A Complete Review of Liberty Bankers Life Final Expense (Rates Included)

Liberty Bankers life final expense insurance is a whole life policy with a small death benefit. Liberty Bankers life insurance rates start at a $10,000 policy with a $25.57/month rate.

Free Life Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Daniel Walker

Licensed Insurance Agent

Daniel Walker graduated with a BS in Administrative Management in 2005 and has run his family’s insurance agency, FCI Agency, for over 15 years (BBB A+). He is licensed as an insurance agent to write property and casualty insurance, including home, life, auto, umbrella, and dwelling fire insurance. He’s also been featured on sites like Reviews.com and Safeco. To ensure our content is accura...

Licensed Insurance Agent

UPDATED: Jan 8, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident life insurance decisions. Comparison shopping should be easy. We are not affiliated with any one life insurance provider and cannot guarantee quotes from any single provider. Our life insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about life insurance. Our goal is to be an objective, third-party resource for everything life insurance related. We update our site regularly, and all content is reviewed by life insurance experts.

UPDATED: Jan 8, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident life insurance decisions. Comparison shopping should be easy. We are not affiliated with any one life insurance provider and cannot guarantee quotes from any single provider. Our life insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

Liberty Bankers Life Company Overview

| Key Info | Company Specifics |

|---|---|

| Year Founded | 1958 |

| Current Executive | CEO - David W. Glidden |

| Number of Employees | 10,000 |

| Total Sales / Total Assets | $36,000,000 / $1,750,000,000 |

| HQ Address | 1605 LBJ Freeway, Suite 710. Dallas, Texas |

| Phone Number | (469) 522-4400 |

| Company Website | www.lbig.com |

| Premiums Written - Individual Life | $55,255,022 |

| Financial Standing | $141,000,000 |

| Best For | Strong Financial Ratings, Final Expense Insurance |

Liberty Bankers Life has traditionally focused on annuity product sales for many decades. Over the past several years, Liberty Bankers Life’s final expense products, which are whole life insurance policies, have appeared.

We will cover Liberty Bankers Life final expense (review below), products, and compare them against some of the top 20 best final expense companies in the industry. To find the best life final expense coverage for you, start comparing quotes today by using our FREE tool above.

Liberty Bankers Whole Life Insurance Review

How does Liberty Bankers Life Insurance make money? Well, Liberty Bankers offers two basic whole life products: SIMPL (preferred & standard) final expense and modified whole life. Both policies are a simplified issue no exam life insurance with minimal health questions. You will have a phone interview with the underwriter, who will also gather further information.

Where does Liberty Bankers Life Insurance get their data from? The Medical Information Bureau (MIB) is used to alert of any medical conditions. Liberty Bankers Life reserves the right to obtain an attending physician statement (APS), but those are rarely used as long as the application is completed.

How does Liberty Bankers Life Insurance work? For starters, whole life policies will never expire as long as the premiums are paid, and will build a cash value that you can use in the future via a loan, or if you surrender your policy. Let’s take a look at the differences between both products.

SIMPL Final Expense

How does Liberty Bankers Life Insurance find you affordable insurance? They offer SIMPL final expense insurance which has a guaranteed premium with an immediate full death benefit. This means there is no waiting period for the policy to kick in, and the premiums will stay leveled (the same) for the life of the policy. This policy has two flavors: preferred and standard. If you qualify for the preferred rating class, you will pay less. Nonetheless, both policies offer the same benefits.

SIMPL Final Expense Highlights

- Issue ages: 18–80

- Minimum face amount: $3,000

- Maximum face amount: $30,000

- Guaranteed death benefit day one

- Guaranteed level premium

- There is a 20% premium discount for the first year only if you elect to pay annually

Modified Whole Life (MWL)

Some individuals who don’t qualify for the SIMPL final expense life insurance due to pre-existing conditions. Liberty Bankers has a second alternative called modified whole life, or MWL for short. This policy will still require you to answer health questions as part of the underwriting process.

Note that this policy is a graded benefit policy – although premiums will stay the same, you won’t get the death benefits if you die in the first 3 years after purchasing the policy, unless it’s accident-related.

If you die from natural causes, your beneficiaries will only collect the premiums paid plus 10%, instead of the purchased death amount you bought. At year 4, the death benefit will equal 100%; year 5 equals 105%, and year 6 equals 110%.

Guaranteed issue life insurance companies like Gerber or AIG may be a better choice since they only have a 2-year graded benefit and no health questions on the application.

Modified Whole Life highlights

- Issue ages: 40–80

- Minimum face amount: $1,000

- Maximum face amount: $20,000

- Graded benefit 3-year

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Liberty Bankers Life vs. Other Carriers’ Sample Monthly Rates

Let’s get right to it, how much is final expense insurance? Below are tables for three different policy amounts for 10 companies including Liberty Bankers Life. Calculator’s to figure out how much coverage you need are a great tool when shopping for life insurance.

*All rates quoted on this page are for a super-preferred healthy individual who does not use tobacco. Monthly rates are updated as of 2019 and are subject to underwriting approval.*

What is Bankers Life Insurance?

Liberty Bankers Life (LBL) history starts in 1958, as Royal Oak Life Insurance Company. They grew very slowly and moderately offering products in 40 states. In 1992, the company was sold to American Hilton, a South Carolina insurance holding company.

In 1998, Liberty Bankers held only $5 million in insurance reserve to pay benefits. By 1999, they started offering annuity products that were very well welcomed in the market. As a result, they experienced rapid growth, but who owns Liberty Bankers Life? Heritage Guaranty Holdings, Inc. purchased the company and its $200 million in assets back in 2004, making Liberty Bankers Life and Capitol Life both subsidiaries of Heritage.

In 2006, Liberty Bankers started to sell traditional life insurance products, such as whole, term, final expense, pre-need funeral, and critical illness insurance. Now, where is Liberty Bankers Life headquartered? The company is based in Dallas, Texas. Due to the efforts of CEO David Glidden and Senior VP Dillion Key, Liberty Bankers Life has over 10,000 agents and assets exceeding $1.75 billion.

Liberty Bankers Life Financial Ratings

Before hopping on board with this insurance company we need to ask a couple of questions: what is Liberty Bankers Life Insurance’s insurability score? And is Liberty Bankers Life Insurance reliable? According to A.M. Best, a leader in ratings in the insurance industry, Liberty Bankers has a B++ (Good) rating, meaning the company can be relied on to meet any financial obligations. Another rating agency, the Better Business Bureau (BBB) gave Liberty Bankers Life an A+ rating, symbolizing great customer interaction.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Available Life Insurance Policy Riders

What are life insurance riders? They are an add-on benefit to enhance or supplement your life insurance policy. Liberty Bankers allows riders to be added to some policies. It’s worth mentioning that riders aren’t available in all states.

- Children’s Term Insurance – One unit equals $5,000, can purchase 4 maximum units. It’s a term coverage to age 25. The child can convert the policy at age 25 or earlier (if married) to a whole life policy up to five times the purchased amount without evidence of insurability.

- Grandchild Term Insurance – Available on the SIMPL preferred and standard only, this rider provides a term coverage to a grandchild for $7,500 to age 25. Can convert term life to whole life at age 25 or earlier (if married) up to 2 times the purchased amount.

- Accidental Death and Dismemberment – Provides extra death benefit should you die as a result of an accident.

- Waiver of Premium – The insurance company will waive the premium and keep your policy in place should you become disabled.

- Accelerated Living Benefit – Allows the policy owner to access some of the death benefits should they develop a terminal illness.

The Application Process

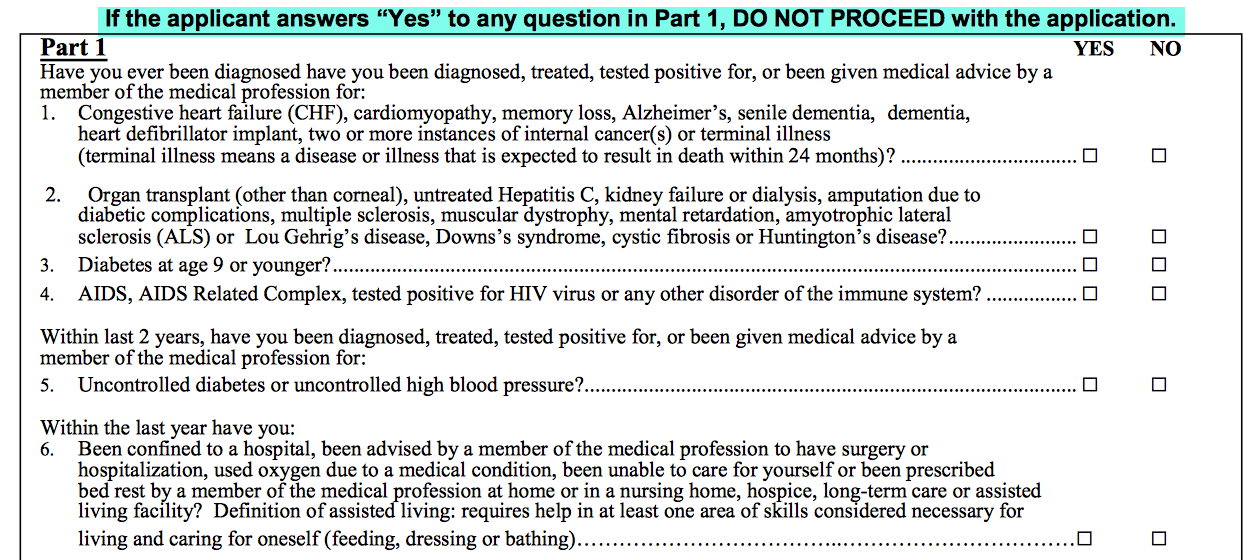

It’s good to know that every life insurance company has its own life insurance underwriting process for its policies There is no universal application for all companies, they each have different risks and stipulations. Liberty Bankers has 3 parts to the application that you must answer “no” to, in order to qualify for the best rate.

Below the application is divided into these 3 parts, you can click the image to enlarge.

Reference: Liberty Bankers Final Expense Application.

Part 1

If the applicant answers “yes” to any question in Part 1, DO NOT PROCEED with the application.

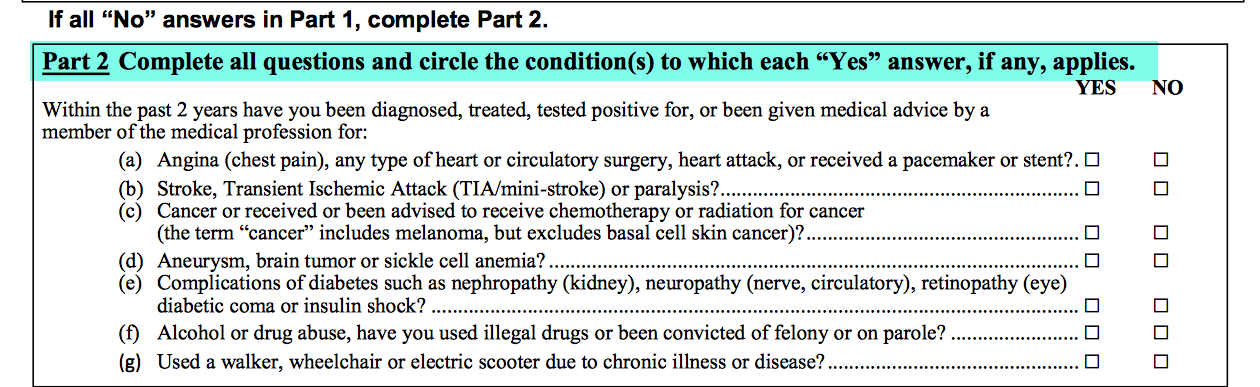

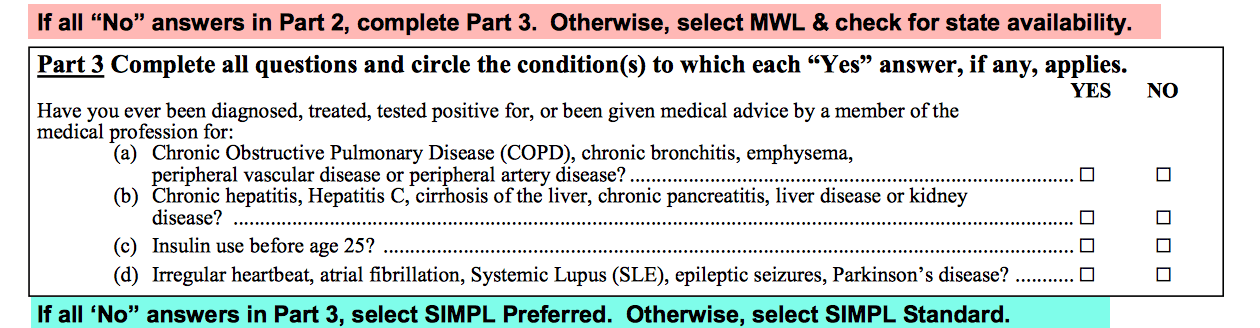

Part 2

If all “no” answers in Part 1, complete Part 2.

If you can’t answer “no” to all the questions in part 2, you will qualify for the graded benefit policy. Make sure you pay attention to this part.

Part 3

If all ‘no” answers in Part 3, select SIMPL Preferred. Otherwise, select SIMPL Standard.

This is the part in which you could qualify for the preferred or standard rating.

Liberty Bankers Life Customer Experience

As a consumer, there are many questions that are used to judge whether or not it would be a good fit. For example, how big a company is Liberty Bankers Life? Or what is Liberty Bankers Life Insurance’s rating with customers? Many people haven’t heard of Liberty Bankers Life due to the smaller size of the company. As for how the customers do rate Liberty Bankers Life, we turned to Glassdoor, where the company is considered to be a 3.7 out of 5 stars.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Pros and Cons of Liberty Bankers Life insurance

Should you consider Liberty Bankers Life for your insurance needs? Let’s take a look at a few pros and cons.

Pros & Cons of Liberty Bankers Life Insurance

| Pros | Cons |

|---|---|

| Strong financial rating | Expensive |

| No exam life insurance offered | Not very well-known |

| Top burial and final expense company | Does not offer universal life policies |

Why use Liberty Bankers Life? If the table wasn’t enough to convince you, either way, let’s break it down.

Liberty Bankers Life Final Expense: The Bottom Line

While Liberty’s prices may be attractive, they are not the most competitively priced when compared to companies like Assurity Life or Mutual of Omaha. Also, keep in mind that even if you qualify for the SIMPL policy with an immediate death benefit, you may still get the standard rate and not the preferred which will cost more. At this point, Liberty Bankers may not even be worth it.

When it comes to the modified whole life policy, you can just as easily buy a guaranteed issue policy without any health questions and get a 2-year waiting period instead of 3. That’s why it is important to make sure you understand the product completely before signing your name. Learning how to get the best deals on insurance starts by comparing multiple companies before making a selection.

You may be wondering: “Can I compare rates on the Liberty Bankers Life website?” Not very efficiently. While you fill out an entire form and wait for a response from Liberty Bankers Life, quoting tools like the one on this page can produce more, for less. How many quotes should you compare? Ultimately, that is up to you, but when you enter in your zip code into our FREE quote tool above, you will receive quotes tailored to your life final expense needs.

Shopping for Life Insurance Quotes

Nowadays, most shopping happens online. So, what are the best and worst sites for comparing rates? Good news, you are on one of the best sites with the worst sites only able to provide one quote at a time. In order to get a quote, companies need some background information. Often people ask: will getting a quote affect my credit? The answer is: no. While they do look at your credit score, a soft pull as it is called does not affect your score.

You are probably thinking, what happens when I receive a quote I like? Or what can I expect from the quote process? Well, when using our quote tool, you enter in minimal information and a qualified and friendly professional will help guide you through the process of getting what you want. However, everyone knows the real question that brought you here: can Liberty Bankers Life help you save money on insurance? Let’s take a look at some final expense rates to find out.

References:

- http://ratings.ambest.com/SearchResults.aspx?AltSrc=9&URATINGID=2960775&MCToken=1566718762671582161572911173154926531248&auth=&NP%3d1

- https://www.bbb.org/us/tx/dallas/profile/life-insurance/liberty-bankers-life-insurance-company-0875-90250773

- https://www.mib.com/risk_selection_mib.html

- https://content.naic.org/article/consumer_insight_how_choose_insurance_agent.htm

Frequently Asked Questions

How does Liberty Bankers Life Insurance make money?

Liberty Bankers offers whole life insurance policies and earns revenue through policy premiums.

Where does Liberty Bankers Life Insurance get their data from?

Liberty Bankers Life uses the Medical Information Bureau (MIB) to gather medical information, and occasionally requests an attending physician statement (APS) if needed.

How does Liberty Bankers Life Insurance work?

Liberty Bankers offers whole life insurance policies that never expire as long as premiums are paid. These policies build cash value over time and can be accessed through loans or policy surrender.

How does Liberty Bankers Life Insurance find affordable insurance?

Liberty Bankers offers SIMPL final expense insurance with guaranteed premiums and an immediate full death benefit. They have preferred and standard policies with the same benefits.

What is Bankers Life Insurance?

Liberty Bankers Life, formerly known as Royal Oak Life Insurance Company, is an insurance provider offering various life insurance products. It is headquartered in Dallas, Texas and has been in business since 1958.

How long has Bankers Life Insurance been in business?

The company was established in 1958, which means they have been in business for 62 years.

How can I contact Liberty Bankers Insurance?

When you visit Liberty Bankers Life’s website, there is a “Contact Us” link in the top right-hand corner that will lead you to phone numbers for policyholders and agents.

Where can I find Liberty Bankers Life provider login?

If you visit myportal.lbig.com, you will be able to log in as a Liberty Bankers Life provider. Phone numbers under the “Contact Us” tab are available for each department.

How does Liberty Bankers Insurance handle your information?

Liberty Bankers Life values your information and more importantly your privacy. Check out the company’s privacy policy at the bottom of every Liberty Bankers webpage. If you are concerned about a company, you should first check to make sure it is licensed with your state.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Daniel Walker

Licensed Insurance Agent

Daniel Walker graduated with a BS in Administrative Management in 2005 and has run his family’s insurance agency, FCI Agency, for over 15 years (BBB A+). He is licensed as an insurance agent to write property and casualty insurance, including home, life, auto, umbrella, and dwelling fire insurance. He’s also been featured on sites like Reviews.com and Safeco. To ensure our content is accura...

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about life insurance. Our goal is to be an objective, third-party resource for everything life insurance related. We update our site regularly, and all content is reviewed by life insurance experts.