Life Insurance After Skin Cancer: Buyer’s Guide (Companies + Rates)

Buying life insurance after skin cancer is possible with preferred rates as low as $11.43/month. The longer you've been in remission and the more preventative measures you take. Use our FREE tool below to get your life insurance quote.

Free Life Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Chris Abrams

Licensed Life Insurance Agent

Chris is the founder of Abrams Insurance Solutions and Marcan Insurance, which provide personal financial analysis and planning services for families and small businesses across the U.S. His companies represent nearly 100 of the top-rated insurance companies. Chris has been a licensed life and health insurance agent since 2009 and has active insurance licenses in all 50 U.S. states and D.C. Chr...

Licensed Life Insurance Agent

UPDATED: Jan 8, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident life insurance decisions. Comparison shopping should be easy. We are not affiliated with any one life insurance provider and cannot guarantee quotes from any single provider. Our life insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about life insurance. Our goal is to be an objective, third-party resource for everything life insurance related. We update our site regularly, and all content is reviewed by life insurance experts.

UPDATED: Jan 8, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident life insurance decisions. Comparison shopping should be easy. We are not affiliated with any one life insurance provider and cannot guarantee quotes from any single provider. Our life insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

Life insurance after skin cancer or any pre-existing medical condition can be complicated. When it comes to buying life insurance after you’ve had skin cancer, you may have questions.

Melanoma life expectancy and melanoma life insurance underwriting are two of the biggest concerns of those with skin cancer. If you’ve had questions like, “What is the life expectancy of someone with metastatic melanoma?” you are probably in the market for life insurance for those with or who have recovered from skin cancer.

The type of skin cancer you had, recurrences, stage, and many other factors will be among the few questions your broker will ask to determine your eligibility for coverage. Looking at sample life insurance rates is a good way to be sure you’re getting the best deal.

This article will cover what you need to know like the concerns the insurance carrier will have if you have had a history of skin cancer, the rates you may expect to pay, and how to better your chances of approval.

So, is skin cancer covered by insurance? Enter your ZIP code in our FREE quote comparison tool to find the best life insurance after cancer rates.

Best Life Insurance Companies for Skin Cancer Survivors

According to the American Academy of Dermatology, skin cancer is the most prevalent type of cancer in the U.S. adult population. It is estimated that one in five adults will develop a type of skin cancer in their lifetime. In fact, more than a million people are living with melanoma, and cases are on the increase.

A diagnosis of skin cancer does not mean life insurance is out of the question, particularly if you are diagnosed early and are under the care of a physician. What you need to do is ask around, be prepared to share your medical history, and compare companies that consider your overall history.

What is skin cancer exactly? Skin cancer is the most common form of cancer in the United States. It is the uncontrolled growth of abnormal cells caused by ultraviolet radiation from overexposure to the sun. There are three types of skin cancer: basal cell carcinoma, squamous cell carcinoma, and malignant melanoma. We will go over the underwriting scenarios for each form of cancer below.

Here are some of the best picks for people with skin cancer based on multiple reviews and recommendations from experienced life insurance agents.

Best Life Insurance Companies for Customers With Skin Cancer

| Companies | Best For |

|---|---|

| Cigna | Best Value and Rate |

| MetLife | No-Exam Insurance |

| Mutual of Omaha | Cancer Plus Critical Illness |

| Physicians Mutual | Additional Riders |

The best way to find insurance in your particular case is to comparison shop, ask an insurance agent for suggestions, and keep looking around.

Is life insurance with a history of skin cancer possible?

Buying life insurance after skin cancer is possible with preferred rates as low as $11.43/month. A history of skin cancer should not discourage you from shopping for life insurance. Here, we display rates that will give you an idea of how rates vary by the health class you are assigned by the insurance company. Keep in mind that a non-smoker will pay significantly less than a smoker the same age.

Average Monthly Life Insurance Rates for Non-Smokers – 20-Year Term, $100,000 Policy

| Health Class | 40-Year-Old Male | 40-Year-Old Female | 50-Year-Old Male | 50-Year-Old Female | 60-Year-Old Male | 60-Year-Old Female |

|---|---|---|---|---|---|---|

| Preferred | $13.03 | $11.43 | $26.53 | $19.92 | $64.79 | $42.96 |

| Standard | $18.23 | $16.10 | $37.36 | $29.05 | $91.85 | $65.62 |

| Table B | $23.49 | $20.34 | $49.22 | $38.98 | $126.00 | $86.10 |

| Table D | $29.57 | $25.37 | $63.87 | $50.22 | $166.25 | $113.05 |

Compare these rates for a $100,000 policy with those of a $250,000 policy.

Average Monthly Life Insurance Rates for Non-Smokers – 20-Year Term, $250,000 Policy

| Health Class | 40-Year-Old Male | 40-Year-Old Female | 50-Year-Old Male | 50-Year-Old Female | 60-Year-Old Male | 60-Year-Old Female |

|---|---|---|---|---|---|---|

| Preferred | $21.66 | $18.81 | $49.44 | $37.80 | $127.83 | $92.97 |

| Standard | $32.59 | $28.87 | $77.31 | $58.36 | $204.70 | $143.50 |

| Table B | $41.67 | $34.41 | $98.11 | $73.17 | $251.41 | $175.83 |

| Table D | $53.81 | $44.03 | $129.06 | $94.63 | $333.37 | $232.60 |

You’ll notice that no matter the coverage amount, rates become increasingly higher the older you are at the time you purchase coverage.

Average Monthly Life Insurance Rates for Non-Smokers – 20-Year Term, $500,000 Policy

| Health Class | 40-Year-Old Male | 40-Year-Old Female | 50-Year-Old Male | 50-Year-Old Female | 60-Year-Old Male | 60-Year-Old Female |

|---|---|---|---|---|---|---|

| Preferred | $37.63 | $32.38 | $91.18 | $69.08 | $243.38 | $170.12 |

| Standard | $59.94 | $51.93 | $143.59 | $110.95 | $392.71 | $273.89 |

| Table B | $75.60 | $62.63 | $187.19 | $137.23 | $492.75 | $337.70 |

| Table D | $98.96 | $81.66 | $247.74 | $181.13 | $655.15 | $448.42 |

These rates vary between insurance companies and should be compared through our quote tool.

[360_quote_tool]

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

What are the insurance companies looking for when insuring skin cancer survivors?

When insuring individuals with a history of skin cancer, the insurance underwriter is interested in a few necessary parameters to gauge life insurance risk class gauge the risk you pose to the insurer. How severe was the condition? Have you received full treatment? Are you following your doctor’s orders? This approach applies to other types of medical impairments such as Type 2 diabetes, high cholesterol, or sleep apnea, for instance. Let’s discuss the questions the underwriter will ask that are related to skin cancer:

Related: What do life insurance companies test for in underwriting?

Date of First Diagnosis

The date you were diagnosed, along with how much time has passed, will give the underwriter an idea of how safe you are to insure. As previously explained, if you are in remission, the insurance company will be interested in knowing how long you have remained cancer-free.

Five years of remission is typically how long it would take for you to receive the most favorable rate.

Which type of skin cancer have you had?

This question is a big one not only concerning your overall health but your life insurance rates. As mentioned above, there are three types of skin cancer:

Basal Cell Carcinoma (BCC)

Basal cell carcinoma (BCC) is the most common type of skin cancer with the best prognosis. BCCs look like open sores, red patches, or scars and are usually attributed to excessive sun exposure. They rarely metastasize (spread) beyond the original location, even though recurrences are pretty frequent.

BCC is highly treatable, and from the insurance company’s standpoint, you can get preferred or preferred best rates after excision.

Squamous Cell Carcinoma (SCC)

The second-most common type is squamous cell carcinoma (SCC), which develops in the squamous cells that make up the middle and outer layers of the skin. Recurrences are frequent, and 3 to 10 percent of squamous cell cancers will spread to other organs of the body.

If localized SCCs are surgically removed, you can expect preferred or preferred best rates.

Malignant Melanoma

This is the least common but most dangerous form of skin cancer. Abnormal cell growths develop when unrepaired DNA damage to skin cells triggers mutations.

This can lead to multiplication and spreading of the skin cells and forming of malignant tumors. Recurrent melanoma patients are often declined when applying for life insurance.

This video from the Mayo Clinic describes how skin cancer can develop and spread.

Malignant melanoma is the deadliest form of skin cancer because of its aggressive nature. It can quickly spread to the lymph nodes in your body, which in turn, can easily spread to other organs.

Regular screening of the entire body — especially for people prone to moles or fair skin — is vital.

Can you get life insurance if you have melanoma? People applying for life insurance that have a history of melanoma are the least likely to be approved for life insurance.

Which type of skin cancer have you had?

Insurers rely on this diagnosis to predict the outcome and life expectancy with your particular level of cancer. Basal cell cancer is the most likely to put you in a lower risk class.

Coverage with basal cell carcinoma is typically approved while coverage with squamous cell carcinoma is more complicated because the prognosis is less favorable. You can still be approved, but expect to pay more in premiums.

According to the American Cancer Society, both basal and squamous cell cancers are less deadly than melanoma, and of those who do die from these two types usually have suppressed or compromised immune systems or waited far too long before the diagnosis.

Coverage with melanoma, the most aggressive form of skin cancer, is the most difficult diagnosis to contend with while shopping for life insurance. Chances are — and only if you are fortunate enough to qualify — you will only be considered at a standard or even a substandard rate. This translates into rates up to four times what someone in good health would pay.

Has the cancer metastasized (spread) beyond the skin?

The pathology report will not only help the doctor come up with a treatment plan but will also give the life insurance underwriter more information about your insurability chances.

The underwriter will take a close look at the staging, classification, and ratings based on the staging system. A skin cancer staging system is based on TNM (tumor, node, metastasis).

Here are the parameters of cancer stages that will be considered on your life insurance application:

- Tumor size (Tis, T1a, T1b, T2a, etc.) and thickness

- Clark Level classification

- Ulceration

Another method of categorizing skin cancer is using the ABCDEs of self-detection which, as previously mentioned, refers to skin mole patterns of:

- Asymmetry

- Borders

- Color

- Diameter

- Evolving changes

If your diagnosis, treatment, and prognosis are favorable according to a physician’s expertise, your chances of qualifying for life insurance are greater.

Has there been any evidence of recurrence?

Recurrences of basal skin cancer are common but rarely spread to other body parts. If, however, you’ve had recurrences in the malignant melanoma type, positive lymph nodes, or metastases, you will not be able to buy a traditional life insurance policy and may need to opt for a guaranteed issue policy.

With a guaranteed issue policy, you are assured coverage, even with a pre-existing condition. This is a good option if you are denied coverage because of your skin cancer diagnosis.

However, you can expect to pay significantly more for the privilege of having coverage.

Numbers of Episodes & Date of Last Episode

This is another crucial factor in assessing the seriousness of your condition. The number of episodes along with the amount of time since the last one may get your application postponed for four years or more.

Life insurance underwriters “crunch numbers,” meaning they have formulas for calculating risk. The longer you remain free of any recurring episodes (evidence of other moles or lesions, for example), the better your chances for obtaining a policy with a better rate.

It’s no secret that the vast majority of skin cancers (80 percent diagnosed in the U.S. are basal cell) are curable, with excellent recovery statistics.

What you will be asked to provide, in addition to going through a medical exam as directed by the insurer, will be at least five years’ worth of medical records. If you can show your cancer is in remission for at least a few years, your rates can be improved significantly.

Here, we place an emphasis on comparison shopping. If you shop hard enough, you will likely find a company that will provide you life insurance after skin cancer. A knowledgeable agent can help you with this, and you can also use our comparison tool to find the best rate.

[360_quote_tool]

What other questions will the underwriter ask?

Skin cancer isn’t the only issue the underwriter is interested in. Your overall health, family history, driving records, and many others are also a vital part of the underwriting process.

Note that if your skin cancer was malignant melanoma, the underwriter will order an attending physician statement (APS) to confirm the stage, type, and criteria. Here is where your physician can help you: If you have been following orders for treatment and exhibit signs of recovery, your chances for coverage are improved.

This video is from a commercial for a life insurance company that makes the application sound easy:

However, the reality is that an insurer will be looking for much more information than just your medical records.

Information about you and your lifestyle is out there — on social media, from public records and prescription databases — and underwriters will look for it. It’s best to be organized and honest about your history so you increase your ability to be accepted.

What rate class can I qualify for if I had skin cancer?

In general, life insurance rates are classified into four basic groups (Preferred Plus, Preferred, Standard Plus, and Standard). Depending upon your insurance company’s particular rating system, however, there are up to 16 different classifications, as illustrated from this table.

Life Insurance Rate Classifications

| Rate Classification | Typical Factors Affecting Score |

|---|---|

| Preferred Plus | Excellent health, good family history, normal height/weight |

| Standard Plus | Certain medications and/or family history of certain diseases |

| Standard | Higher Body Mass Index (BMI) and significant family history |

| Table Rating 1–2 (or A–B) | Average health, but may have a prior illness or mild, chronic condition |

| Table Rating 3–4 (or C–D) | >25 pounds overweight, high blood pressure and/or cholesterol, etc. |

| Table Rating 5–6 (or E–F) | Chronic conditions such as diabetes, overweight, abnormal lab results, questionable lifestyle |

| Table Rating 7–8 (or G–H) | Obesity, major health considerations, history of cancer, MS, or Parkinson's, etc. |

| Table Rating 9–16 (I–P) | Least favorable because of multiple conditions, lab results, poor health history |

What is important to remember with skin cancer and life insurance is that comparison shopping is important in finding the best rates. There are specific policies out there to help people cope with cancer.

If you are reading this because there is a history of cancer in your family, you may find it comforting that there do exist policies specifically designed for meeting the costs of cancer treatment.

If you only had basal cell carcinoma, you may get preferred or preferred best rates. Keep in mind that if you have any other health issues, such as chronic depression or anxiety disorder or being classified as overweight or obese, it will push the prices much higher. If you don’t have other underlying conditions such as these, you will likely be quoted a standard rate with basal cell carcinoma.

As we reviewed elsewhere in this article, the standard rate will likely not apply to you if you have had squamous cell carcinoma or melanoma.

The insurance company, not the broker, is the one who dictates the final rate, so we like to play it safe and be a little more conservative. If they come back at a preferred rate, we’re as happy as they are.

For the more severe type, such as melanoma, there are too many variables to conclude, and without knowing about the stage, Clark’s level, ulceration, and thickness, it will be impossible to estimate.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Cancer Survivors & Life Insurance

The good news is that cancer survivors can still apply for life insurance, but much of the approval process has to do with the type of skin cancer you have.

Genetic testing may reveal certain hereditary cancers, including the susceptibility of skin cancer. There is plenty of controversy about this subject and the effect genetic testing may have on life insurance underwriting.

Many cancer patients — or people interested in finding out their genetic predisposition to certain diseases — have genetic testing done.

Calling it the “Angelina Jolie Effect,” (the actress who famously had a double mastectomy after discovering her elevated genetic risk for breast cancer), it can be helpful for a person with a family history of skin cancer to find out if they are at risk.

On the other hand, if you are tested and are in fact at risk for skin cancer, this is not something you’d be likely to share with an underwriter — especially if you have been detected early.

The ethical way to deal with genetic testing for life insurance purposes at this point is to adhere to HIPAA privacy protection laws.

Genetic testing has not been proven definitively to predict cancer; it only predicts a person’s genetic predisposition to certain diseases.

This video by Allstate explains that there are policies available to help you pay for costs associated with cancer.

https://youtu.be/PvhvWtliPN0

Expect to pay much higher rates for cancer insurance. You can also consider taking advances on your existing life insurance to cover major expenses during cancer treatment. You may be charged substantial fees for this service. Check with an insurance agent for all your options.

What are the insurance companies looking for when insuring skin cancer survivors?

When insuring individuals with a history of skin cancer, the insurance underwriter is interested in a few necessary parameters to gauge the risk you pose to the insurer.

Be prepared to answer the following questions:

- How severe was the condition? If you’ve had basal or squamous cell carcinoma, your chances of being insured are better.

- Have you received full treatment? Being prepared with your medical records and prognosis is advised and will make the application process easier.

- Are you following your doctor’s orders? Your treating dermatologist or other physician can provide letters that document your treatment and prognosis.

This approach also applies to other types of medical impairments such as having Type 2 diabetes, pre-existing high cholesterol, or other disorders like sleep apnea.

Finding out what life insurance companies test for in underwriting will help you be prepared.

What is the application process for life insurance with skin cancer?

Life insurance with a skin cancer diagnosis does not mean you are necessarily eliminated from applying. The importance of early detection and treatment can make the difference not only in your survival but in your ability to be insured, to protect your assets and your family.

Common sense on preventing skin cancer, or worsening it if you ‘ve already been diagnosed, is also essential.

Being outdoors, as this video from the Skin Cancer Foundation demonstrates, does not mean that people should stay indoors and avoid the benefits of sunshine entirely.

Golfing, running, or going to the beach can be done safely while preventing the common cause of skin cancer: exposure to UV rays.

When you apply for life insurance, you’ll be asked several questions that seemingly have nothing to do with skin cancer. This is because insurers are simply looking for risk factors other than just a skin cancer diagnosis. Red flags go up if you’ve had cancer to begin with, but that should not discourage you from looking into your options.

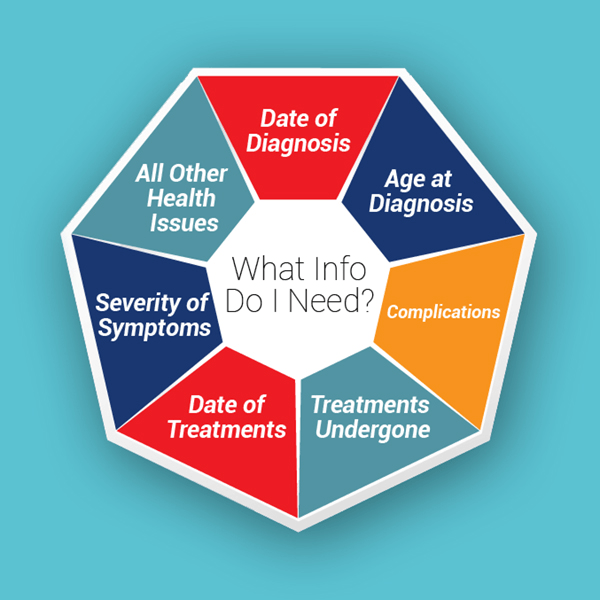

A sample life insurance application can help prepare you for the information required. Other underwriting expectations are described in this illustration below.

Now that you understand the risks, the classifications of skin cancer and how your individual diagnosis affects your rates, you should feel more confident in finding a life insurance product that makes the most sense for your given situation.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Case Studies: Life Insurance After Skin Cancer

Case Study 1: John’s Basal Cell Carcinoma

John, a 45-year-old individual, was diagnosed with basal cell carcinoma, the most common type of skin cancer. After undergoing excision and following his doctor’s orders, John has remained cancer-free for over five years. He decides to shop for life insurance to protect his family.

John applies for a $500,000 life insurance policy with Life Insurance. Based on his medical records, the insurance underwriter determines that John’s basal cell carcinoma diagnosis is low risk and he has a favorable prognosis. The underwriter assigns him a preferred rate, which is a lower premium compared to standard rates.

Case Study 2: Sarah’s Squamous Cell Carcinoma

Sarah, a 38-year-old individual, had squamous cell carcinoma, the second-most common type of skin cancer. She underwent surgical removal of localized SCCs and has been in remission for three years. Sarah decides to explore her options for life insurance.

Sarah applies for a $250,000 life insurance policy with Life Insurance. The underwriter reviews her medical records and determines that while she has a favorable prognosis, the recurrence risk for squamous cell carcinoma is higher compared to basal cell carcinoma. Therefore, Sarah is assigned a standard rate, which is a slightly higher premium than preferred rates.

Case Study 3: Mark’s Malignant Melanoma

Mark, a 50-year-old individual, had malignant melanoma, the most aggressive and dangerous form of skin cancer. He underwent treatment for metastatic melanoma and has been in remission for two years. Mark wants to secure life insurance to provide financial protection for his family.

Mark applies for a $1,000,000 life insurance policy with Life Insurance. Given the severity and aggressiveness of malignant melanoma, the underwriter considers Mark’s case high risk. After reviewing his medical records and consulting with medical experts, the underwriter offers Mark a substandard rate, which is a significantly higher premium than standard rates.

Despite the higher premium, Mark understands the challenges associated with obtaining life insurance after malignant melanoma. He decides to proceed with the policy to ensure his family’s financial well-being.

Life Insurance After Skin Cancer: The Bottom Line

Every life insurance company has its own process for underwriting individuals for coverage. Where one company charges you a standard rate, the other will offer preferred. Shopping for the best rate and making comparisons is crucial.

Saving money on life insurance starts by choosing the best company for your unique health condition. Our quote tool, blogs, and extensive research will help you find very specific life insurance requirements.

We work for you by matching you with the best company for your circumstances. You can run the numbers yourself on this page and receive instant quotes. Be sure to select the regular health class.

We’re here to help you find the best rates and comparisons. Start today, and get a FREE quote to get the best life insurance after cancer rates available.

References:

- https://www.aad.org/media/stats-skin-cancer

- https://www.skincancer.org/skin-cancer-information/skin-cancer-facts/

- https://www.mskcc.org/cancer-care/types/squamous-cell-carcinoma

- https://www.cancer.gov/publications/dictionaries/cancer-terms/def/clark-level-iv-skin-cancer

Frequently Asked Questions

If I have existing life insurance when my cancer is diagnosed, will my rates go up?

If you already have life insurance, a diagnosis of skin cancer will not affect your existing rate. It will only affect your ability to apply for a new policy. You are not required to inform your insurance company of your diagnosis but read the fine print on your existing policy. Be sure there is no fine print excluding coverage for cancer.

What happens to my life insurance if I have a skin cancer recurrence or a different type of cancer?

If you’re diagnosed with a different type of cancer, or if you have a recurrence, another option available for you is critical illness insurance to help cover costs such as medical expenses or lost wages due to loss of work. Companies willing to insure you in this scenario pay out a lump sum.

Can rates be lowered if I am determined to be cancer-free after treatment & remission?

It depends on how your policy is written, the company you are with, and how your remission is determined. It is important to pay attention to the legalese and language written into the policy.

Some insurance companies will honor your health status by lowering your premiums (as they will do with factors such as smoking cessation and weight loss). It is advised to have a financial advisor or lawyer take a look at your particular policy’s rules to maximize the benefits and rates.

Can I get life insurance if I currently have active skin cancer?

Generally, it can be challenging to obtain life insurance coverage while actively undergoing treatment for skin cancer. Insurance companies typically prefer to insure individuals who have completed treatment and have a stable health status. However, each case is unique, and it’s best to consult with an experienced insurance professional to explore your options.

What information will life insurance companies require regarding my skin cancer history?

When applying for life insurance after skin cancer, you can expect to provide information such as:

- Type of skin cancer (e.g., basal cell carcinoma, squamous cell carcinoma, melanoma)

- Date of diagnosis

- Stage and grade of cancer

- Details of treatment received (surgery, radiation, chemotherapy, immunotherapy, etc.)

- Recurrence history, if any

- Follow-up and surveillance plans

- Current status of your health, including any ongoing treatment or medications

How long should I wait after skin cancer treatment before applying for life insurance?

The waiting period before applying for life insurance after skin cancer treatment can vary depending on the insurance company and the specifics of your case. In some cases, you may need to wait for a certain number of years post-treatment, while other insurers may consider coverage sooner. It’s advisable to consult with an experienced insurance professional who can guide you based on your unique circumstances.

Are there specific life insurance companies that specialize in coverage for individuals with a history of skin cancer?

While not all insurance companies may have specific policies for individuals with a history of skin cancer, some insurers are more lenient than others when underwriting such cases. It’s advisable to consult with an experienced insurance agent or broker who can help you find companies that are more likely to offer coverage at competitive rates.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Chris Abrams

Licensed Life Insurance Agent

Chris is the founder of Abrams Insurance Solutions and Marcan Insurance, which provide personal financial analysis and planning services for families and small businesses across the U.S. His companies represent nearly 100 of the top-rated insurance companies. Chris has been a licensed life and health insurance agent since 2009 and has active insurance licenses in all 50 U.S. states and D.C. Chr...

Licensed Life Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about life insurance. Our goal is to be an objective, third-party resource for everything life insurance related. We update our site regularly, and all content is reviewed by life insurance experts.