Learn the Facts About Annual Renewable Term Life Insurance

Annual renewable term life insurance can keep you protected during periods of time when you might not qualify for more affordable term life insurance. With annual renewable term life insurance rates as low as $22.08/mo, you can have peace of mind until you can secure a proper longer term insurance policy. If a longer term policy is out of reach for you, a renewable annual term policy could be the right solution for you and your family. Find annual renewable term life insurance quotes now.

Read moreFree Life Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Chris Abrams

Licensed Life Insurance Agent

Chris is the founder of Abrams Insurance Solutions and Marcan Insurance, which provide personal financial analysis and planning services for families and small businesses across the U.S. His companies represent nearly 100 of the top-rated insurance companies. Chris has been a licensed life and health insurance agent since 2009 and has active insurance licenses in all 50 U.S. states and D.C. Chr...

Licensed Life Insurance Agent

UPDATED: Jan 8, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident life insurance decisions. Comparison shopping should be easy. We are not affiliated with any one life insurance provider and cannot guarantee quotes from any single provider. Our life insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about life insurance. Our goal is to be an objective, third-party resource for everything life insurance related. We update our site regularly, and all content is reviewed by life insurance experts.

UPDATED: Jan 8, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident life insurance decisions. Comparison shopping should be easy. We are not affiliated with any one life insurance provider and cannot guarantee quotes from any single provider. Our life insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

You may have heard of 10-, 20-, or 30-year term life insurance, but did you know you have another alternative called annual renewable term life insurance? In this post, we will answer the question: what is a renewable term?

I will explain the annual renewable term, pros & cons, and pricing compared to a level term life insurance. We will also identify why you might opt for a renewable term life policy instead of choosing a term life policy that will keep you covered for longer.

Whether you are looking for a short term solution for annual renewable life insurance or are looking to secure a longer-term affordable term life insurance policy, by using our free quote generator you can get an actual annual renewable term life insurance quote in just seconds. Get started now.

What is annual renewable term insurance?

Annual renewable term (ART) is temporary protection for a duration of one year. With 1-year renewable term life insurance, you will not need to take an exam or go through the life insurance underwriting process again. Instead, your coverage is automatically renewable by paying your premiums.

Usually, annually renewable term life insurance’s premiums increase every year.

- With annual life insurance that renews each year, the premiums will be determined based on your attained age. The premiums gradually increase as you get older.

- Most ART expires when the insured reaches the age of 95.

- ART policies are fully convertible to term life insurance policies or are fully convertible to whole life or universal life insurance in the first few years, or when the insured reaches 65 (depending on the carrier and the policy).

- The life insurance death benefit remains level (the same) throughout the renewal years.

- With most companies, only the annual payment mode is available. You will not be able to pay monthly or quarterly.

Annual renewable term life insurance is a good interim solution if you have dropped one policy and are shopping for another or had a policy through one employer’s benefits and will assume a policy from a new employer’s benefits soon. According to III, the annual renewable term has lost popularity as a longer-term insurance solution to 20-year term life policies.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

How Yearly Renewable Term Works

The annual renewable term, just like traditional term life insurance, will pay a death benefit to your beneficiaries if you pass away during the time in which the policy is active. When can a renewable term life policy be renewed? The period of insurability guarantees that you be able to renew your policy each year even if your health deteriorates. AAA annual renewable term life insurance covers a 10- to 30-year coverage period.

What happens when the year term of an annually renewable term policy expires?

Your death benefit amount will remain the same with each annual renewable term but your premiums will rise each year as you get older and your risk increases. So, unlike decreasing term insurance where your benefit will decrease over time along with your premiums, you will be paying more for the same amount of insurance benefit each year.

With most companies, you can add riders to your policy, like terminal illness or a disability rider. Pay attention to the convertibility option, since not all companies offer that and there is an age restriction in which you can take that option.

Why on earth would someone buy ART?

It’s a good question, and I’ll start with the obvious. Level term insurance and whole life provide insurance for prolonged periods because those who buy these coverages are interested in income replacement or estate planning, which require a continued period of protection.

For others who are only looking for a short-term protection, the annual renewable term is an excellent choice. Here are a few other reasons:

- They have a current policy in force but need a supplemental coverage for a short-term loan or expense.

- They need to fill an employment gap because they are in between jobs. The future position will offer a group life insurance plan.

- Initially, ART premiums are lower when compared to a 10- or 20-year term. For some who have a few years left to retirement age (typically less than five), buying a 10-year term will cost more than buying yearly renewable term.

- When smokers apply for life insurance, they may pay three to four times as much as non-smokers. With most carriers, they need to be smoke-free for one to three years before getting the preferred non-smoker rate. If you just quit smoking, it may be a good idea to buy a short-term policy, and after a year, you can apply for a traditional term and get the non-smoker rate (as long as you quit the bad habit).

Be aware that if you are able to get a proper term life policy for even a 10-year or 20-year term, you will likely save more in the long run.

Level Term Life vs. Annual Renewable Term

I’m sure you are curious to see if you could save money by buying annual renewable term life insurance versus purchasing 10-, 20- or 30-year term life insurance. Rather than seek out an annual renewable term calculator, check out the table below, taken from Prudential, in which I compare the premiums of ART and 10-, 20- and a 30-year term.

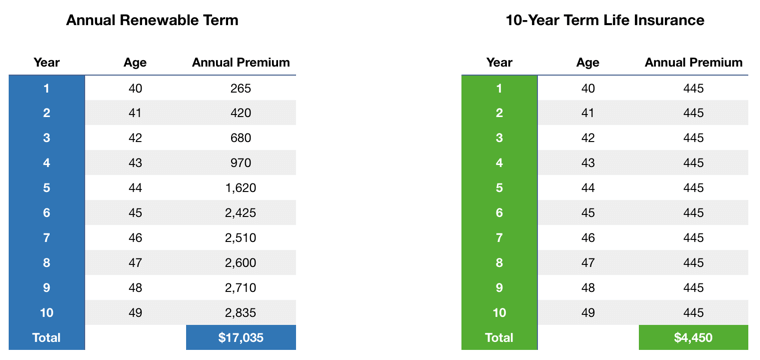

ART vs. 10-Year Level Term Insurance

As you can see from the annual renewable term table below, a 40-year-old male in a preferred health class will have a starting payment on ART of $265 while the starts at $445. However, as the years go by, especially the third year onwards, the premiums on ART are more expensive.

Even for a shorter term of 10 years, you save considerably against rates for an annual renewable term policy.

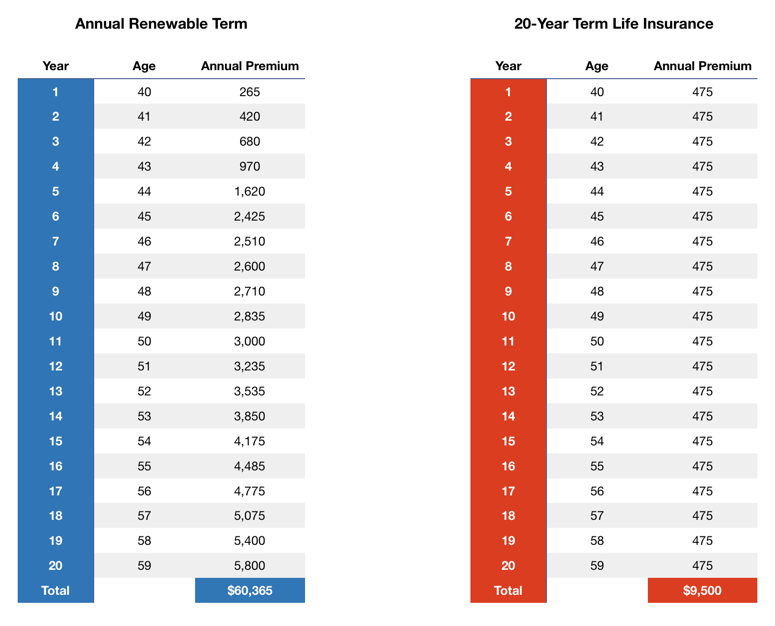

ART vs. 20-Year Level Term Insurance

On this chart, the same 40-year-old male will save money on ART for the first three years when compared to 20-year term life insurance. In the fourth year, he will pay $970 per month while the level term the premium of $475 will remain the same for 20 years.

As you can see, the longer the term, the more you save over the duration of coverage.

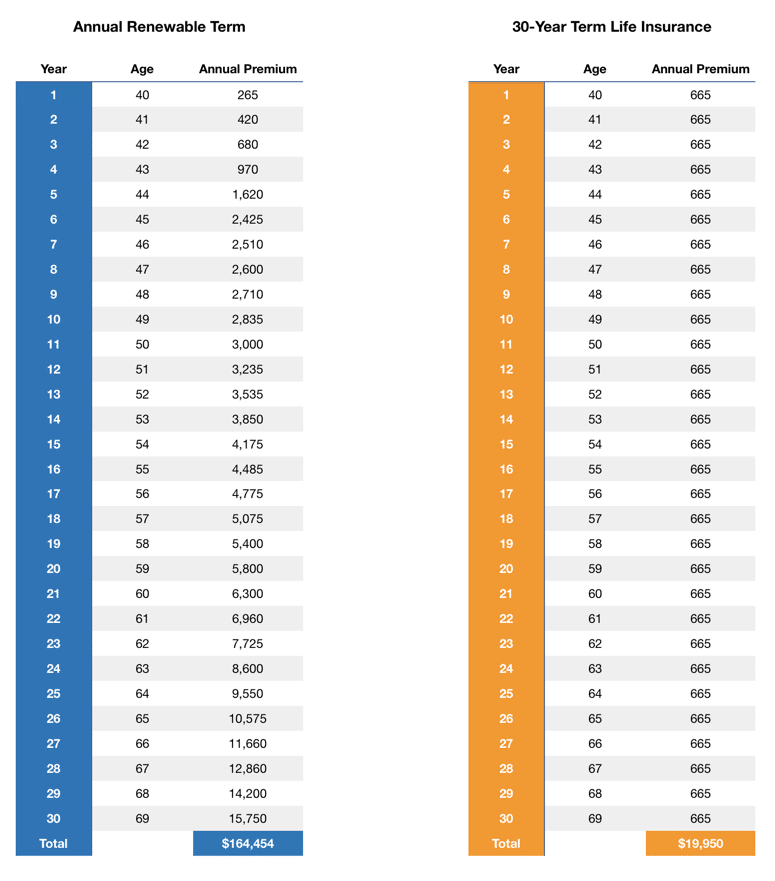

ART vs. 30-Year Level Term Insurance

The same goes for this chart. The savings on ART are only for the first three years when compared to a 30-year term. By the fourth year, you will be paying $970 while the 30-year offers a level premium of $665 for 30 years.

If you can qualify for a 30-year term policy and you know you will need the coverage for at least that amount of time, you can save well over $100,000.00 by securing a proper term policy instead of renewing annual term year over year.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

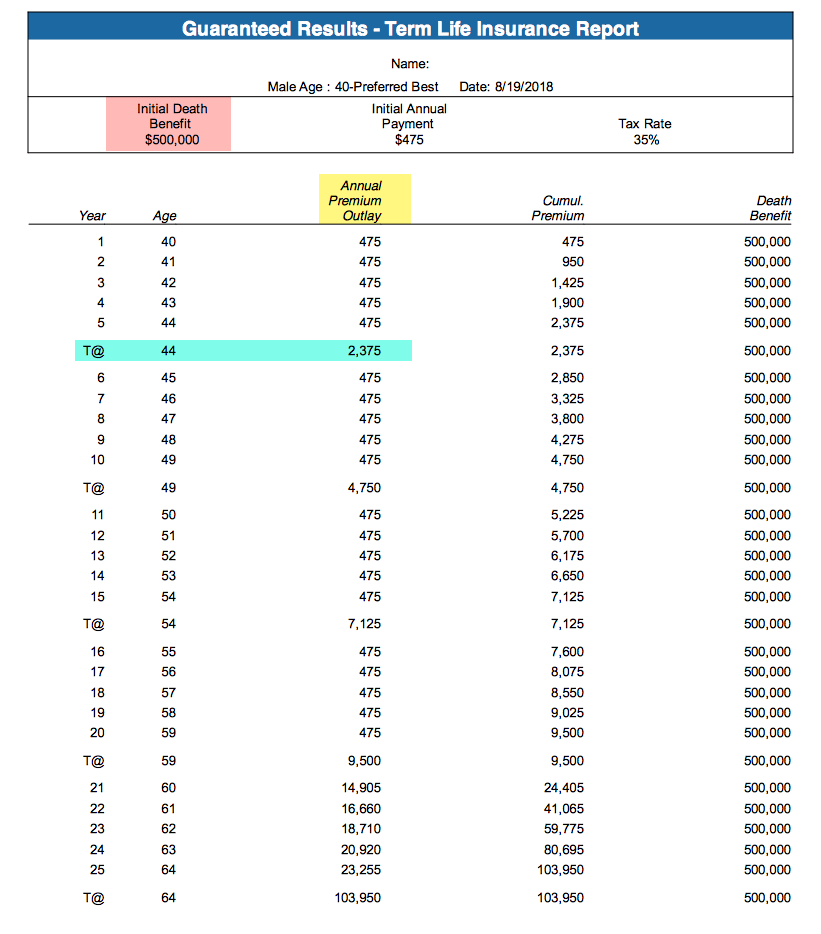

Schedule of Premiums — Life Insurance Illustration

You will not be surprised or shocked by the increased premium cost every year. By law, the insurance company is required to provide you with an illustration. The illustration shows the maximum premiums for each year, total premiums paid every five years, and the death benefit.

The insurance carrier cannot charge you a higher premium than what you see on the illustration. Below, I’ve included a sample chart with a schedule of premiums.

Case Studies: Annual Renewable Term Life Insurance

Case Study 1: John’s Short-Term Coverage Needs

John recently switched jobs and lost his previous employer-provided life insurance coverage. While he plans to secure a new long-term insurance policy soon, he needs temporary coverage in the meantime. John decides to opt for an annual renewable term (ART) life insurance policy to bridge the gap. This allows him to have coverage for a year without the need for additional underwriting or a medical exam.

Case Study 2: Sarah’s Changing Insurance Needs

Sarah had a 20-year term life insurance policy that recently expired. However, she still requires some coverage until she can reassess her insurance needs in the near future. Instead of committing to another long-term policy, Sarah chooses an annual renewable term life insurance policy. This way, she has the flexibility to adjust her coverage as her circumstances change without being locked into a fixed term.

Case Study 3: Mark’s Short-Term Financial Goals

Mark is a 35-year-old individual who has specific short-term financial goals that he wants to achieve within the next few years. He decides to purchase an annual renewable term life insurance policy to provide financial protection during this period. By choosing a renewable policy, Mark can adjust his coverage as needed and align it with his changing financial objectives.

Annual Renewable Term Life Insurance: The Bottom Line

We hope this article has helped you to understand annual renewable term policies.

For most people, traditional long-term protection is the right solution when buying life insurance. The premiums remain level for 20 or 30 years, and they don’t have to think about the new premium every year. The longer-term length you buy, the longer your premium is fixed, and if you decide that you no longer need the policy, you can always drop it.

Does term life insurance automatically renew? If you are concerned about renewing your term policy, you should consider that although an annual renewable term policy renews each year, your conversion options will be more limited each year as you pricing goes up.

With a good affordable term life policy, not only will you lock in a great rate, but most policies today are convertible to universal term life insurance or other whole life insurance options.

Ready to buy annual renewable term life insurance? See how annual renewable term compares to longer-term life insurance for you. Get a free quote right now to find affordable annual renewable term life insurance and to learn which annual renewable term life insurance company is the best for you.

Frequently Asked Questions

What is Annual Renewable Term Life Insurance?

Annual Renewable Term Life Insurance is a type of life insurance policy that provides coverage for a specified term, typically one year. It offers a death benefit to the beneficiaries if the insured passes away during the term of the policy.

How does Annual Renewable Term Life Insurance work?

With Annual Renewable Term Life Insurance, the policy is renewable on an annual basis. The coverage remains in force for one year and can be renewed each year without having to reapply or undergo additional medical underwriting. However, the premium typically increases each year as the insured ages.

What are the benefits of Annual Renewable Term Life Insurance?

Annual Renewable Term Life Insurance offers several benefits, including:

- Flexibility: The policy provides coverage for a renewable term, allowing individuals to adjust their coverage based on their changing needs.

- No long-term commitment: Unlike longer-term policies, such as 10 or 20-year term life insurance, Annual Renewable Term Life Insurance allows individuals to reassess their coverage needs annually.

- Ease of renewal: Policyholders can typically renew the coverage each year without undergoing a new application or medical examination.

- Lower initial premiums: Annual Renewable Term Life Insurance often has lower premiums in the early years compared to longer-term policies, making it more affordable initially.

Is Annual Renewable Term Life Insurance suitable for everyone?

Annual Renewable Term Life Insurance may be suitable for individuals who have short-term coverage needs or anticipate changes in their insurance needs over time. It may not be ideal for those seeking long-term or guaranteed coverage, as the premium increases each year and can become cost-prohibitive in later years.

Can I convert Annual Renewable Term Life Insurance to a permanent policy?

Some insurance companies may offer conversion options for Annual Renewable Term Life Insurance policies. This allows policyholders to convert their term policy into a permanent life insurance policy, such as whole life or universal life insurance, without undergoing additional underwriting. Conversion options and specific terms can vary, so it’s important to review the policy details or consult with an insurance agent.

How can I obtain a quote for Annual Renewable Term Life Insurance?

To obtain a quote for Annual Renewable Term Life Insurance, you can contact insurance companies or work with an independent insurance agent. Provide relevant information such as your age, desired coverage amount, and any specific preferences to receive a personalized quote.

Can I renew Annual Renewable Term Life Insurance indefinitely?

In most cases, Annual Renewable Term Life Insurance policies have a maximum age limit for renewal, typically up to a certain age, such as 70 or 80. After reaching the maximum age, policyholders may need to explore alternative coverage options or convert their policy to a permanent life insurance policy.

Are there any exclusions or limitations with Annual Renewable Term Life Insurance?

Annual Renewable Term Life Insurance policies may have certain exclusions or limitations, similar to other life insurance policies. These can vary depending on the policy and the insurance company. It’s important to carefully review the policy documents and discuss any specific concerns or questions with an insurance agent or representative.

Can I cancel Annual Renewable Term Life Insurance before the renewal?

Yes, policyholders can generally cancel Annual Renewable Term Life Insurance before the renewal date if they no longer require the coverage. However, it’s important to review the cancellation terms and any potential fees or penalties that may apply. Contact the insurance company or your agent to discuss the cancellation process.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Chris Abrams

Licensed Life Insurance Agent

Chris is the founder of Abrams Insurance Solutions and Marcan Insurance, which provide personal financial analysis and planning services for families and small businesses across the U.S. His companies represent nearly 100 of the top-rated insurance companies. Chris has been a licensed life and health insurance agent since 2009 and has active insurance licenses in all 50 U.S. states and D.C. Chr...

Licensed Life Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about life insurance. Our goal is to be an objective, third-party resource for everything life insurance related. We update our site regularly, and all content is reviewed by life insurance experts.