AARP Life Insurance Company Review

Free Life Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Michelle Robbins

Licensed Insurance Agent

Michelle Robbins has been a licensed insurance agent for over 13 years. Her career began in the real estate industry, supporting local realtors with Title Insurance. After several years, Michelle shifted to real estate home warranty insurance, where she managed a territory of over 100 miles of real estate professionals. Later, Agent Robbins obtained more licensing and experience serving families a...

Licensed Insurance Agent

UPDATED: Jan 8, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident life insurance decisions. Comparison shopping should be easy. We are not affiliated with any one life insurance provider and cannot guarantee quotes from any single provider. Our life insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about life insurance. Our goal is to be an objective, third-party resource for everything life insurance related. We update our site regularly, and all content is reviewed by life insurance experts.

UPDATED: Jan 8, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident life insurance decisions. Comparison shopping should be easy. We are not affiliated with any one life insurance provider and cannot guarantee quotes from any single provider. Our life insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

Disclaimer: We are not AARP Life Insurance Company. If you need to reach the company directly, please call 1-800-865-7927.

AARP was founded in 1958 by Ethel Percy Andrus and Leonard Davis, later the founder of the Colonial Penn Group of insurance companies. AARP, formerly the American Association of Retired Persons, is a non-profit enterprise with one goal: to improve the life quality of aging adults. AARP has over 38 million members and is considered one of the strongest lobbying groups in the United States.

Related: Top 20 final expense companies.

How Does AARP Make Money?

I get this question a few times a month. If AARP isn’t an insurance company, how do they make money? AARP makes money on products and services it endorses. Anyone aged 50 or older can join the group. AARP uses NY Life for the life insurance lines they sell, United Healthcare for Medicare Supplement plans, and Hartford for car insurance.

To qualify for their services, you must pay a membership fee. You’d think you may get better rates if you’re a paying member, right? Let’s find out.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

New York Life

NY Life is one of the biggest companies in the world; however, that doesn’t mean that their products are good for everyone. As I’ve discussed numerous time in the past, life insurance is such a personal thing that depends on so many variables such as age, income, health history, and family history, to name a few.

While most just hear the name of a company and decide whether or not it’s a good fit, a broker will interview the client first and then match him/her with the appropriate company.

New York Life Ratings

- AM Best A++

- Fitch Ratings AAA

- Moody’s Investors Service AAA

- Standard & Poor AA+

Please note: If choosing a life insurance policy were as easy as looking at the financial ratings of a company and making an instant decision, life would be great. The truth, though, is that the life insurance industry is heavily regulated by the state in which it’s licensed, and you’d be hard-pressed to find a company that isn’t financially solid. In other words, the government makes sure to allow only the financially stable companies to do business to ensure that they can pay your beneficiaries.

Products Offered by AARP through NY Life

AARP offers 4 products:

- Level Benefit Term

- Permanent

- Guaranteed Acceptance

- Young Start

Let’s take a look at each policy in detail.

AARP Level Benefit Term Insurance

To qualify for this option, you must be an AARP member between the ages of 50 and 74 or a spouse aged 45 to 74. The benefit (“face amount,” in insurance terms) is up to $100,000, and the acceptance is based on 3 questions. (It took me over an hour to find these questions!) How do you like this terminology for marketing purposes: “level benefit term”? In reality, term life insurance is called “level premium term,” which means the premium never increases.

We never talk about the benefit changing; it’s a given. Not with AARP, though. In this option, the benefit stays the same, but the premium changes every 5 years based on your age. How would you like to buy a policy whose premium increases every 5 years?

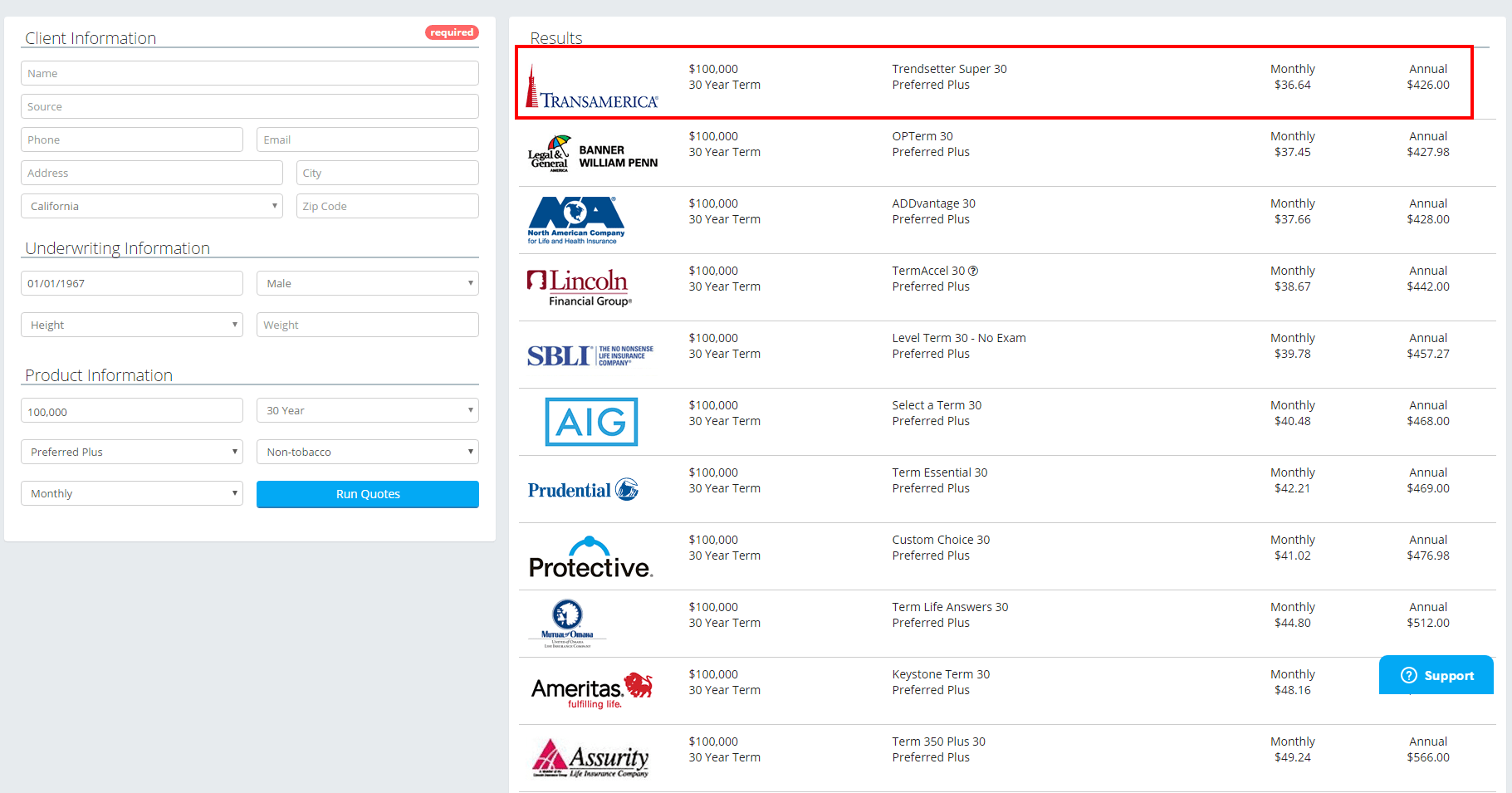

AARP Level Benefit Term Rates

AARP vs. Other Carriers’ Sample Monthly Rates

Male 50 years old $100,000 in coverage

AARP Permanent Life Insurance

You must be an AARP member between the ages of 50 and 80 or a spouse aged 45 to 80. The face amount for this coverage is up to $50,000. This is a whole life policy you can keep for the rest of your life. (Most of us never ask, “Why would I need a policy for the rest of my life?” This may be another good subject for another post.)

Whole life insurance has a cash benefit. However, it may kick in after a few years paying into the policy. Also keep in mind that, if you take some of the cashout, the company will deduct it from your death benefit, which is supposed to be paid to your beneficiaries when you’re gone. Your inability to predict when you’ll die isn’t a good reason to buy whole life insurance.

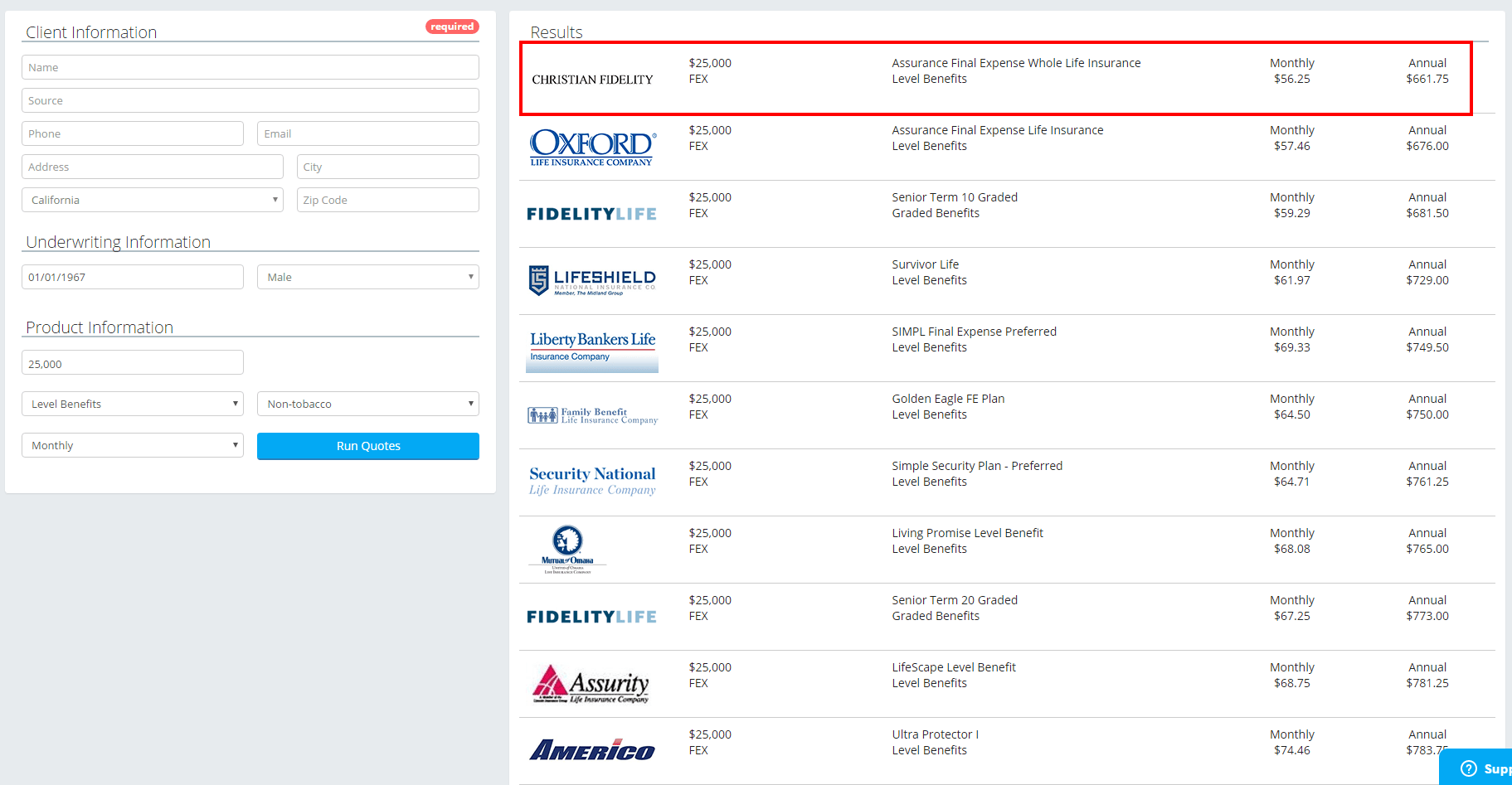

AARP Permanent Life Rates

AARP vs Other Carriers’ Sample Monthly Rates

Male 50 years old $25,000 in coverage

AARP Guaranteed Acceptance Life Insurance

You must be an AARP member between the ages of 50 and 80 or a spouse aged 45 to 80 for this coverage. The face amount is up to $25,000. This is a permanent type of life insurance that has a cash benefit. However, the benefits are limited for the first 2 years, and the coverage is only up to $25,000.

This clause is called a “graded benefit,” and it means that, if you die within the first 2 years of coverage (not accident related, just sickness and such), the carrier will not pay the benefits; they would only pay 125% of the premium paid. After 2 years, they would pay the full $25,000. This is a typical graded benefit life insurance and is considered a last resort for those who are unable to otherwise qualify for traditional life insurance because of health issues.

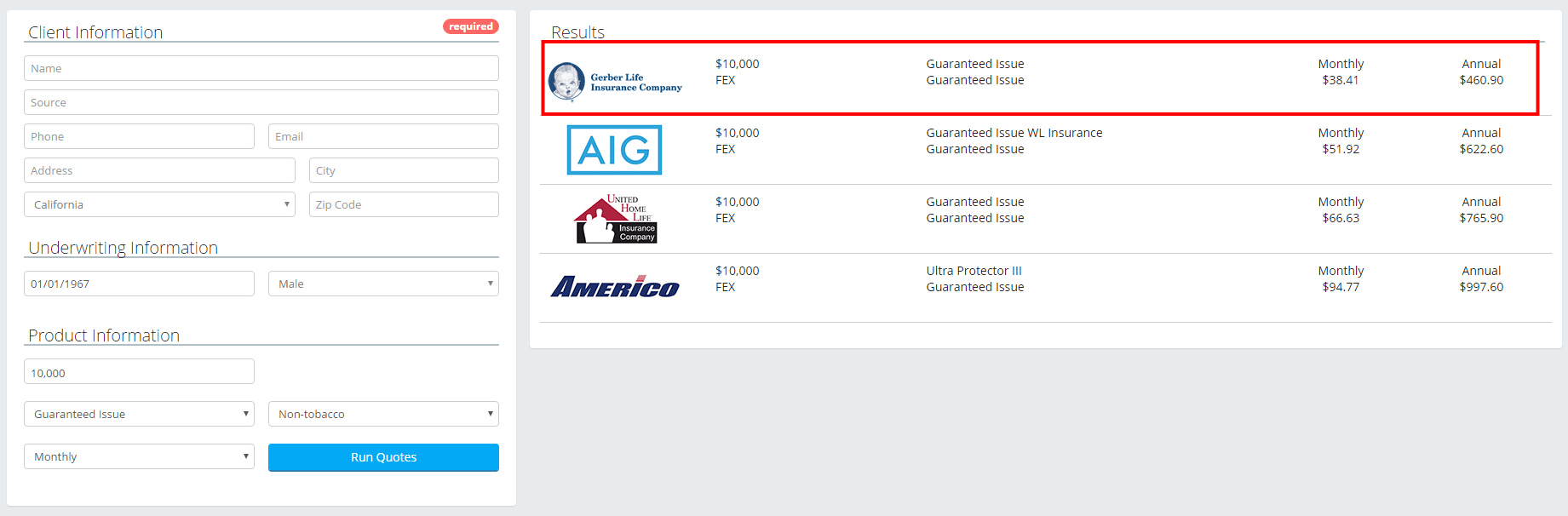

AARP Guaranteed Acceptance Rates

AARP vs Other Carriers’ Sample Monthly Rates

Male 50 years old $10,000 in coverage

AARP Young Start Life Insurance

You must be an AARP member between the ages of 50 and 80. Young start is for children up to 17 years old. This is a whole life, permanent insurance for children, which they can keep for their entire lives. You can buy up to $20,000. Rates aren’t guaranteed, and they can change in the future. (Side note: This may be a moot point, but why do I need to insure a child who isn’t responsible for the household’s income?)

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

AARP’s 3 Qualifying Questions

AARP bases your approval on 3 questions. (They don’t list the questions on their webpage—I really had to dig for them!)

1. In the past 2 years, have you had treatment for or been diagnosed by a doctor as having heart trouble, stroke, cancer, lung disease or disorder, diabetes, liver or kidney disease, AIDS, AIDS Related Complex, or immune system disorder?

*Yes/No

List date(s) of onset along with types of treatment, medicine and dosage.

2. In the past 2 years, for any condition, have you been admitted to or confined in a hospital, sanitarium, nursing home, extended care, or special treatment facility?

*Yes/No

List date(s) of onset along with types of treatment, medicine and dosage.

3. In the past 3 months, have you consulted a doctor or had treatment or diagnostic tests of any type? (Note: You are not required to report negative AIDS or HIV tests.)

*Yes/No

AARP “No Medical Exam”

It seems like many companies today are using the marketing slogan, “no medical exam.” What most don’t understand is that insurance, in general, is based on risks and rates, which means the healthier you are, the better rate you will get because you are a lower risk to the insurer. Also, no exam doesn’t mean that they accept everyone.

You still need to answer health questions, and they can still check your medical records and not pay claims if you lied on the application.

Every time you agree to buy such a policy, you are buying a policy with a pool of higher risk and unhealthy customers. In other words, you get a policy that justifies your health condition.

There is a reason why a carrier’s products are priced the way they are. For instance, a 55-year-old would pay $188 per month for a $50,000 policy with AARP but could get $81 with AIG for a 30-year term.

If you’re healthy, why buy a no-exam or, even worse, a guaranteed issue policy, which are the most overpriced life insurance policies? And even if you are diabetic or overweight, you still may get a better rate if you just talk to a broker who represents all companies rather than buying blindly because you saw the offer of no exam.

Summary

It’s a good rule of thumb to always compare your rates and not just choose a company because you like the commercial or because your neighbor has the same policy. Every company looks at certain risks differently, and you need a company that views you in the best possible light. That’s why it’s a good idea to work with a broker rather than a company who can only offer you one product.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

When Should I Look into AARP?

There are certain circumstances under which it’s a good idea to look into AARP.

- If you are under probation or were charged with a felony within the last 2–5 years. Most insurers will look at your criminal history when determining whether to approve you or not. AARP doesn’t ask about these issues, so it might be something you want to look into.

- If you are obese or very overweight. AARP doesn’t ask anything about your weight. You can be overweight and get a standard rate with most companies.

- If you are a smoker over 50 and only need up to $100,000 in coverage. AARP doesn’t ask anything about smoking habits, so you may get a lower rate.

When Should I Look Somewhere Else?

If you aren’t an AARP member or are under the age of 45, you are ineligible to buy any of these policies. AARP policies cater to a very specific age group and offer up to $100,000 in coverage, which is considered low by most. If you need more than $100,000, look somewhere else; AARP isn’t for you.

If you are very healthy, you will have much better options for traditional life insurance for much lower rates. Just contact an insurance broker such as myself so you can get a personalized quote based on your unique situation, health and income.

Life insurance with AARP will cease when you reach your 80th birthday, and you may face a different challenge now: How do I find an affordable plan if I’m over 80? If you need your life insurance to last past 80, you may need to look for policies that run up to 90, 95, or 100. These are called guaranteed universal life or GUL for short.

Frequently Asked Questions

What is AARP Life Insurance Company?

AARP Life Insurance Company is a subsidiary of New York Life Insurance Company and provides life insurance coverage specifically designed for AARP members and their families. It is endorsed by AARP, a nonprofit organization dedicated to serving the needs of individuals aged 50 and older.

What types of life insurance does AARP Life Insurance Company offer?

AARP Life Insurance Company offers several types of life insurance coverage, including:

- Term life insurance: Provides coverage for a specific term, such as 10, 15, or 20 years.

- Permanent life insurance: Offers lifelong coverage with a cash value component that can grow over time.

- Guaranteed acceptance life insurance: A simplified issue policy that does not require a medical exam or health questions, making it easier to qualify for coverage.

- Final expense insurance: A smaller whole life insurance policy designed to cover end-of-life expenses.

Is AARP Life Insurance Company reputable?

AARP Life Insurance Company, endorsed by AARP, is generally considered a reputable insurance provider. It has a long-standing relationship with AARP and operates under the financial strength and stability of New York Life Insurance Company, one of the largest and most respected insurance companies in the industry.

Can anyone apply for AARP Life Insurance?

AARP Life Insurance policies are specifically designed for AARP members, their spouses, and their dependents. To apply for coverage, individuals generally need to be AARP members. However, membership eligibility and specific policy details may vary, so it is recommended to review the eligibility requirements and policy terms directly with AARP Life Insurance Company.

Are there any age restrictions for applying for AARP life insurance?

AARP life insurance policies generally have age eligibility criteria, which may vary depending on the specific policy type. While some policies may have minimum age requirements, such as 50 or 55, others may have maximum age limits for application. It’s advisable to review the policy details or consult with an insurance agent to determine eligibility based on age.

Can I customize my AARP life insurance policy to meet my specific needs?

AARP life insurance policies often offer customization options to align with individual needs. You can typically choose the coverage amount, policy duration (for term policies), premium payment frequency, and add optional riders to enhance your coverage. These options allow you to tailor the policy to your specific circumstances and goals.

How is the customer service and claims process with AARP Life Insurance Company?

AARP Life Insurance Company aims to provide quality customer service to its policyholders. They offer customer support channels to address inquiries, policy management tools, and a claims process designed to be efficient and customer-friendly. The specific experience may vary based on individual circumstances and the nature of the claim.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Michelle Robbins

Licensed Insurance Agent

Michelle Robbins has been a licensed insurance agent for over 13 years. Her career began in the real estate industry, supporting local realtors with Title Insurance. After several years, Michelle shifted to real estate home warranty insurance, where she managed a territory of over 100 miles of real estate professionals. Later, Agent Robbins obtained more licensing and experience serving families a...

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about life insurance. Our goal is to be an objective, third-party resource for everything life insurance related. We update our site regularly, and all content is reviewed by life insurance experts.