Life Insurance for Heart Attack Survivors (Companies + Rates)

Free Life Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Chris Abrams

Licensed Life Insurance Agent

Chris is the founder of Abrams Insurance Solutions and Marcan Insurance, which provide personal financial analysis and planning services for families and small businesses across the U.S. His companies represent nearly 100 of the top-rated insurance companies. Chris has been a licensed life and health insurance agent since 2009 and has active insurance licenses in all 50 U.S. states and D.C. Chr...

Licensed Life Insurance Agent

UPDATED: Jan 8, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident life insurance decisions. Comparison shopping should be easy. We are not affiliated with any one life insurance provider and cannot guarantee quotes from any single provider. Our life insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about life insurance. Our goal is to be an objective, third-party resource for everything life insurance related. We update our site regularly, and all content is reviewed by life insurance experts.

UPDATED: Jan 8, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident life insurance decisions. Comparison shopping should be easy. We are not affiliated with any one life insurance provider and cannot guarantee quotes from any single provider. Our life insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

Surviving a heart attack can change your life, as nearly one million survivors know each year. It may also change the way you think about life insurance and the consequences for your loved ones if you hadn’t survived.

If you’re wondering whether you can still get life insurance after a heart attack, the answer is yes.

What you get will depend on several factors such as the severity of the heart attack, your age, and how much time has passed since your event.

Read on to learn more about the questions life insurance underwriters may ask you, the types of coverage you can expect to get after a heart attack, and sample life insurance rates for people in this situation.

Ready to buy life insurance? Use our FREE quote tool above to get started.

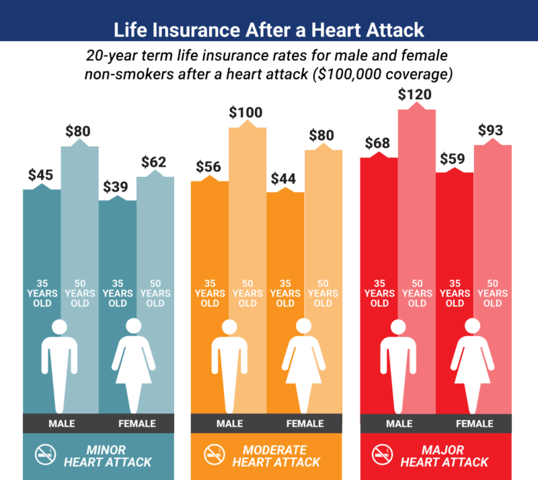

Life Insurance for Heart Attack Survivors – Sample Monthly Rates

Wondering what rates you might get for life insurance after a heart attack? Check out the sample rates below.

| Rate Classification | Age | Male $100,000/20-Year | Female $100,000/20-Year | Male $250,000/20-Year | Female $250,00/20-Year | Male $500,00/20-Year | Female $500,000/20-Year |

|---|---|---|---|---|---|---|---|

| Standard | 40 | $18.23 | $16.10 | $32.59 | $28.87 | $59.94 | $51.93 |

| Substandard – 50% over Standard | 40 | $23.49 | $20.34 | $41.67 | $34.41 | $75.60 | $62.63 |

| Substandard – 100% over Standard | 40 | $29.57 | $25.37 | $53.81 | $44.03 | $98.96 | $81.66 |

| Substandard – 150% over Standard | 40 | $35.58 | $27.08 | $64.38 | $53.86 | $120.49 | $94.02 |

| Standard | 50 | $37.36 | $29.05 | $77.31 | $58.36 | $143.59 | $110.95 |

| Substandard – 50% over Standard | 50 | $49.22 | $38.98 | $98.11 | $73.17 | $187.19 | $137.23 |

| Substandard – 100% over Standard | 50 | $63.87 | $50.22 | $129.06 | $94.63 | $247.74 | $181.13 |

| Substandard – 150% over Standard | 50 | $78.93 | $60.45 | $152.46 | $115.80 | $293.77 | $221.02 |

| Standard | 60 | $91.85 | $65.62 | $204.70 | $143.50 | $392.71 | $273.89 |

| Substandard – 50% over Standard | 60 | $126.00 | $86.10 | $251.41 | $175.83 | $492.75 | $337.70 |

| Substandard – 100% over Standard | 60 | $166.25 | $113.05 | $333.37 | $232.60 | $655.15 | $448.42 |

| Substandard – 175% over Standard | 60 | $196.66 | $136.73 | $403.21 | $285.59 | $795.27 | $550.68 |

As you can see, there are several factors in play, including your age, your gender, how much coverage you want, and how severe your health situation is post-heart attack.

Your life insurance coverage rate after a heart attack varies based on the severity of the heart attack. The important thing to remember as you examine these sample rates is that the healthier you are after your heart attack, the less you’re going to pay compared to same-age or same-gender peers.

We’ll explain the rate classifications later. But first, keep reading to learn why and how having a heart attack influences your life insurance options.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Heart Attack Facts

According to the Centers for Disease Control and Prevention, about 647,000 people in the United States die of heart attacks every year. That translates to one out of every four deaths, and somebody falls victim to a heart attack approximately every 37 seconds.

Thankfully, not all heart attacks are fatal.

Approximately 805,000 Americans have a heart attack each year, which is a higher number than those that die of it. Of those, 605,000 are a victim’s first heart attack.

This means that if you’ve suffered a heart attack, you’re far from alone, especially if you’ve experienced any of the following symptoms Dr. Oz describes.

https://www.youtube.com/watch?v=l7zc8C7Qlqk

You’re also not the first person to apply for life insurance after a heart attack.

| Race or Ethnic Group | Percentage of Death | Men (%) | Women (%) |

|---|---|---|---|

| American Indian or Alaska Native | 18.3 | 19.4 | 17.0 |

| Asian American or Pacific Islander | 21.4 | 22.9 | 19.9 |

| Black (Non-Hispanic) | 23.5 | 23.9 | 23.1 |

| White (Non-Hispanic) | 23.7 | 24.9 | 22.5 |

| Hispanic | 20.3 | 20.6 | 19.9 |

| All | 23.4 | 24.4 | 22.3 |

As the above table shows, there are slight differences in heart attack rates based on race and gender, with Native American women being the least likely to suffer a heart attack and white men being the most likely.

Types of Life Insurance You Might Qualify For

There are several types of life insurance you might qualify for following a heart attack.

| Type | Description |

|---|---|

| Term | Life insurance that covers you for a specific period of time (e.g. 20 years). |

| Guaranteed Whole | Life insurance that covers you for the remainder of your life, usually available to people over 50. |

| Universal | A flexible type of permanent life insurance |

| Critical Illness | A life insurance rider that allows you to get benefits while still alive to help defray medical costs |

As the above table shows, there are many different life insurance plans available. Read on to learn more about each one.

Term Life Insurance

In general, term life insurance is cheaper than other types of life insurance because it only covers you for a specific period of time.

However, when it comes to heart attacks, this type of insurance might not be your best bet. Most life insurance companies require a medical exam before issuing term life insurance.

Depending on the severity of your heart issues, you may be required to pay higher rates or be denied term life insurance altogether.

The other issue with term life insurance is that it’s time-limited. If you die after the insurance expires, your family won’t be covered. Many term life insurance policies allow you to convert the policy to a whole life policy as it nears its expiration date for this reason.

Guaranteed Issue Whole Life Insurance

If you’re over the age of 50, guaranteed issue whole life insurance might be an option for you after a heart attack.

As the name implies, you’re guaranteed to be approved for this type of life insurance. Guaranteed issue whole life insurance doesn’t require a medical exam, so the severity of your heart attack won’t be as much of a factor in setting your rates.

Guaranteed issue whole life insurance is also permanent coverage. This means that you’ll be covered for the rest of your life, regardless of how much longer you live.

Whole life insurance policies grow in cash value over time and you can borrow against the cash value of the policy as needed.

This type of insurance is more expensive than term life insurance, but it can be worth it, especially if you don’t qualify for other types of life insurance due to your heart attack or heart health history.

However, most life insurance companies don’t provide it to people under the age of 50, so if you suffer a heart attack at an early age, this type of insurance isn’t an option for you.

Universal Life

Universal life insurance is a type of permanent life insurance that offers flexible payments and ways to invest in your life insurance policy to make its cash value grow.

For heart attack sufferers, the flexible payments can be helpful if you’re also trying to pay off medical expenses, as you can adjust your premiums on a month-by-month basis.

Critical Illness

Many life insurance companies also offer critical illness insurance, either as a rider to life insurance or as a separate type of insurance in its own right.

Critical illness insurance allows you to get benefits while you’re still alive. It can be used to offset the costs of medical care and medication.

What are the insurance companies looking for when insuring heart attack survivors?

The unfortunate truth is that any health event — whether it’s cancer, heart attack, or Type 1 & 2 diabetes — makes life insurance harder to buy and more expensive. Any pre-existing condition will trigger a different set of questions by the underwriter to assess the overall risk you pose to the insurance carrier.

The underwriting process is the evaluation of your eligibility for coverage and the rates you should expect to pay.

Let’s review the questions you should be prepared to answer when shopping for life insurance with a history of heart attacks.

Date of the Heart Attack

If your heart attack (myocardial infarction) happened within the last six months, it may be more difficult for you to get any type of coverage that requires a medical examination.

The underwriter is looking for reassurance that your situation is stable before approving you for coverage.

Remember: life insurance companies base their coverage decisions on how likely it is that your family will have to file a claim on your behalf.

Having had a recent heart attack or have suffered multiple heart attacks means it’s more likely that you’ll die sooner. Thus, you’ll probably have to pay higher rates if you’re approved.

Conversely, the longer it’s been since your heart attack, the more likely you are to be approved for coverage at a lower rate.

A Note About Multiple Heart Attacks

You might think that if you’ve had more than one heart attack, you won’t qualify for coverage. However, this isn’t necessarily the case.

Depending on your heart health history, you may qualify for either standard or substandard coverage.

Substandard life insurance coverage is life insurance for higher-risk individuals such as people who have suffered multiple heart attacks. It often requires far higher premiums, and there may be more restrictions on your benefits.

If you don’t qualify for this type of coverage either, you may want to consider guaranteed issue whole life insurance. As mentioned above, this type of insurance doesn’t require a medical exam, and you’re guaranteed approval.

Do any of these medical circumstances apply to you?

Life insurance companies will look at any medical tests and heart procedures you underwent to help them gauge how likely it is that you’ll die from a heart-related condition.

Some of the things they look at include:

- Echocardiogram – a test using sound waves to generate images of your heart to identify heart disease

- Coronary catheterization – a procedure to diagnose and treat cardiovascular conditions

- Coronary angiography – a procedure that uses special dye and X-rays to evaluate the blood flow through the arteries

- Bypass surgery – a surgery to restore normal blood flow to the arteries

- Heart failure – a condition in which the heart doesn’t pump blood as it should

- Arrhythmia – an irregular heartbeat that can be too slow or fast

Looking at all of this information will help the life insurance underwriters determine how big a risk they are taking by insuring you.

They are looking for two things here: how severe your heart attack was and whether there are underlying medical issues that could cause other serious illnesses.

How old were you when you first suffered a heart attack?

From the insurance company’s standpoint, the younger you were when you first suffered a heart attack, the greater the risk is.

Having a heart attack at a young age suggests poorer heart health and greater risk of multiple heart attacks and issues, while to an extent it’s expected that older people will have some issues.

Thus, in general, the older you are when you have your first heart attack, the easier it will be for you to get insurance.

Are you on any medication?

In most cases, underwriters check your prescription history when setting life insurance rates.

Taking certain medications may concern life insurance companies because they indicate serious problems or are known to have problematic side effects. If you’re on a lot of different medications for your heart, that might also raise red flags.

For example, if you’re taking Plavix following a stent placement, insurance companies may charge you higher rates or deny your application for certain types of life insurance.

If you’re on medication for your heart, make sure you follow doctor’s orders.

Failure to do so is risky not only to your health but to your life insurance application. An individual who doesn’t take the doctor’s advice seriously poses a higher risk, and this is something insurers are trying to avoid.

How severe was the heart attack?

Heart attacks have severity levels. A mild heart attack only affects a small part of the heart muscle or doesn’t cause permanent damage. A massive, or severe, heart attack can result in permanent damage to the heart or a more substantial portion of the heart muscle.

| Severity | Description |

|---|---|

| Mild | Blood flow through one artery is partially blocked |

| Moderate | There is some damage to the heart muscle |

| Severe/Massive | There is a lot of damage to heart muscle and there may be other serious medical problems |

| Silent | Oxygen flow to the heart is cut off, but you have no traditional heart attack symptoms |

In addition to the heart attack types listed above, you may also suffer a procedure-related heart attack, such as a heart attack during angioplasty or stent placement.

Doctors classify the heart attack’s severity based on how much damage it does to your heart and your general health.

Mild heart attacks generally affect only one vessel and do not cause much, if any, muscle damage, while moderate or severe heart attacks cause significant damage.

You may also suffer a silent heart attack, which could range from mild to severe, but which does not cause chest pain or other traditional heart attack symptoms.

Regardless of the severity of your heart attack, you’ll need to get treatment right away to prevent life-threatening complications. Even a mild heart attack can kill you if it’s left untreated.

Silent heart attacks are more common in women than men and have symptoms similar to indigestion. If you have stomach pain and nausea, you should see a doctor as soon as possible to make sure you haven’t suffered a silent heart attack.

You can expect to get a standard rate if you only had one vessel affected, retain normal left ventricular function (55 percent or higher), and have improved cardiac factors.

You can still get life insurance if you have moderate or significant damage to your heart. In this case, you may be offered substandard rates. This means you’ll be charged higher than average rates because you’re considered a higher risk.

In a worst-case scenario, you may have to purchase guaranteed issue whole life insurance. If your heart attack significantly compromises your health and you don’t qualify for other types of life insurance, this option will allow you to receive coverage.

Have you completed an electrocardiogram since the heart attack?

The electrocardiogram is a simple test with useful information about your heart’s health. It measures the electrical activity of the heart muscle as it changes over time.

Your insurance carrier will want results of any electrocardiograms you’ve had, along with the dates. Electrocardiogram results can show not only your current heart health but whether your heart is strengthening over time. That tells a more complete story about your heart health than simply knowing that you had a heart attack.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

What other questions will the underwriter ask?

In addition to questions specifically related to your heart health, your insurance underwriter will ask the same general questions that they do of all applicants.

Demographic factors such as your age, gender, and marital status are important to life insurance companies because these factors often predict longevity.

As unpleasant as it may be to think about, the fact is that nobody lives forever. So the older you are, the more likely you are to die soon. Thus, older people generally have to pay higher life insurance rates than younger people, regardless of health status.

Similarly, women tend to live an average of five years longer than men, and married people live longer on average than those who are single, divorced, or widowed. So insurance companies also take gender and marital status into account.

Insurance companies will also take your entire health history into account, not just your heart attack.

With the exception of guaranteed issue whole life insurance, you’ll generally have to have a medical exam in which the doctor will check your blood pressure and other vital signs as well as test your cholesterol level.

Your cholesterol level is an important piece of your heart health as well as your general health. High cholesterol can put you at risk of another heart attack or a stroke.

Whether or not you’re required to have a medical exam, your insurance underwriter will have access to your prescription history and your Medical Insurance Board, or MIB, information.

Your medical records are confidential, so insurance underwriters can’t access them. However, whenever you apply for health insurance, you’re required to consent to allow underwriters access to your MIB information.

This is encrypted information about your general health, including your heart health. Underwriters use this information to help them make decisions about your life insurance rates.

Having serious health problems or taking lots of medications may result in a higher rate.

If you work at a high-risk occupation, you’ll pay more for life insurance. High-risk occupations are jobs where there’s a significant risk of injury or death. Some examples of high-risk occupations include:

- Police officers

- Stunt doubles

- Fighter pilots

Your habits are also important. Some habits put your life at greater risk and are therefore going to be of concern to life insurance providers.

Smoking is a huge concern for life insurance providers, especially if you’ve had a heart attack.

In general, smokers pay higher rates for life insurance than non-smokers.

Smoking is associated with health risks, including lung cancer, and heart disease. If you’ve already had a heart attack, life insurance providers are likely to be extra concerned about smoking because it can make heart problems worse.

While smoking is a big concern, it’s not the only habit life insurance providers look at. Another big one is drug abuse.

If you’ve abused drugs at any time during your life, even if you’re clean now, life insurance companies will likely charge you higher rates.

Some drugs, such as crack cocaine, also negatively affect your heart health, so this may be a bigger factor if you’ve had a heart attack.

If you have a poor driving record, especially if you’ve ever been arrested for driving under the influence of alcohol or for reckless driving, have had license suspensions or revocations, or have a ton of speeding tickets, you can expect to pay higher rates for life insurance. This is because these behaviors make it more likely that you’ll die in a fatal accident.

Some hobbies are considered high-risk behaviors too, such as skydiving or bungee jumping. These hobbies can lead to serious injury or death.

Your military status is also a factor in determining your life insurance rates.

Whether you’re on active duty or are a veteran, you’ll pay higher life insurance rates if you have military experience. Active-duty personnel are often stationed in combat zones even if they aren’t on combat duty, which puts their life at extra risk.

Unfortunately, many veterans return home with physical or mental health issues. If you were injured in the line of duty, that makes it more likely that you’ll die sooner. Many veterans also suffer from post-traumatic stress disorder (PTSD), depression, or anxiety, which can cut their lives short, and some may have been exposed to toxins while on duty that could cause health issues later on.

What rate class can I qualify for if I am a heart attack survivor?

While life insurance companies may differ slightly in how they calculate rates, almost all companies categorize applicants into standard rate classes.

Life Insurance Rate Classes

| Rate Class | Description |

|---|---|

| Preferred Plus | Applicant is in exceptional health and otherwise presents little risk. |

| Preferred | Applicant is mostly low risk, but may have a minor health issue such as slightly elevated cholesterol. |

| Standard Plus | Applicant is in generally good health and presents lower than average risks, but has several health issues such as being overweight, high blood pressure, and high cholesterol which are cause for concern |

| Standard | Applicant is in average health. They may have negative health history such as a family member dying of a stroke. |

| Preferred Smoker | Applicant is in good health despite being a smoker and thus qualifies for lower rates than average for smokers |

| Standard Smoker | Applicant is a smoker and has some minor health issues |

| Substandard | Applicant has serious health issues or is otherwise a higher insurance risk |

As you can see, better health often leads to being assigned to a better rate class, which means lower premiums for you.

Can you be assigned to Standard, Preferred, or Preferred Plus if you’ve had a heart attack?

This is a complicated question. Having a heart attack is considered a serious health issue, so you may end up being assigned to Substandard, which is 25 percent or more than the standard rate.

However, it’s not that cut-and-dry.

As noted before, your age, medication, the severity of the heart attack, and contributing factors such as your weight, whether you smoke, and your general health will all play a role in determining your rates.

Every situation is different, so it’s impossible to gauge where you’d fall on the ratings classification scale without information about your personal circumstances.

It’s not likely that you would be able to get the lowest rates after a heart attack, but depending on the circumstances, you might qualify for Standard or Standard Smoker rates.

The following factors make it more likely that you’ll get a higher rate.

- Heart attack at a young age

- Multiple heart attacks

- New episodes of chest pain

- New electrocardiogram changes

- Diabetes

- Being classified as overweight

- Uncontrolled blood pressure

- Having high cholesterol

- Being a smoker

All of these factors indicate a higher risk. However, some of them may be changeable.

A heart attack is often the result of another underlying health condition, so if you address the conditions that caused the heart attack, you can get better life insurance rates. If you stop smoking, lose weight, or otherwise follow doctor’s orders, it may help you get better life insurance rates as well as improve your health.

How to Get the Best Rates

In general, the younger you are, the lower your rate is going to be, though this isn’t guaranteed after a heart attack. Having your first heart attack at a young age indicates a pre-existing health condition that could shorten your life, and thus you may be classified toward the higher end of the rating scale.

Some of the factors contributing to your rate are out of your control, but there is plenty you can do to try to get your best rate.

- Don’t smoke – Smoking is considered a major health risk, and people who smoke will get higher rates. This is especially true after a heart attack since smoking can contribute to heart disease. So if you currently smoke, quitting can help lower your rate.

- Keep up with your doctor’s recommendations – Get needed tests, follow the diet your doctor recommends, and take all medication as prescribed. Some of your doctor’s recommendations may improve your general health after a heart attack, which could lower your rate.

- Apply sooner rather than later – The older you are, the higher your rate is likely to be, so lock in your rates as soon as possible.

- Figure out in advance how much coverage you’ll need – It’s cheaper to purchase the right amount of life insurance the first time than to change your coverage later, so planning in advance will help you save money.

- Comparison shop – Get quotes from several life insurance companies so you can compare rates and purchase the best plan for your needs.

If you follow these tips, it will help you lock in a lower insurance rate. Remember: even after a heart attack, you may still qualify for standard or close-to-standard rates if you’re sufficiently healthy, so don’t despair.

What if I don’t qualify?

In some cases, you may not qualify for the life insurance plan you originally wanted. The insurer may feel that you are just too big a risk because of your heart attack or other factors such as your habits or occupation.

If that happens, don’t worry. There may still be options for you.

If you’re over the age of 50, you might want to consider guaranteed whole life insurance.

As mentioned earlier, this type of insurance doesn’t require a medical exam, and you’re guaranteed to be approved. Guaranteed whole life insurance also has the advantage of not expiring as term life insurance does, so your family’s needs will be covered no matter when you die.

If you’re not over 50 or would prefer not to use guaranteed whole life insurance, you might also look into group insurance via your employer. Sometimes group insurance plans have less strict requirements.

Whatever your circumstances are, don’t give up. Keep talking to different life insurance companies and keep shopping around until you find a life insurance policy that works for you and is willing to take you on.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Case Studies: Life Insurance for Heart Attack Survivors

Case Study 1: John’s Story

John is a 50-year-old man who suffered a heart attack six months ago. He is in good health now and has made significant lifestyle changes to manage his heart condition. He is interested in obtaining life insurance to protect his family in case something happens to him.

John applies for term life insurance, but due to the recent heart attack, he is required to undergo a medical exam. The underwriter reviews his medical records and sees that his heart attack was mild and did not cause permanent damage. They also consider John’s age and overall health.

Case Study 2: Sarah’s Story

Sarah is a 65-year-old woman who suffered a severe heart attack three years ago. She has managed her health well since then and has made significant lifestyle changes. Sarah is looking for permanent life insurance coverage that will last for the rest of her life.

Sarah applies for guaranteed issue whole life insurance, which does not require a medical exam. The insurance company approves her application, and she is offered a coverage amount of $100,000 with a monthly premium of $250. Sarah is satisfied with the coverage and accepts the policy, knowing that it will provide financial security for her loved ones.

Case Study 3: Mark’s Story

Mark is a 40-year-old man who had a moderate heart attack two years ago. He has made lifestyle changes and is in good health now. Mark wants a flexible life insurance policy that allows him to adjust his premiums and grow his policy’s cash value over time.

Mark decides to apply for universal life insurance. The underwriter considers his age, the severity of his heart attack, and his overall health. Based on these factors, Mark is approved for a preferred rate classification with a monthly premium of $200. He is pleased with the policy’s flexibility and the potential for his policy’s cash value to grow over time.

The Bottom Line

Underwriting a potential client who is looking for life insurance after a heart attack involves many moving pieces.

It can be difficult, but not impossible, to get life insurance after you’ve suffered a heart attack. It’s important to begin the process now so that you’ll have the coverage your family needs in the event of your death. If you can get accelerated death benefits, it can also help you offset the cost of any future serious illnesses related to your heart attack.

You might think that life insurance companies would never insure someone who has had a heart attack, but that’s not necessarily true.

The severity of your heart attack, your health now, and how much coverage you want are all factors that contribute to insurance companies’ decisions if an applicant has had a heart attack.

You lose nothing by applying for life insurance, so it doesn’t hurt to try. Just make sure that you know what you want before you begin comparing rates and making applications. That way you can make sure you’re getting the right coverage for your needs after your heart attack.

Ready to buy life insurance? Use our FREE tool below to get quotes.

FAQs

#1 – I had a mild heart attack and my doctor says that I am in good health now. Since I probably will live a number of years still, do I really need to get life insurance now?

It’s important to get life insurance as soon as possible no matter what your health status is.

You never know when you’ll have another catastrophic illness or a fatal accident, so you should get life insurance to make sure your family’s needs are covered in the event of your unexpected death.

It’s also important to get it sooner rather than later because your rates tend to go up as you age.

#2 – Judging from the sample rates, I’m probably going to pay a ton for life insurance. Is there anything I can do to lower my rates?

The best thing to do is to contact several insurance companies to get rates. Sample rates are average rates. Your rate may be higher or lower depending on your individual circumstances.

Taking care of your heart and general health, avoiding bad habits such as smoking, and purchasing the right amount of insurance upfront can also help lower your rates.

#3 – I don’t qualify for term life insurance. Will guaranteed whole life insurance really cover my needs?

Every situation is different, and only you — and your insurance agent — can decide what’s best for you.

Guaranteed whole life insurance does have some advantages for people over 50, especially if you’ve had a heart attack or have another serious health condition. You won’t have to have a medical exam, and you won’t have to worry about whether you’ll qualify. And your family will be covered permanently, so you don’t have to worry about the insurance expiring.

It’s best to talk to your agent or financial planner if you have any questions about whether this type of insurance is right for you, though. They can advise you as to what is best for your individual situation.

Frequently Asked Questions

Can I get life insurance after a heart attack?

Yes, you can still get life insurance after a heart attack. The type of coverage and rates you can expect will depend on factors such as the severity of the heart attack, your age, and the time that has passed since the event.

What types of life insurance can heart attack survivors qualify for?

Heart attack survivors may qualify for various types of life insurance, including term life insurance, guaranteed issue whole life insurance, universal life insurance, and critical illness insurance. The availability and suitability of these options depend on individual circumstances.

How does the severity of the heart attack affect life insurance rates?

The severity of the heart attack can impact life insurance rates. Generally, the healthier you are after the heart attack, the lower the rates you’re likely to pay compared to individuals of the same age and gender. Rates may vary based on factors such as the extent of heart damage and underlying medical issues.

What do insurance companies look for when insuring heart attack survivors?

Insurance companies assess several factors when insuring heart attack survivors, including the date of the heart attack, any additional medical circumstances, age at the time of the heart attack, medication usage, and the severity of the heart attack. These factors help underwriters determine the risk and set appropriate rates.

What other questions will the insurance underwriter ask?

In addition to heart-related questions, insurance underwriters will ask general questions about demographic factors such as age, gender, and marital status. They will also consider your overall health history, including cholesterol levels and medical exams. These factors help insurers evaluate your overall risk and determine your eligibility and rates for life insurance.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Chris Abrams

Licensed Life Insurance Agent

Chris is the founder of Abrams Insurance Solutions and Marcan Insurance, which provide personal financial analysis and planning services for families and small businesses across the U.S. His companies represent nearly 100 of the top-rated insurance companies. Chris has been a licensed life and health insurance agent since 2009 and has active insurance licenses in all 50 U.S. states and D.C. Chr...

Licensed Life Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about life insurance. Our goal is to be an objective, third-party resource for everything life insurance related. We update our site regularly, and all content is reviewed by life insurance experts.