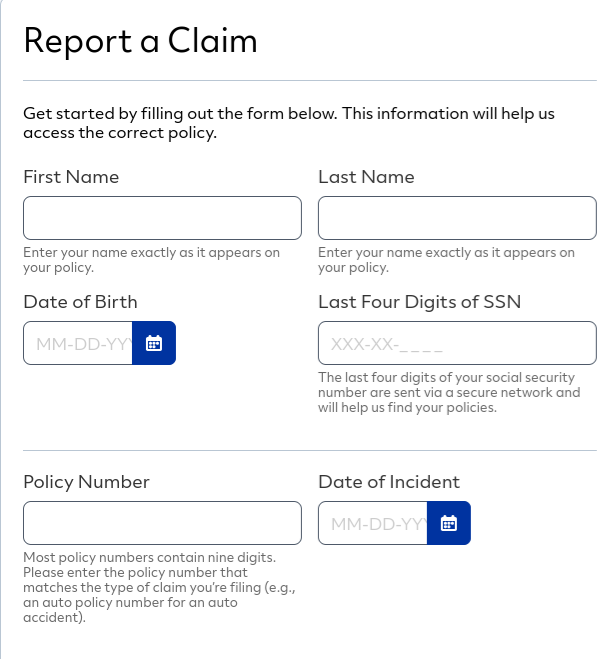

What happens after the key person dies?

After a key person dies, you must make a claim on behalf of your business. This is similar to making a personal life insurance claim.

Gather all necessary information

You may need to coordinate with the family of your deceased employee to get the information you need to file a key person life insurance claim. Most insurance companies will want a copy of the death certificate as well as information about how and where the person died. It is the family’s responsibility to get death certificates in most cases. Make sure to be sensitive to their grief when you ask them for this information.

You’ll also need information such as:

- Your policy number

- The deceased’s full legal name, date of birth, and similar personal information

- Names and contact information for all beneficiaries

Organizing all of this information ahead of time will make the claims process easier.

Contact Your Insurance Company & Get Needed Forms

Once you’ve gathered all the information that you’ll need, your next step is to contact your insurance company to initiate a claim. Some insurance companies allow you to file a claim online.

For example, Allstate allows policyholders to either create an account to use for online claims or use a generic claim form. Online claim forms usually require you to type the needed information into the form and then click Submit. The form is secure so you don’t have to worry about someone intercepting sensitive information.

Some insurance companies do not have this option but do allow you to download and print out forms. You can then fill them out by hand and mail them back. Make sure you mail them to the correct address if you do this, as some companies have several mailing addresses for different types of insurance or for claims originating in different states.

If your insurance company does not offer this option either, you will have to call the company and request the forms you need and/or provide your information over the phone.

Contact Your Insurance Company Again After Returning Forms

Whether you fill out your forms online or by hand, you’ll need to contact the insurance company after you return them to make sure they don’t need any additional information.

Receive Benefits

Most insurance companies take about seven days to process claims, but it could take longer depending on whether the company needs additional information to make a claim.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Key Person Insurance: Pros & Cons

If you’re on the fence about whether or not to purchase key person life insurance, consider the pros and cons.

Key Person Life Insurance Pros and Cons

| Pros | Cons |

|---|---|

| Can help you keep your business open in the event of a key employee's death | Only protects business assets -- it doesn't protect your family or personal finances |

| Can help you avoid bankruptcy if the key person's death creates a financial burden for your business | Can be expensive, making it difficult for small businesses to carry this type of insurance |

| Can help you pay employees and close your business if needed | It doesn't cover all employees and doesn't defray the cost of health insurance for your employees |

As the above table indicates, key person life insurance has advantages for larger businesses that might incur a lot of debt and/or have to close if a key employee dies. However, key person life insurance can be costly, doesn’t cover all employees, and doesn’t offset other business costs like health insurance for employees.

Case Studies: Key Person Insurance

Case Study 1: Manufacturing Inc.

Manufacturing Inc. is a medium-sized manufacturing company that specializes in producing automotive parts. The company’s success largely relies on its CEO, John Smith, who has extensive knowledge of the industry and strong business relationships.

Concerned about the potential financial impact of John Smith’s unexpected death, Manufacturing Inc. decides to explore key person insurance options to safeguard its business continuity and financial stability.

The company opts for a key person insurance policy with a coverage amount of $5 million, reflecting John Smith’s significant contribution to the company’s success. The policy covers the company’s financial obligations, such as hiring and training a replacement, maintaining business operations during the transition, and covering any potential loss of revenue.

Tragically, John Smith passes away unexpectedly in a car accident unrelated to work. Manufacturing Inc. files a claim with the insurance company, and the death benefit of $5 million is paid out to the company. This payout allows the company to smoothly transition its operations, recruit and train a new CEO, and maintain its financial stability during this challenging time.

Case Study 2: Tech Solutions

Tech Solutions is a small IT consulting firm known for its innovative solutions and personalized services. The company heavily relies on its Chief Technology Officer (CTO), Sarah Johnson, who possesses unique expertise and is the driving force behind the company’s success.

Recognizing the potential risks associated with Sarah Johnson’s sudden disability, Tech Solutions seeks to protect its business interests and ensure that it can continue its operations without disruption. The company purchases a key person insurance policy with a coverage amount of $2 million, reflecting Sarah Johnson’s vital role in the organization.

The policy is tailored to cover potential expenses, such as hiring a temporary replacement, maintaining day-to-day operations, and supporting Sarah’s family during her disability. Unfortunately, Sarah Johnson suffers a severe injury that leaves her unable to work for an extended period.

Tech Solutions files a claim under the key person insurance policy, and the insurance company disburses the disability benefits to the company. The funds allow Tech Solutions to hire a temporary CTO, continue its services to clients, and alleviate the financial burden on Sarah and her family.

Case Study 3: Startup Ventures

Startup Ventures is a newly established technology startup with ambitious growth plans. The company’s CEO, Michael Anderson, is not only the co-founder but also the visionary driving the company’s innovation and expansion strategies.

As Startup Ventures seeks venture capital funding to accelerate its growth, potential investors express concern about the company’s financial stability in the event of Michael Anderson’s untimely death. To address these concerns, the startup decides to explore key person insurance options.

Startup Ventures secures a key person insurance policy with a coverage amount of $1 million to mitigate the financial risks associated with the sudden loss of Michael Anderson. The policy is designed to reassure investors about the company’s ability to maintain its operations and repay debts in the event of unforeseen circumstances.

Tragically, Michael Anderson passes away due to a heart attack while on a business trip. The startup files a claim under the key person insurance policy, and the death benefit of $1 million is disbursed to the company.

Key Person Insurance: The Bottom Line

Key person life insurance can protect your business’ financial stability in the event of a CEO or other important person’s death. If you are a larger business, it often makes sense to purchase this type of insurance because the death of any or all of your key employees could make a huge difference to your bottom line.

In this case, you might also want to purchase buy-sell agreements so that you can buy out a partner if they die while working with you.

Small businesses may also benefit from getting key person life insurance, although some companies also offer key person disability insurance, which provides benefits if an employee should become too disabled to work.

Key person insurance can mean the difference between going bankrupt or remaining solvent. If you plan to close your business after a key person dies, key person insurance can give you the money you need to provide severance pay for employees or pay your business’ debts before you close your doors.

If you are a sole proprietorship, however, you are likely better off getting personal life insurance to cover your family in the event of your death. Your business will cease to exist if you die, since you are the only one running it, and key person life insurance benefits must go to your business, not to your family.

Ready to buy key person life insurance? Get a FREE quote so you can see what your options are.

References:

- http://www.sbwire.com/press-releases/key-person-income-insurance-market-to-see-huge-growth-by-2025-allstate-the-hartford-nationwide-axa-1291707.htm

- https://www.mcb-cpa.com/how-does-key-person-insurance-work/

Frequently Asked Questions

Who is the owner and who is the beneficiary on a key person life insurance policy?

With key person life insurance policies, the business itself is both the owner and the beneficiary of the policy, while the key person is the insured person. This differs from personal life insurance, in which you own the policy that insures you and choose your beneficiaries.

Is key person life insurance tax deductible?

In most cases, it is not, as premiums are paid for with after-tax dollars. In the rare instance where the employee is the beneficiary and insurance premiums are considered taxable income, your company can write off key person insurance premiums.

A key person insurance policy can pay for which of the following: an employee’s death in a car accident unrelated to work, an employee’s fatal heart attack on the job, or both?

Both, as long as the employee was a key person. Remember: key person insurance provides benefits to the company if a key employee dies. So if a CEO or manager has a fatal accident off the job, the company is still entitled to benefits. However, the employee’s family will not get any benefits from key person insurance and would have to make a claim with the employee’s personal life insurance company.

Can the coverage amount be adjusted over time?

Yes, the coverage amount for key person insurance can be adjusted over time. As a company grows or experiences changes in its operations, it may require additional coverage or choose to decrease coverage if the need diminishes. It is important to review the policy periodically and make adjustments as necessary to ensure adequate coverage.

Which companies offer key person insurance?

Many insurance companies offer key person insurance policies. Some well-known insurance providers include XYZ Insurance, ABC Insurance, and DEF Insurance. It is recommended to compare quotes and policies from multiple companies to find the coverage that best suits your company’s needs.

How are the premiums determined for key person insurance?

The premiums for key person insurance are determined based on various factors such as the key person’s age, health, occupation, and coverage amount. Insurance companies may also consider the company’s industry, financial stability, and the key person’s contribution to the company’s success. Generally, the healthier and younger the key person, the lower the premiums.

How does key person insurance work?

When a company purchases a key person insurance policy, it becomes the policyholder and pays the premiums. In the event of the key person’s death or disability, the company receives a lump sum payment, also known as the death benefit. The company can use this payment as needed, such as to cover expenses related to the loss or to support the company’s operations during the transition.

Who is considered a key person?

A key person is typically an individual whose absence or loss would have a significant impact on the financial stability or operations of a company. This can include executives, founders, top salespersons, or individuals with specialized skills or knowledge that are crucial to the company’s success.

Can multiple key persons be covered under a single policy?

Yes, it is possible to cover multiple key persons under a single key person insurance policy. The coverage amount and premiums will be determined based on factors such as the importance of each individual to the company and their respective roles. This can be a cost-effective option for companies that have multiple key individuals they wish to insure.

Can key person insurance be canceled or terminated?

Key person insurance can be canceled or terminated by the company at any time. However, it is important to review the policy terms and conditions, as cancellation or termination may result in the loss of premiums paid or impose certain penalties. It is advisable to consult with the insurance provider or broker before making any decisions regarding the cancellation or termination of the policy.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Michael Leotta

Insurance Operations Specialist

Michael earned a degree in Business Management with an insurance focus, which led to a successful 25-year career in insurance claims operations and support. He possesses a high-level of business acumen across multiple areas of the insurance industry. Over the course of his career, he served in multiple roles supporting claims operations including: Claims Specialist, Claims Trainer, Claim Automatio...

Insurance Operations Specialist

Editorial Guidelines: We are a free online resource for anyone interested in learning more about life insurance. Our goal is to be an objective, third-party resource for everything life insurance related. We update our site regularly, and all content is reviewed by life insurance experts.