Northwestern Mutual Life Insurance Review (Companies + Rates)

Free Life Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Jeff Root

Licensed Life Insurance Agent

Jeff is a well-known speaker and expert in life insurance and financial planning. He has spoken at top insurance conferences around the U.S., including the InsuranceNewsNet Super Conference, the 8% Nation Insurance Wealth Conference, and the Digital Life Insurance Agent Mastermind. He has been featured and quoted in Nerdwallet, Bloomberg, Forbes, U.S. News & Money, USA Today, and other leading...

Licensed Life Insurance Agent

UPDATED: Jan 8, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident life insurance decisions. Comparison shopping should be easy. We are not affiliated with any one life insurance provider and cannot guarantee quotes from any single provider. Our life insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about life insurance. Our goal is to be an objective, third-party resource for everything life insurance related. We update our site regularly, and all content is reviewed by life insurance experts.

UPDATED: Jan 8, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident life insurance decisions. Comparison shopping should be easy. We are not affiliated with any one life insurance provider and cannot guarantee quotes from any single provider. Our life insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

| Key Info | Company Specifics |

|---|---|

| Year Founded | 1926 |

| Current Executives | CEO - Stephen Rasmussen |

| COO - Kirt Walker | |

| Number of Employees | 32,110 |

| Total Sales | $46,000,000,000 |

| Total Assets | $236,000,000,000 |

| HQ Address | 1 Nationwide Plaza, Columbus, OH 43215 |

| Phone Number | 1-877-669-6877 |

| Company Website | www.nationwide.com |

| Premiums Written | $10,547,469 |

| Net Income/Loss | 73.85% |

| Best For | Insurance, Investing, and Banking |

Northwestern Mutual has been around for 160 years and has been making positive strides even in the face of hard times. The owners had a vision and wanted to take care of their policy owners.

This American company has been a mutual company from the very beginning, meaning there are no private stockholders. The policyholders share stock in the company and have received dividend checks every year since 1872.

They presently sit at 111th on the Fortune 500 list and have been the number-one provider of life insurance policies for the last four years. They hold over 8 percent of the market share for premiums written.

Want to see what Northwestern Mutual has to offer you for life insurance policies? Get a quote right now with our FREE tool above.

Northwestern Mutual’s Ratings

Overall, Northwestern Mutual has a solid stance among the insurance groups with their overall superior ratings among all the rating agencies. They perform strongly, with solid financial stability and a stable outlook for the future when it comes to their policyholders.

A.M. Best

As the most widely recognized financial rating service, A.M. Best rates Northwestern Mutual an A++, which is Superior, on the rating scale. This rating confirms with consumers their financial strength and creditworthiness at honoring financial obligations worldwide to their policyholders.

Moody’s

Moody’s is a credit rating agency that looks closely at a borrower’s ability to make interest payments or their creditworthiness, especially if you should need to cash out your life insurance policy early. Northwestern Mutual has a very high rating of Aaa, with a stable outlook for the future.

Standard & Poor (S&P)

S&P is another of the Big Three credit agencies that rates the creditworthiness or ability of a company to repay a debt. Northwestern scores A++, showing creditworthiness and a stable financial strength for the future.

Better Business Bureau (BBB)

The BBB is known for providing top-notch information, both in customer satisfaction and complaints. For the New Jersey location, they received an A+ rating with no complaints.

NAIC Complaint Index

The National Association of Insurance Commissioners (NAIC) showed no complaints about Northwestern Mutual for 2018. The NAIC is an advocate for insurance consumers offering resources and guidance for anything insurance-related.

It regulates the insurance industry across all states. This is where an insurer would go to file a complaint against an insurance company if they feel there was misrepresentation or issues with underwriting, for example.

J.D. Power

J.D. Power is another agency that conducts customer surveys of satisfaction, product quality, and buyer behavior, but is best known for its customer satisfaction ratings. Northwestern Mutual scored four out of five in overall customer experience.

They put the customer first in everything they do, from their client relationships to providing new technologies to do business to simplifying administrative tasks and making the customer experience the best possible.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Company History

Northwestern Mutual was originally founded as the Mutual Life Insurance Company of the State of Wisconsin in 1857 in Janesville, Wisconsin. It had early success by paying out its first dividends in 1864 to policy owners and has continued to do so annually since 1872.

As the company grew and expanded into the finance industry in the 1990s and 2000s, it began focusing their attention on life insurance and offering mutual funds, trusts, and annuities as part of their financial services.

With this expansion, came a new, shortened name.

In 2000, the company changed its name to reflect its new vision, Northwestern Mutual.

Northwestern’s first large purchase was a financial planning company, LearnVest, for over $250 million in March 2015.

Northwestern Mutual’s Market Share

From 2015 – 2018, Northwestern remained number one, earning more than $10 million each year and maintaining over 8 percent of the market share each year.

| Year | Market Share | Rank |

|---|---|---|

| 2015 | 8.3 | 1 |

| 2016 | 8.1 | 1 |

| 2017 | 8.2 | 1 |

| 2018 | 8.2 | 1 |

Northwestern Mutual is an American organization based in Milwaukee with offices and subsidiaries throughout the United States. Its subsidiaries are:

- Northwestern Mutual Real Estate Investments, LLC

- Northwestern Mutual Life Foundation, Inc.

- NM GP Holdings, LLC

- Ru Sell Investments France SAS

- Northwestern Mutual Registry, LLC

- Northwestern Mutual MU TLD Registry, LLC

- NM Investment Holdings, LLC

- The Northwestern Mutual Life Insurance Company, Insurance Investments

- NM Pebble Valley LLC

- NM Planning, LLC

- Lydell, Inc.

- Van Buren Building Co.

- The Holter Financial Group

- Northwestern International Holdings, Inc.

- Northwestern Mutual Financial Network of Alabama, Inc.

- Mitchell, Inc.

- NM Regal, LLC

- Northwestern Mutual – Dallas

- Northwestern Mutual Investment Services, LLC

- Northwestern Mutual Foundation

Northwestern Mutual’s Position for the Future

Northwestern Mutual has held the number-one position in market share for individual life insurance for the past four years; however, since their work is mainly in individual plans, they are not as well known for group life as other big-name insurance companies.

Both Moody’s and S&P report a stable outlook for the future and financial standing for Northwestern Mutual’s policyholders, which makes Northwestern a strong company for your life insurance needs.

Northwestern Mutual has a strong, consistent performance from year to year.

Policyowners stay with the company for many years, increasing revenue and building cash value, and because of this, the company continues to see payouts in the amount of $4.8 billion to policy owners and beneficiaries in 2018.

Northwestern Mutual has held the number-one spot for premiums written in the last four years, with the most being written in 2018. The more premiums written, them more policies sold, equaling a higher likelihood of dividends being paid out to policyholders in the company at the end of each year.

| Year | Premiums Written |

|---|---|

| 2015 | $10,123,987 |

| 2016 | $10,100,910 |

| 2017 | $10,488,214 |

| 2018 | $10,547,469 |

In following the industry-wide trend, according to NAIC data, Northwestern Mutual had a loss of income in 2018 from 2017 by 24 percent.

| Financial Standing | 2017 | 2018 |

|---|---|---|

| Northwestern Mutual | $783,000,000 | $1,017,000,000 |

| Industry | $50,600,000,000 | $41,200,000 |

Even with this loss, Northwestern Mutual still boasts a very productive year with dividends paid to policyholders and claims written and paid to beneficiaries.

Northwestern Mutual’s Online Presence

Northwestern Mutual’s website is comprehensive and user -friendly, outlining all the services they provide in detail, locating a financial advisor, and explaining how to file a claim.

The website lays out awards it has received as well as community involvement, partnerships, and ways employees have volunteered hours to help others.

The website is geared toward future policyholders, educating them on different policies and investment options, keeping them updated on market trends and market news, and answering frequently asked questions. It also offers a life insurance calculator, helping future policyholders determine the amount of life insurance coverage to purchase.

However, their website is limited in what they provide, notably lacking an online quote option. Interested consumers must contact a Northwestern Mutual agent to obtain life insurance quotes. Lack of an online quote can result in loss of potential policyholders.

Northwestern Mutual’s Commercials

Northwestern Mutual’s present marketing approach with commercials is focused on their policyholders “living in the present” versus pushing their financial planning to the future, stating that today is just as important as tomorrow.

They want their consumers to understand life does not begin at retirement and they should start enjoying it now. This is a very lighthearted approach to take the anxiety out of financial planning.

Northwestern Mutual in the Community

Northwestern Mutual is very involved in its community, both financially and altruistically. Their employees work selfless volunteer hours — over 30,000 hours each year — to various community organizations, creating opportunities for growth, and funding for cancer.

Over the last decade, Northwestern Mutual has given nearly $170 million to communities across the nation and more than $9 million to support urban education in Milwaukee.

Childhood cancer has become a national focus for Northwestern Mutual and their efforts are astounding. More than 240,000 hours of childhood cancer research has been funded and $20 million in contributions given since 2012.

Lastly, they look to improve the quality of life for Milwaukee residents through improvements to education and creating their hometown as a great destination for tourists.

Northwestern Mutual’s Employees

According to Niche, 40 percent of employees tend to stay with Northwestern Mutual for more than 10 years and 70 percent believe their work makes a positive impact on the world.

Northwestern Mutual is known for its diverse and inclusive workforce and was awarded for this by Forbes in 2018.

Employees enjoy flexible work hours and schedules, provided lunch, access to an on-site gym, and team happy hour. Other positive vibes from employees include good healthcare and retirement benefits. Vacation is encouraged and the workplace is parent-friendly.

Based on reviews, Glassdoor.com gives Northwestern Mutual 3.8 out of five stars and 65 percent of people would recommend Northwestern Mutual to a friend. Reviews on Glassdoor are positive, stating it is a good place to work, great people, flexible hours — overall, a company that cares about its employees.

Northwestern Mutual has been awarded:

- One of the “World’s Most Admired” life insurance companies: FORTUNE Magazine, 2017

- Best Places to Work #67: Glassdoor, 2018

- Highest Rated CEO’s: Glassdoor, 2017

- Top Companies for Women Technologists – Leadership Index: AnitaB.Org, 2017

- Best Places to Work – 100% Corporate Equality Index: Human Rights Campaign, 2018

- Vault 2016 Top Five Financial Services Internships: Vault Guide to Internships, 2017

- 50 Best Companies for Diversity: Black Enterprise Magazine, 2016

- 50 Best Companies to Sell For: Selling Power Magazine, 2016

- America’s Best Employers for Diversity: Forbes.com, 2018

- 100 Best Companies to Work: Glassdoor, 2018

- Training Top 125: Training Magazine, 2017

Shopping for Life Insurance

Northwestern Mutual focuses more on individual policies than group policies, and the bulk of its assets come from these individual policies. The company goes out of its way to market their products and services well, which has kept them in the number-one spot as a life insurance provider for the last four years.

There are many reasons individuals purchase life insurance, including lost income, burial expenses, paying off debt, and building cash value, but for whatever reason you are considering, make sure you choose a company that will be there to make good on its promise to pay out when the time is right.

Coverage Offered

Northwestern Mutual offers term, whole, and universal life insurance coverage. While burial and final expense insurance are not offered as an add-on or “rider,” there is death benefit protection within their policies.

Types of Coverage Offered

To get a better understanding of exactly what Northwestern Mutual has to offer with its policies, read on.

Term

Northwestern Mutual’s term life insurance is the most affordable policy they offer. It provides coverage for a specific time period, such as 10, 20, or 30 years, or to a certain age.

Term life insurance allows you to choose the type of coverage based on your financial situation and budget. You can choose to have the premiums stay the same or have them increase over the length of your policy.

Once that time period has come to an end, so does your coverage. Should you pass after your coverage ends, your family will not receive any benefits or payouts from your policy.

You do, however, have the option of converting your term life policy to a permanent life policy with guaranteed acceptance with no additional underwriting. New premiums are based on age and type of policy chosen.

Whole

Northwestern Mutual’s whole life insurance provides lifetime coverage with level premiums, meaning the premiums paid are guaranteed to remain the same throughout the contract, while the amount of coverage provided increases.

Once purchased, whole life insurance cannot be revoked, reduced, or canceled with the exception of nonpayment of premiums or fraud. Knowing this, you have assured a level of certainty with your life insurance policy.

The advantages of whole life insurance are protection for life, level premiums, cash value, and guaranteed death benefit.

This plan can be purchased at any time until you turn 85. The premium amount is guaranteed regardless of the insured’s increasing age or if they suddenly receive an adverse health condition during the insured time.

The minimum death benefit for a whole life insurance policy is $25,000 and is guaranteed. The coverage amount can be increased depending on your financial situation and need. With this benefit, you can receive it while you are still alive if you become seriously ill and need to pay for medical bills or anything related to illness.

Another great perk of the whole life policy is the cash value component. It grows at a guaranteed rate over the lifetime of the policy and is not taxed until the amount withdrawn exceeds the amount already paid in. This is the money received if you give up your policy or borrow from the insurer.

There are three types of whole life insurance policies offered through Northwestern Mutual:

- 65 Life – level premiums until insured turns 65, then coverage remains in place but no more payments are made

- 90 Life – insured pays payments premiums until 90 with continued coverage but no more payments

- Limited Pay Life – insured chooses how long they will pay for coverage, anywhere from 10 – 30 years based on their financial situation

When a life insurance company is doing well, as Northwestern Mutual has proven itself to be — especially these last four years — they are able to return those profits back to their policyholders.

Northwestern Mutual, as a mutual company, has no stockholders that share in the profits, so the company is able to return those profits directly to its policyholders through dividends. These dividends are a portion of the company’s profits that can be used to pay premiums, increase cash value, purchase additional insurance, or taken as cash.

Adjustable CompLife

Adjustable CompLife Insurance is a hybrid of whole life insurance and term life insurance. It focuses on flexibility and allows you to choose how coverage is divided. The advantages of this type of coverage are cash value accumulation, flexibility, and the ability to have an income stream during retirement along with a death benefit.

Another advantage of this policy is the ability to surrender it for its cash value whenever you choose. So, if you come upon a difficult time in your life where you need those funds, this policy allows you that freedom. You can also borrow up to 90 percent of its value as security if needed.

To better explain the flexibility of this policy, take this example: you would like to purchase a policy to cover your mortgage and also leave an inheritance for your children. You purchase a $400,000 CompLife policy and designate $150,000 term for your mortgage and $250,000 term as the inheritance.

There are some disadvantages to this type of plan, including investment risk and the possibility of premium increases, but for those individuals looking for flexibility and a lower cost option, this is a good choice.

Universal

Universal Life Insurance is another form of whole life insurance with more flexibility. You are still given the lifetime death benefit and the cash value component, but with different payment structures.

The payment structures of a universal life policy allow you to vary the amount and frequency of your payments based on your financial situation at the time. This flexible payment structure is very appealing to those whose incomes change from month to month, like a small business owner or a salesperson working off of a small salary with commissions.

With a universal insurance policy, if you choose to overpay one month, that surplus amount goes toward your cash value which in turn earns interest every month. This money can then be used to cover insurance costs or other needs without the worry of reducing your death benefit.

It is very important to mention, though, that you monitor your cash value. As long as you have enough, you can vary the amount and frequency of your payments. Should your cash value become insufficient, your policy may lapse and you could incur tax consequences as well.

There is a guaranteed death benefit with a universal life policy, but it is important you talk with your agent, because not all policies are the same. Some policies level the benefit, meaning it remains fixed throughout the life of the policy. The cost of insurance increases as one ages, though, so this leveling keeps the costs from increasing too high.

However, some users package death and policy value together, so as one increases so does the other, which causes expenses to rise as you age.

Lastly, because universal is a whole life insurance policy, policyholders are eligible to receive dividends to be used to pay premiums, increase their cash value, purchase additional insurance, or take as cash.

Variable Universal

Variable universal life insurance is a policy that provides lifelong insurance coverage along with a cash value account and a death benefit. This type of policy gives the policyholder the ability to invest and offers a variety of investment options to choose from. There are three primary pieces to this type of coverage: death benefit, cash value, and premium.

As long as premiums are paid, coverage remains in place for the lifetime of the policyholder. A portion of each premium payment goes toward the cost of insurance and the insurer’s fees. These fees keep the death benefit in place for the policyholder. The remainder of the monthly premium goes toward cash value.

Because there are no guaranteed returns on cash value investments (or because those returns can be quite low), a policyholder’s premiums may increase if cash value performs poorly. Also, there is usually a maximum limit on the rate of return, so even during good years, there is the risk that cash value may not perform as well as expected, either.

These restrictions are typically standard with a variable universal life policy and some view them as a higher risk tradeoff when looking at higher potential return.

Riders

Northwestern Mutual carries a variety of add-ons or “riders” you can customize your policy with to fit the individual needs of your family.

Accidental Death & Dismemberment (AD&D) – Covers the loss, or loss of use, of parts or functions of the body or death due to an accident. This double indemnity rider will pay the beneficiary up to double the policy’s value if you die in an accident.

Critical Illness – This insurance is for those incurring a big health emergency such as cancer, heart attack, stroke, or organ transplant. Because of the usual exorbitant prices associated with these illnesses, this insurance pays for those costs not covered by typical medical insurance, including non-medical costs related to the illness.

Disability Income – This insurance supplements your income in the event you are unable to perform your work and earn money due to a disability. This can be either short- or long-term.

Accelerated Death Benefit – Provides cash advances against the death benefit if you are diagnosed with a terminal illness and are expected to pass within two years. Covers medical bills, treatments and other costs associated with end-of-life care.

Factors That Affect Your Rate

Though certain life insurance policies may be more cost-effective than others, there are certain factors that will affect rates and cause the policyholder to pay a higher premium.

Demographics

Age is an important factor when thinking about life insurance. The younger you are, the longer you will be paying premiums and cashing out your policy, so it is very likely your payments will be lower.

Also, since women are likely to live five years longer than men, insurance companies may offer women slightly lower premiums.

Current Health & Family Medical History

To help mitigate the possibility of increasing premium costs and to speed up the underwriting process, having your medical records readily available. These should outline height and weight, blood pressure, cholesterol, ECG, and any family medical history that may predispose you to ailments that could lead to higher rates.

High-Risk Occupations & Habits

Smoking, a high-risk lifestyle, high-risk occupations, and a poor driving record can all cause premium payments to increase.

Getting the Best Rate with Northwestern Mutual

There are many factors that go into getting the best rate when shopping for insurance. A big one is age, as the younger you are, the better the rate you will get. However, gender and health play a big role as well. Women, on average, live longer than men and can expect a lower premium because of this.

The healthier you are, including having an active lifestyle, tips the scale in your favor.

Someone who smokes, which leads to other medical conditions, can expect to pay higher premiums.

Finally, the type of policy you choose affects premium rates. Term policies typically cost less because it covers you for as long as that term lasts whereas whole life lasts your entire life and builds up cash value at the same time costing you more in premiums.

Northwestern Mutual’s Programs

Northwestern Mutual has put into place training and development programs so their employees can succeed from day one. These training programs have earned their place among the best in the country, according to Training Magazine’s “Training Top 125” List.

The Fastrack Sales School – Provides financial representatives with a shared space for independent study and interactive work that enhances and develops a representative’s confidence and skill set to be successful.

E3: Education + Expertise = Empowerment – Training for representatives in the field that is easily and quickly accessible and on a mobile platform that provides video and audio content on a variety of topics for continuing education and training.

Our Mutual Experience – An in-depth development approach for corporate employees that guides and fosters their growth throughout their career.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Canceling Your Policy

Reasons for canceling life insurance are different for everyone, but once you decide to cancel your policy, you will no longer receive any coverage and your family will no longer receive any death benefit when you die.

Depending on the type of policy, there may be a surrender fee and tax penalties charged against the cash value of your policy, especially if you cancel within the first 10-20 years.

With regard to a term policy, if you cancel or let your policy lapse, you forfeit any refund of the premium payments you have made.

For whole life policies with a cash value, there is a possibility of some cash value being returned, but only after any surrender fees and tax penalties have been applied.

How to Cancel

To cancel term life, you can stop paying your premiums altogether and your insurance will be canceled or will lapse. You can also write a letter to your insurer informing them you would like to cancel your policy.

Canceling whole life is a little different because of the cash value aspect. You first need to contact your financial advisor to let them know your intent and discuss the best way to cancel your policy. Your options for canceling your policy include:

- Cash-Out Policy – you will receive the surrender value, which is the cash value minus any surrender fees required by the insurer. If this is early in the policy, there is usually no cash to redeem after fees and penalties are paid

- Reduced Paid-Up Option – you can stop paying your premiums but still maintain a reduced death benefit on your whole life policy

- Let it Lapse – if you choose to let your policy lapse, some insurers will automatically cancel and cash out your policy.

You can cancel your policy at any time. If you choose to cancel your policy during the free look period, which is a state-mandated period of time to cancel without any penalty to the insured, you can receive a refund of any premiums paid.

How to Make a Claim

Dealing with the death of a loved one is difficult enough without the added stress of filing for the life insurance claim. However, Northwestern Mutual has made the process as quick and seamless as possible.

If you know the insured’s financial representative or have one yourself, you can contact them, but if not, call the toll-free number, 1-800-635-8855, or complete the online form to begin the process. Once Northwestern Mutual has been notified, a claim kit will be mailed to you with important information and forms to complete.

Once the kit has arrived, there will be forms to complete along with helpful information and a checklist of materials that will need to be returned, including a copy of the death certificate.

Also, you will need to decide how you would like to receive payment of the life insurance claim once it is finalized. There are different options, such as a lump sum check, an income plan, or a variety of other investment options. If you are unsure or have questions, reach out to a trusted source, like an attorney, accountant, family friend, or your Northwestern Mutual representative for guidance.

After you have completed all the forms and gathered all necessary materials, return the kit via mail, email, or fax to Northwestern Mutual for review. This process typically takes three to five business days.

Once the claim is finalized, payment will be processed and distributed as you have requested.

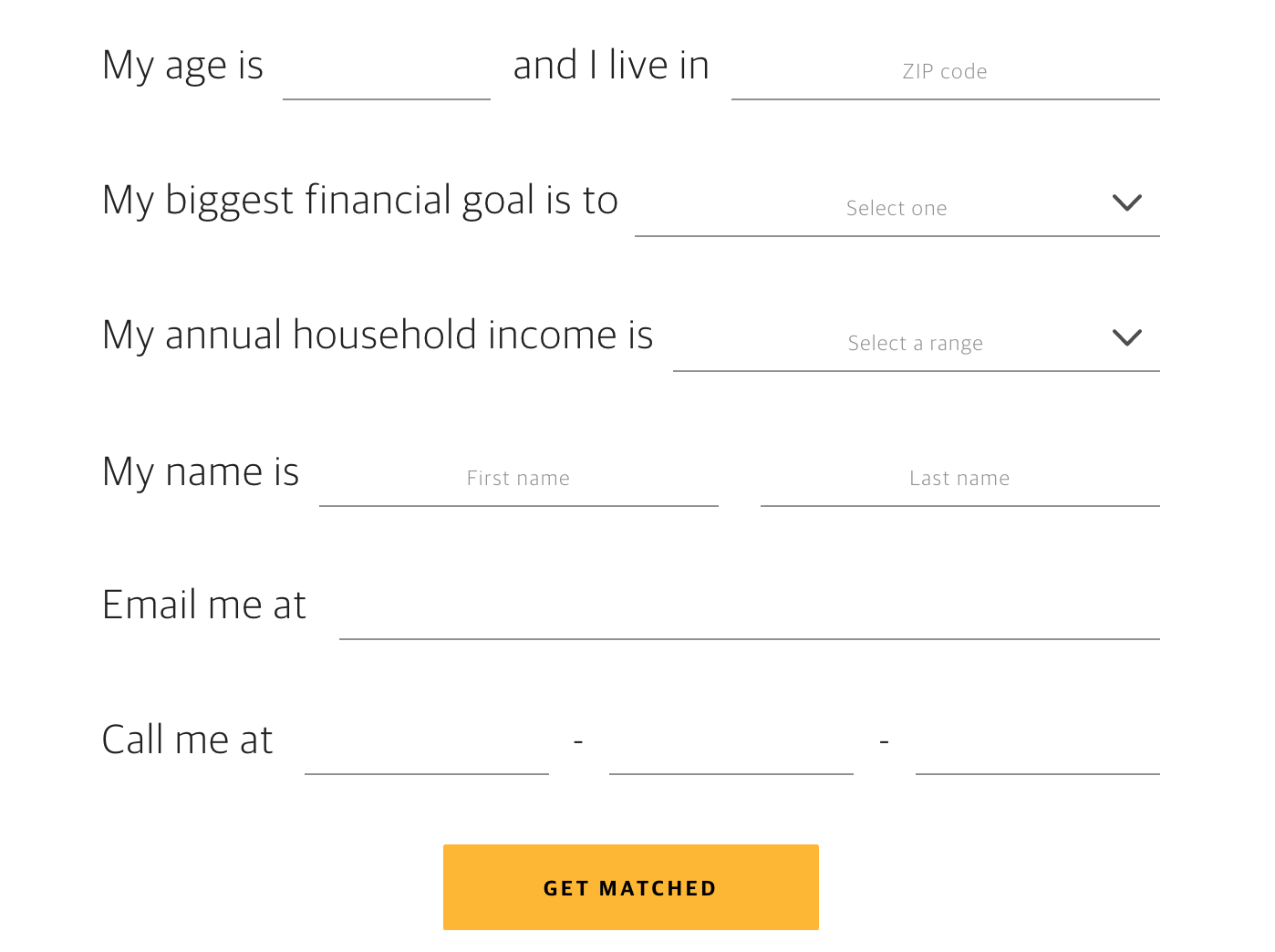

How to Get a Quote Online

Northwestern Mutual does not offer an online quote tool, as they prefer you speak to a financial representative when planning and purchasing your life insurance policy.

#1 – Go to Northwesternmutual.com

When you are ready to start the process of purchasing a life insurance policy, you will begin at the Northwestern Mutual website. However, they do not offer the option of an only quote tool.

#2 – Choose Insurance Policy

Once you’ve decided on the type of insurance you are interested in, you will be prompted to click a “learn more” button that will guide you to fill out a short form with some basic information including a contact email and phone number.

#3 – Click Submit

Once you submit that form, Northwestern Mutual will match you with an agent to get the process started.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Design of Website/App

Northwestern Mutual’s website is well laid out, informative, and easy to navigate. They offer a life insurance calculator to help you figure out how much life insurance is right for you. All of their insurance plans, as well as investment options, are explained in detail.

There is also a very comprehensive section called Life & Money that contains articles about family, home, career and money basics. Lastly, there is an FAQ section to answer the most commonly asked questions about the different types of insurance policies.

Northwestern Mutual does have an app, but it only rates three out of five stars, with most of the negative reviews referring to issues with having to log into their accounts each time they open their app as well as touchID no longer working.

There were reviews stating that basic information regarding balances was good; however, in-depth information regarding the growth of accounts and options to make changes or deposits was lacking.

The company is good, however, at responding to reviewer complaints, explaining that their teams have identified the problem and are fixing the login issue, but it appears the problem continues.

The Northwestern Mutual website is mobile-friendly on both cell phones and the iPad and has the same appearance and content as the website. On the iPhone 6/7/8, the website and content come through clearly. The website is easy to navigate and functions as it does on the computer.

On both the iPad and iPad Pro, content, navigation, and features are all user-friendly and reflect the computer website. You can click through the website and different pages and retrieve the same information as you would from the computer website.

Pros & Cons

As you can see, Northwestern Mutual has earned its place among the top 10 and has worked hard to remain there for the past 10 years. However, with that status comes hard knocks and criticisms, but they work diligently to provide their policyholders with pristine customer service, claim payouts, and continual dividend revenue every year.

Pros

- High customer satisfaction ratings

- Number one in market share for premiums written from 2015 – 2018

- .03 NAIC customer complaint ratio — one of the lowest of all major insurers

- Fixed premiums

- A.M. Best rating of A++, strong financial strength ensures payouts on future claims

Cons

- Does not have an online quote tool

- Premiums can be expensive

- Online resources are limited on the website, including their app, making online shopping difficult

- Policies can be difficult to understand without the help of a financial representative

The Bottom Line

Overall, Northwestern Mutual offers a variety of insurance plans to suit the needs of most. Their overall satisfaction rating is superior and their financial strength for the future is strong, meaning their ability to pay out claims is sound.

They have been the number-one life insurance provider for the last four years and have secured over 8 percent of the market share for premiums written. They have a long history of customer satisfaction, financial strength in the industry, and the ability to pay dividends to their policyholders every year since 1872.

Want to know more? Get started now and compare life insurance quotes below.

Frequently Asked Questions

What is Northwestern Mutual Life Insurance?

Northwestern Mutual Life Insurance is a reputable insurance company that offers various life insurance products and financial services. They have been in operation for over 160 years and are known for their financial strength and stability.

What types of life insurance does Northwestern Mutual offer?

Northwestern Mutual offers a range of life insurance options, including term life insurance, permanent life insurance (such as whole life and universal life), and variable life insurance. They also provide additional riders and options to customize policies based on individual needs.

How can I obtain a life insurance policy from Northwestern Mutual?

To obtain a life insurance policy from Northwestern Mutual, you can start by contacting a Northwestern Mutual financial advisor. They will guide you through the process of assessing your needs, selecting the appropriate policy, and completing the application and underwriting process.

Is Northwestern Mutual a reliable insurance company?

Yes, Northwestern Mutual is widely recognized as a reliable and reputable insurance company. They have consistently received high ratings from independent rating agencies such as A.M. Best, Moody’s, and Standard & Poor’s, indicating their financial strength and ability to meet policyholder obligations.

What factors should I consider when evaluating Northwestern Mutual’s life insurance rates?

When evaluating life insurance rates, it’s essential to consider factors such as your age, health status, coverage amount, policy type, and any additional riders or options you choose. These factors can influence the premium rates you may be quoted by Northwestern Mutual.

How can I get a quote for life insurance from Northwestern Mutual?

To get a quote for life insurance from Northwestern Mutual, you can reach out to a Northwestern Mutual financial advisor. They will gather the necessary information, assess your needs, and provide you with a personalized quote based on the coverage options and policy type you are interested in.

Does Northwestern Mutual offer competitive life insurance rates?

Northwestern Mutual is known for its strong financial position and competitive rates. However, insurance rates can vary based on individual circumstances and factors. It’s recommended to compare quotes from multiple insurance companies to ensure you are getting the best rate for your specific situation.

Can I customize my Northwestern Mutual life insurance policy?

Yes, Northwestern Mutual provides options for customizing life insurance policies to meet individual needs. You can add riders and additional coverage options to tailor the policy to your specific requirements. It’s recommended to discuss customization options with a Northwestern Mutual financial advisor.

What are the benefits of choosing Northwestern Mutual for life insurance?

Choosing Northwestern Mutual for life insurance offers several benefits, including their long-standing reputation, financial strength, a wide range of policy options, the ability to customize policies, access to professional financial advisors, and a history of reliable customer service.

How can I contact Northwestern Mutual for more information?

To contact Northwestern Mutual for more information, you can visit their official website and find contact details for their customer service or locate a local Northwestern Mutual office. Additionally, you can reach out to a Northwestern Mutual financial advisor for personalized assistance and guidance.

How much coverage do I need?

You should always take into account your lifestyle and your future needs when thinking about life insurance. Talk with a financial advisor who can help you analyze your goals based on your financial situation and come up with a plan that suits your needs.

How do I submit a Long-Term Care claim?

You can complete an online form or contact a Northwestern Long-Term Care Claims Administration Office at 800-748-9493.

How do I report the death of an insured?

Complete the online form and someone from Northwestern Mutual will reach out to you shortly thereafter. You can also call client services at 800-535-8855 between 7 a.m. – 6 p.m. CST with any questions. There is also a video that walks you through what to expect when filing a claim.

How do I register for an account?

You can register for online access through the Northwestern Mutual website. This will give you access to your financial summary, as well as let manage your accounts and make payments online.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Jeff Root

Licensed Life Insurance Agent

Jeff is a well-known speaker and expert in life insurance and financial planning. He has spoken at top insurance conferences around the U.S., including the InsuranceNewsNet Super Conference, the 8% Nation Insurance Wealth Conference, and the Digital Life Insurance Agent Mastermind. He has been featured and quoted in Nerdwallet, Bloomberg, Forbes, U.S. News & Money, USA Today, and other leading...

Licensed Life Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about life insurance. Our goal is to be an objective, third-party resource for everything life insurance related. We update our site regularly, and all content is reviewed by life insurance experts.